Stocks Rally on Debt Ceiling Progress and AI Optimism; Eurozone Inflation Data Awaited | Daily Market Analysis

Key events:

- UK – Bank Holiday

- USA – Memorial Day

US stocks experienced significant gains on Friday, driven by positive developments in talks regarding the US debt ceiling and a surge in chip stocks fueled by optimism surrounding artificial intelligence.

Following multiple rounds of negotiations, US President Joe Biden and top congressional Republican Kevin McCarthy were reported to be approaching a deal to raise the government's debt limit of $31.4 trillion for two years. The deal also included a spending cap on most items, according to a US official cited by Reuters.

As a result, the Dow Jones Industrial Average managed to break a five-day losing streak, while both the Nasdaq Composite Index and the S&P 500 reached their highest levels since August 2022. Notably, the S&P 500 surpassed the 4,200-point mark, reflecting positive investor sentiment.

The surge in chip stocks can be attributed to growing optimism surrounding the prospects of artificial intelligence, which heavily relies on advanced chip technologies. This positive outlook in the AI sector contributed to the overall market optimism and played a role in the stock market's upward trajectory on Friday.

Investors maintained a close watch on the ongoing debt ceiling talks, as President Joe Biden and top congressional Republican Kevin McCarthy continued to navigate disagreements on several key issues. These deliberations took place ahead of the long weekend, with the US stock market closed on Monday in observance of the Memorial Day holiday.

The outcome of the debt ceiling negotiations remained uncertain, leaving investors eager to see how the discussions would progress and whether a resolution could be reached. The closure of the stock market on Monday added to the anticipation surrounding the talks, as investors awaited further developments and their potential impact on the market when trading resumed.

Meanwhile, the US dollar displayed strength as the country's economic resilience fueled market expectations for potential interest rate hikes by the Federal Reserve. Additionally, the news of a finalized debt ceiling deal contributed to a sense of optimism, prompting some risk-on sentiment.

Against the Japanese yen, the greenback reached a fresh six-month high of 140.91 yen during early Asia trade. Furthermore, the US dollar was on track to record a monthly gain of over 3% against the Japanese currency.

The yen's decline can be attributed to the rising yields of US Treasury bonds, as investors increasingly anticipate that interest rates in the United States will remain elevated for a more extended period.

Data released on Friday revealed that US consumer spending surpassed expectations in April, while inflation also showed signs of picking up. These positive indicators further bolstered the perception of a resilient US economy.

This week markets will eye several important reports: the US jobs report and Eurozone inflation.

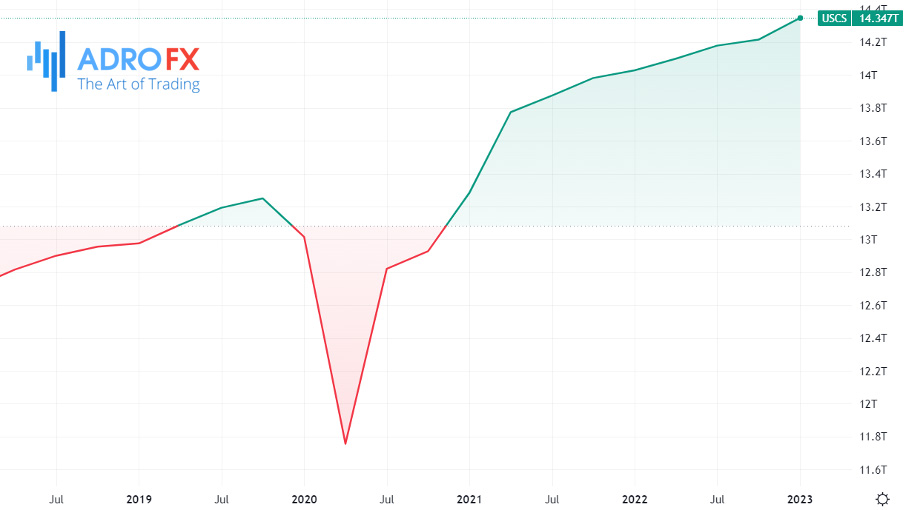

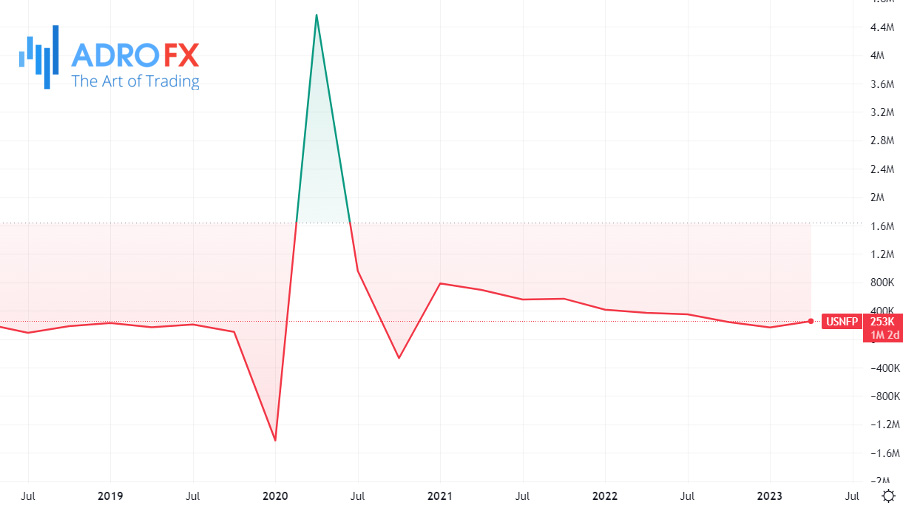

First off, economists anticipate that the nonfarm payrolls report, set to be released on Friday, will reveal the addition of 180,000 jobs to the U.S. economy in May. In April, the country experienced an acceleration in job growth, with an increase of 253,000 jobs, accompanied by solid wage gains.

The upcoming jobs report holds significance as it will be among the final data points available before the Federal Reserve's June meeting. During the Fed's May meeting, indications were given that the central bank was open to pausing its aggressive 14-month campaign of raising interest rates in June.

However, since then, several Fed policymakers have expressed the belief that inflation is not decelerating at a satisfactory pace. This sentiment was reinforced by data released on Friday, which revealed a significant increase in underlying core inflation, reaching 4.7% in April, surpassing the Fed's 2% target.

Currently, market expectations reflect a probability of approximately 64% that the Fed will raise interest rates by another 25 basis points during its June 14 meeting, according to Investing.com's Fed rate monitor tool. Investors will closely analyze the upcoming jobs report to gather insights and gauge the potential course of the Federal Reserve's monetary policy.

The Eurozone is set to release its flash consumer price inflation data for May on Thursday, which is expected to emphasize the ongoing challenges faced by the European Central Bank (ECB) in containing price pressures. Currently, headline inflation stands at 7% on a year-over-year basis, while underlying annual inflation is at 5.4%, both significantly above the ECB's 2% target.

During its most recent meeting earlier this month, the ECB reaffirmed its commitment to a rate-hiking stance, stating that further progress is necessary to address inflationary pressures. The central bank acknowledges that there is still a considerable distance to go in order to bring inflation under control.

Last week's data revealed that Germany, the largest economy in the Eurozone, entered a recession in the first quarter due to the impact of high inflation on consumer spending. This underscores the real-world effects of elevated price levels within the bloc.

The upcoming release of Eurozone consumer price inflation data will be closely monitored to assess the extent of the inflationary pressures and the ECB's ability to address them effectively.