Tech Surge Drives Dow Higher, Positive Earnings Expectations Rise for Major Wall Street Banks | Daily Market Analysis

Key events:

- USA - Export Price Index (MoM) (Jun)

- USA - Import Price Index (MoM) (Jun)

- USA - Michigan Consumer Sentiment (Jul)

The Dow Jones Industrial Average closed higher on Thursday, boosted by a surge in Google's stock, which contributed to a positive day for the technology sector. Investors also digested better-than-expected quarterly results from Pepsico and Delta, with anticipation building for upcoming earnings reports from major Wall Street banks.

The Dow Jones Industrial Average rose by 0.14%, equivalent to 47 points, while the Nasdaq saw a substantial increase of 1.6%. The S&P 500 also experienced gains, rising by 0.8%.

Alphabet, the parent company of Google (NASDAQ: GOOGL), saw its stock rise over 4% after launching Bard AI in Brazil and the European Union. This move is part of Google's efforts to compete with rival ChatGPT in the field of artificial intelligence.

According to Morgan Stanley, Google Search, which contributes significantly to Alphabet's revenue, is expected to become "more personalized" and develop "critical competitive moats" as the company further invests in AI.

Meta Platforms Inc (NASDAQ: META), the social media giant, is also capitalizing on the AI trend. It is preparing to release a commercial version of its AI large learning model, which was previously available only to researchers and academics earlier this year.

Positive sentiment towards Meta was further bolstered by TD Cowen's upgrade of the company's stock to outperform from perform. This upgrade is based on expectations of enhanced performance resulting from cost cuts and increased monetization from features such as Reels and Threads.

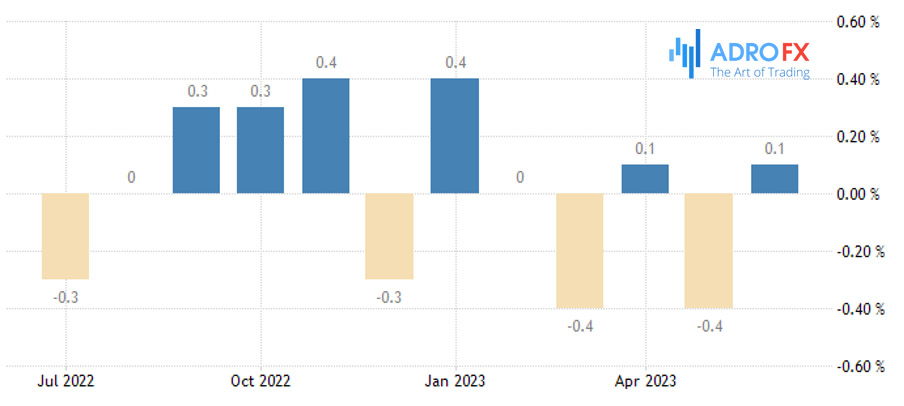

In economic news, producer prices in June showed a slower-than-expected increase, following the trend of slowing consumer price pressures. The Price Producer Index rose by 0.1% in June, falling short of the anticipated 0.2% rise. Analysts at Stifel noted that earlier policy initiatives are already working to cool inflation towards the Federal Reserve's target, particularly on the producer side.

However, weekly jobless claims for the week ending July 7 fell more than expected. This indicates that the labor market remains strong, which may impact the Federal Reserve's decision-making regarding interest rate hikes.

Overall, the market witnessed a positive day with tech stocks leading the way, boosted by developments in the AI space and encouraging economic data.

European markets have experienced a notable rebound as investors reassess their expectations of multiple rate hikes from the European Central Bank (ECB) and the Bank of England. While it is still highly likely that the ECB will raise rates by 25 basis points this month and the Bank of England will do so at the beginning of August, the path beyond these initial hikes has become less clear.

Despite a contraction in UK GDP numbers for May due to an additional Bank Holiday, the figures were better than forecast, leading to another daily gain for the pound.

The UK's services sector also outperformed expectations, indicating that the economy has held up reasonably well amidst current challenges. This suggests that the Bank of England may still have room to raise rates further, with 25 basis points already priced in for August and potentially 50 basis points if next week's Consumer Price Index (CPI) data does not show a significant slowdown. However, there is a belief that UK inflation could decline rapidly by the end of the third quarter, in line with global inflation trends.

The recent decline in the US dollar has been remarkable, and despite this week's data, there is little sign that the Federal Open Market Committee (FOMC) has changed its stance on the need for multiple rate hikes by the end of the year. However, the market is increasingly skeptical, as reflected in sharply retreating 2-year yields, with investors pricing in a scenario of slowing prices and a resilient labor market.

In terms of economic data, today's noteworthy releases include US import and export prices for June, which are expected to reinforce the deflationary narrative observed in this week's data. Both month-on-month and annual figures are anticipated to show negative readings for the second consecutive month. The latest University of Michigan sentiment numbers for July will also be released, though they may not receive the same level of attention given this week's CPI and PPI numbers.

On the earnings front, the focus will be on the second-quarter results of JPMorgan Chase, Citigroup, and Wells Fargo. Investors will closely examine their views on the health of the US consumer, provisions set aside, and guidance on the outlook for the US economy in the third quarter.