Tech Earnings Drag S&P 500 to Steepest Drop Since 2022 as Tesla and Alphabet Plunge | Daily Market Analysis

Key events:

- USA - Durable Goods Orders (MoM) (Jun)

- USA - GDP (QoQ) (Q2)

- USA - Initial Jobless Claims

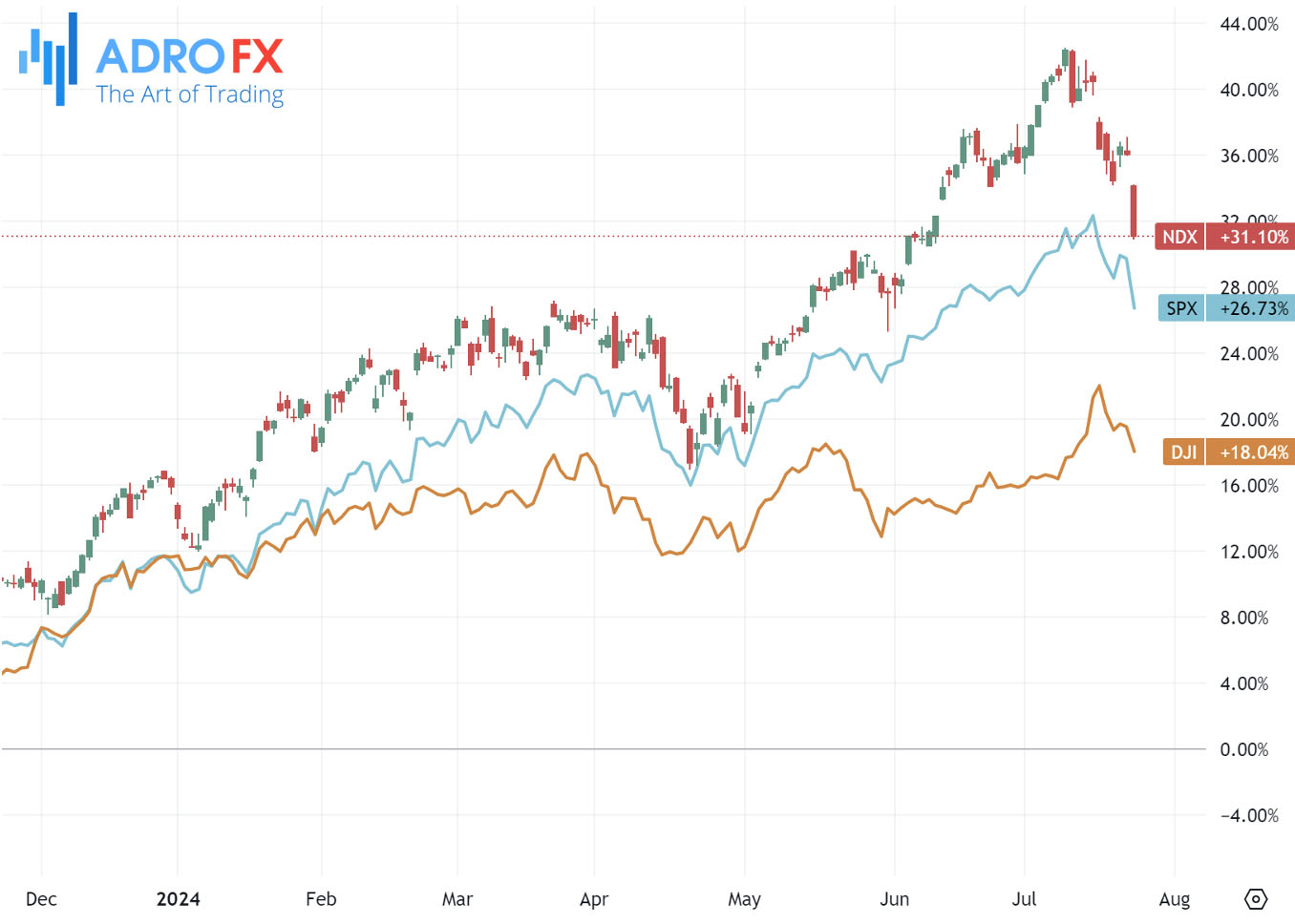

The S&P 500 experienced a significant decline on Wednesday, marking its largest one-day loss since 2022, as tech stocks plummeted following disappointing second-quarter earnings from Alphabet and Tesla.

