The Truss Fiasco Could Be the Herald of a Global Crisis | Daily Market Analysis

Key events:

- Eurozone - CPI (YoY) (Sep)

- USA - Building Permits (Sep)

- Canada - Core CPI (MoM) (Sep)

- USA - Crude Oil Inventories

If mistakes by central banks lead to high interest rates and recession, real chaos is created by the government. This is the case in Britain when it comes to the tug-of-war between fiscal and monetary policy.

The utter failure of the Liz Truss government has already cost Quasi Kwarteng the post of finance minister, and many now believe that Truss herself will remain in office for days or weeks – certainly not months.

Trump's replacement Jeremy Hunt appears to be a more reliable choice, although Bank of England Governor Andrew Bailey said that the ill-fated "mini-budget" will still leave a legacy of higher inflation and interest rates. Still, Hunt reversed most of the decisions contained in it.

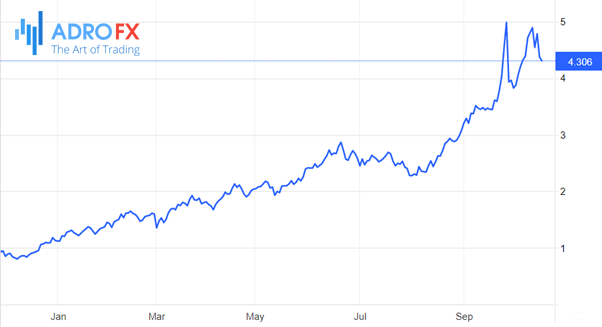

The yield on 30-year government bonds, the very bonds most affected by the pension crisis, fell from a high of about 4.9 percent Friday to 4.306 percent after Hunt reversed decisions on tax cuts and subsidies. Nevertheless, the figure remains well above the 3.3% level it was at before Truss became prime minister and while Trump was only hatching his plans.

The U.K. is now a bit on the back burner, as investor attention has turned back to the Federal Reserve (Fed). And here things are sad.

Last week's consumer price index for September came in at 8.2%, exceeding the forecast and undermining hopes that the Fed might slow the pace of rate hikes.

The minutes of the Sept. 20-21 meeting of the Federal Open Market Committee (FOMC), released last week after a standard three-week delay, contained unmistakable signals:

"Many participants emphasized that the risks of not doing enough to reduce inflation probably outweigh the risks of doing too much."

The Fed is overreacting. It seems that in the eyes of the central bank, even a painful recession is now better than higher inflation and an even deeper recession later.

And yet, hedge funds and other sophisticated investors are betting that the Fed will pause to raise rates and then lower them next year when inflation eases. This, of course, will not happen at the next meeting on Nov. 1-2. In the absence of a significant decline in inflation, the Fed won't change course for several months at the earliest.

Now almost everyone expects the Fed to raise its key interest rate by 75 basis points for the fourth time in a row next month, and some are even expecting a full percentage point increase. In mid-December, the rate will probably be raised by a similar amount.

Getting back to the subject of government action chaos, U.S. officials are so concerned about the midterm elections coming up in a few weeks that President Joe Biden has become the chief denier of inflation and recession, despite all evidence to the contrary. The election scheduled for Nov. 8, which could result in a pole shift in both houses of Congress, comes at a bad time for Democrats. True, they had an opportunity to cut off inflation at the root last year, but they didn't take it.

Speaking of the challenges facing the global economy, former U.S. Treasury Secretary Larry Summers said: "I think the fire truck hasn't left the station yet."

He was referring primarily to the World Bank and the International Monetary Fund, both of which are acting at the behest of the U.S., but those words probably also apply to the Fed and the U.S. government itself.

"We have the most complex, heterogeneous, and intertwined problems right now in the 40 years that I've been following this sort of thing," Summers said Friday during his speech at the Institute of International Finance annual meeting.

The policy vacuum isn't just about politicians worrying about the election, it's also about the unfortunate fact that the biggest global economy is being run by former U.S. central banker Janet Yellen and the world's second-biggest central bank is being run by politician Christine Lagarde. Both are at a disadvantage and can't support any coherent initiatives.

The political and financial crisis in Britain may be a precursor to a global crisis. Summers warned last week that the U.K. crisis may portend global shocks, noting: "When it shakes, it doesn't necessarily mean an earthquake, but you should still think about protecting yourself."