Federal Reserve Cautious on Inflation while UK GDP Disappoints | Daily Market Analysis

Key events:

- Australia – Employment Change (Mar)

- UK – GDP (MoM) (Feb)

- UK – Manufacturing Production (MoM) (Feb)

- UK – Monthly GDP 3M/3M Change (Feb)

- USA – Initial Jobless Claims

- USA – PPI (MoM) (Mar)

The Federal Reserve's minutes from last night did not reveal much more than what was already known from the post-meeting statement and Powell's press conference. According to Fed staffers, the recent banking turmoil has tempered the reaction function of many Fed officials in terms of how many more hikes are needed to control prices. Additionally, the risks of a modest recession have increased. However, the primary focus remains on inflation, which is still high and stubborn, and a labor market that is proving to be increasingly resilient.

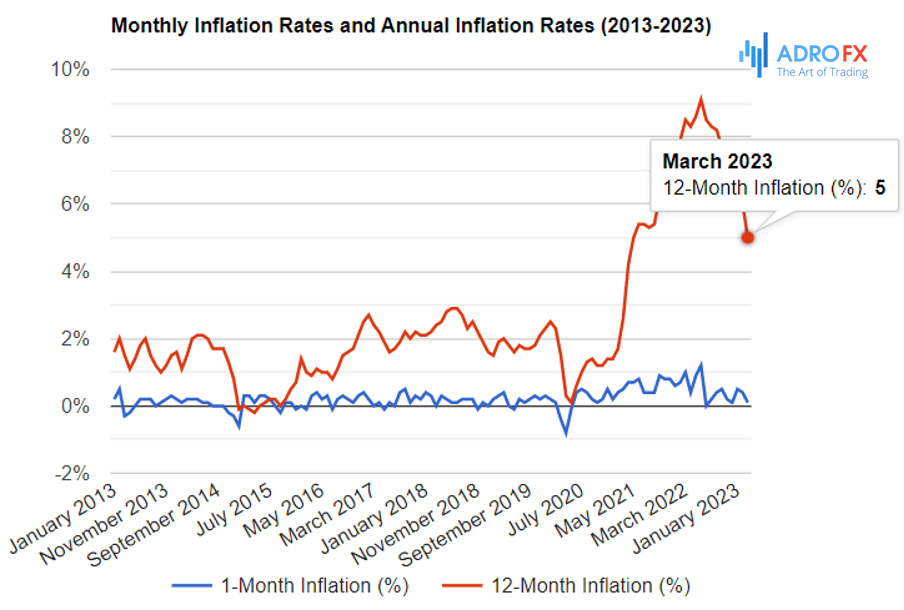

While US inflation has continued to decrease, the core Consumer Price Index (CPI) remained strong, and higher energy prices are expected to impact the index in the coming months. Although markets initially responded positively to the better-than-expected drop in the headline inflation data, monthly inflation fell from 0.4% to 0.1%, and the yearly drop was as expected, decreasing to 5.0%.

The Australian dollar has received positive updates recently, such as increases in business and consumer confidence and improved relations with China. China has announced a quicker investigation into the antidumping tariffs imposed on Australian barley, in exchange for Australia suspending its case against China on the tariffs at the WTO. These tariffs, along with other trade barriers against Australian imports of wine, seafood, meat, and coal, were established by China following Australia's previous conservative government's call for an international inquiry into the origins of Covid-19, leading to a deterioration in relations between the two countries. China has already lifted restrictions on Australian coal, and this barley agreement may pave the way for the easing of restrictions on other Australian imports. Despite these developments being positive, they only have a marginal effect on the AUD, in my opinion, as China's trade barriers have had a small impact on Australia's trade balance.

More important for the AUD/USD exchange rate will be Australia's labor market data, as relative rates and risk sentiment are the primary focus. Australia's tight labor market and the possibility of stronger wage growth are keeping the RBA on a tightening bias. Although Australian job growth rebounded strongly in February, this was partially due to a statistical anomaly, and employment growth is likely to slow in line with weaker leading indicators.

At the same time, the Bank of Canada (BoC) decided not to increase interest rates during their meeting this morning. Consequently, the 2-year USD-CAD swap spread has tightened to its narrowest point since last September when it returned to positive territory. Canadian money markets are pricing in steady rates for the remainder of the year, with only a slight chance of cuts. This position should not be challenged unless the bank announces that its tightening cycle is over for good, which appears unlikely at this meeting given growing uncertainties across global financial markets.

While core inflation and wages growth have slightly cooled in Canada, they remain sticky. The BoC may want to see more progress in that direction before officially ending this tightening cycle, while their updated base case scenario in the new Monetary Policy Report will likely be closely scrutinized. Ultimately, the Canadian dollar (CAD) will depend more on other factors such as resilient risk appetite and energy prices to recoup additional ground, as short CAD positions remain very crowded.

Earlier today, the GDP report for the UK in February was published, falling short of expectations as the economy came to a halt after expanding by 0.4% in January. Economists had predicted a growth rate of 0.1%. The services sector shrank by 0.1% after showing a growth of 0.7% in January, while production output decreased by 0.2%, following a decline of 0.5% in the previous month. Nevertheless, construction growth compensated for the fall in services and production, and output in consumer-facing services increased by 0.4%, driven by a surge in retail trade. Over the past three months, the economy grew by 0.1%.

After the report was released, the GBP/USD remained unchanged at $1.24849. If the figures had been better than expected, it could have affected the outlook towards the monetary policy of the Bank of England, which has been weakened by recent remarks from dovish Monetary Policy Committee members.