The S&P 500 fell 2.2%, the steepest drop since December 15, 2022. The NASDAQ Composite slid 3.6%, and the Dow Jones Industrial Average dropped 504 points, or 1.3%.

Tesla (NASDAQ: TSLA) shares plunged 12% after its second-quarter earnings missed estimates due to declining vehicle sales.

Tesla’s profit margins reached a five-year low as the electric vehicle manufacturer slashed prices to combat increased competition in crucial markets like China.

Despite the margin pressures, some Wall Street analysts remained optimistic about Tesla, citing potential growth opportunities in areas such as robotaxis.

"While the margin weakness is weighing on the stock... the next phase of the Tesla growth story is around autonomous, robotaxis, and AI playing out for Musk & Co. in our view, and that vision is on the doorstep," Wedbush noted.

Google-parent Alphabet (NASDAQ: GOOGL) dropped nearly 5%, despite its second-quarter earnings surpassing expectations due to increased advertising sales and strong demand for its cloud services.

Alphabet's strong performance in its Search and Cloud segments was offset by "underperformance at YouTube, largely due to difficult comps, and continued weakness at Google Network," according to Deutsche Bank.

Gold prices continued their downward trend for the second consecutive day, falling to a two-week low during Thursday's Asian session. However, the precious metal found some support around the $2,365 level, helping to mitigate part of the intraday losses. The expectation that the Federal Reserve will start cutting interest rates in September is keeping the US Dollar below its two-week high from Wednesday, providing a boost for gold.

Additionally, a risk-off sentiment, reflected in weaker global equity markets, is benefiting traditional safe-haven assets like gold. Traders are likely to remain cautious, awaiting more clarity on the Fed's policy direction. Key US economic data, including the Advance Q2 GDP report due later on Thursday and the crucial Personal Consumption Expenditures Price Index on Friday, will be closely watched.

Meanwhile, the Japanese Yen extended its gains against the US Dollar for the fourth straight session, nearing its 12-week high of 152.22 reached on Thursday. This Yen strength is attributed to traders unwinding carry trades ahead of the Bank of Japan's policy meeting next week.

The BoJ is expected to raise interest rates at the upcoming meeting, prompting short-sellers to close their positions and strengthening the JPY. The BoJ is also anticipated to outline plans to reduce its bond purchases, signaling a reduction in monetary stimulus. On Wednesday, Japanese Finance Minister Shunichi Suzuki and top currency diplomat Masato Kanda refrained from commenting on foreign exchange matters as the USD/JPY pair hit its lowest level in over two months.

The Australian Dollar continued its losing streak for the ninth consecutive day on Thursday, driven by falling prices of oil, iron ore, and copper. As a net exporter of these commodities, Australia's currency is highly sensitive to their price movements.

The AUD was further pressured by recent Purchasing Managers Index data showing that Australia's business activity dropped to a six-month low in July, with manufacturing activity remaining in contraction and growth in the services sector slowing. However, the AUD may find some support as the Reserve Bank of Australia is expected to delay easing its policy tightening due to persistent inflation and a tight labor market. Futures markets indicate a 20% chance of an RBA rate hike in August.

The USD/CAD pair continued its upward trajectory, gaining for the seventh consecutive day on Thursday. This marks the tenth positive move in eleven days, lifting spot prices to the highest level since April 17, around the 1.3820 region during the Asian session.

Crude oil prices remain near a one-and-a-half-month low amid concerns about slowing demand from China, the world's largest importer. This, coupled with the Bank of Canada's dovish outlook, is weighing on the commodity-linked Loonie and supporting the USD/CAD pair. The BoC recently cut its key policy rate by 25 basis points for the second consecutive month and indicated more cuts could follow if inflation continues to cool as expected.

Furthermore, the BoC lowered its 2024 growth forecast to 1.2% from the 1.5% predicted in April and reiterated that inflation should return to the 2% target by the second half of 2025. Market reactions suggest a more than 52% probability of another rate cut at the BoC's next meeting in September. This outlook is overshadowing a modest USD downtick and bolstering the USD/CAD pair's prospects for further appreciation.