Stock Market Up Despite Bank Collapse - Fed, ECB Meetings in Focus | Daily Market Analysis

Key events:

- USA - ISM Manufacturing PMI (Apr)

Last week, the stock market continued its upward momentum as investors analyzed the latest earnings reports and economic data. However, Friday brought news of the collapse of First Republic Bank, which was brought down by hysteria sparked by venture capitalists realizing that their influence had spread beyond Silicon Valley Bank and caused turmoil in the regional banking industry. This once high-flying bank was left struggling to recover and ultimately entered into official receivership on April 28th, 2023. Despite this news, the Dow rose by 270 points (0.8%), the S&P gained 35 points (0.8%), and the Nasdaq was up 85 points (0.7%).

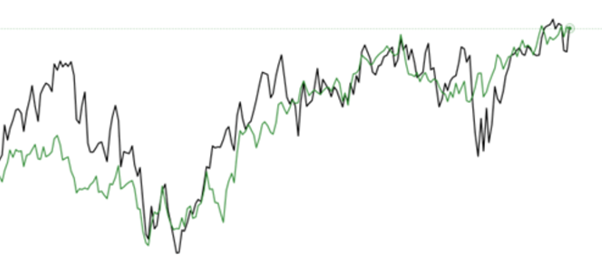

The USD Index has experienced a decline recently, and there are concerns that the ECB may adopt a more hawkish stance than the Fed. However, the truth is that the EUR/USD has mostly benefited from a strong US stock market and low volatility. The green line in the chart shows the daily movement of the EUR/USD, while the black line represents the inverted (down means up) daily movement of the Cboe Volatility Index (VIX). As seen from the relationship between the two lines, the currency pair has moved in the opposite direction to the VIX for almost a year. When the VIX falls and there is a risk-on sentiment in the market, the euro appreciates at the expense of the USD. However, the situation is expected to change going forward.

The Fed's tightening cycle still has room to go, which will likely lead to a rise in real interest rates and be bullish for the USD Index. Additionally, the calendar is set to turn bullish for the greenback in the coming days, and with investors loosening financial conditions and inflation rising due to rallying risk assets in April, the narrative may shift significantly in the months ahead.

Meanwhile, investors and traders are looking forward to a packed week ahead, with central bank meetings from the Reserve Bank of Australia, the Federal Open Market Committee, and the European Central Bank taking center stage. On Tuesday, the RBA is expected to keep its Official Cash Rate unchanged at 3.6%, with annual inflation in Australia cooling to 7.0% in Q1 2023, according to the Australian Bureau of Statistics. The ASX 30-Day Interbank Cash Rate Futures predict that there will be no change to the benchmark rate, indicating that we may not see significant movement in the market unless there is a surprise move.

On Wednesday, the Federal Open Market Committee (FOMC) is expected to raise the Fed Funds Target range to 5.0%-5.25%, despite ongoing turmoil in the banking sector, specifically First Republic Bank (FRC) which plunged on Friday with a rescue deal seeming unlikely. Investors are closely monitoring the latest data from the Federal Reserve, with many waiting to see if there will be any hints at a June rate hike or a potential decrease in rates. The expected 25 basis point hike on Wednesday has led some to speculate about the possibility of lower rates in the near future. However, many analysts, including myself, do not believe this to be a likely scenario. It's hard to justify raising rates due to inflation concerns, only to cut them a few months later to stimulate an already hot economy. Instead, my prediction is that the Fed will raise rates to 5.25% to 5.5% by June, followed by a holding period until at least year-end. Investors are closely watching for any indications from the Fed about their next steps, and how these will affect the markets in the coming weeks.

The ECB rate decision is on Thursday, with many expecting a 25bp increase. Inflation data will be released before the decision on Tuesday, but economists do not anticipate this data affecting the decision.

Looking ahead, Friday's US jobs data is in focus for investors. The consensus forecast for non-farm payrolls in April is around 180,000, a decrease from March's 236,000. However, forecasts range between 220,000 and 150,000 leading up to the event. Meanwhile, the median forecast predicts an uptick in the unemployment rate from 3.5% to 3.6%.

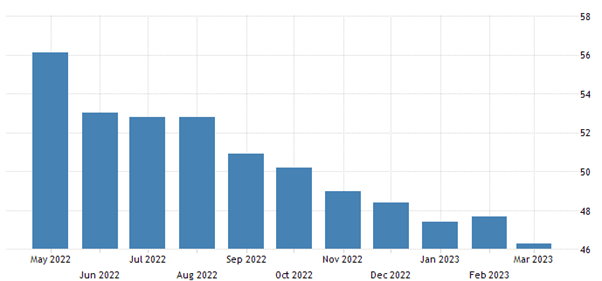

Today, investors are keeping an eye on the US ISM manufacturing index for April to determine whether it will reflect the same strength as the earlier PMIs.