S&P 500 Inches Up Amidst Earnings Review While Australian Dollar Plunges Post RBA Decision | Daily Market Analysis

Key events:

- Eurozone - European Central Bank Non-monetary Policy Meeting

- USA - Crude Oil Inventories

- USA - 10-Year Note Auction

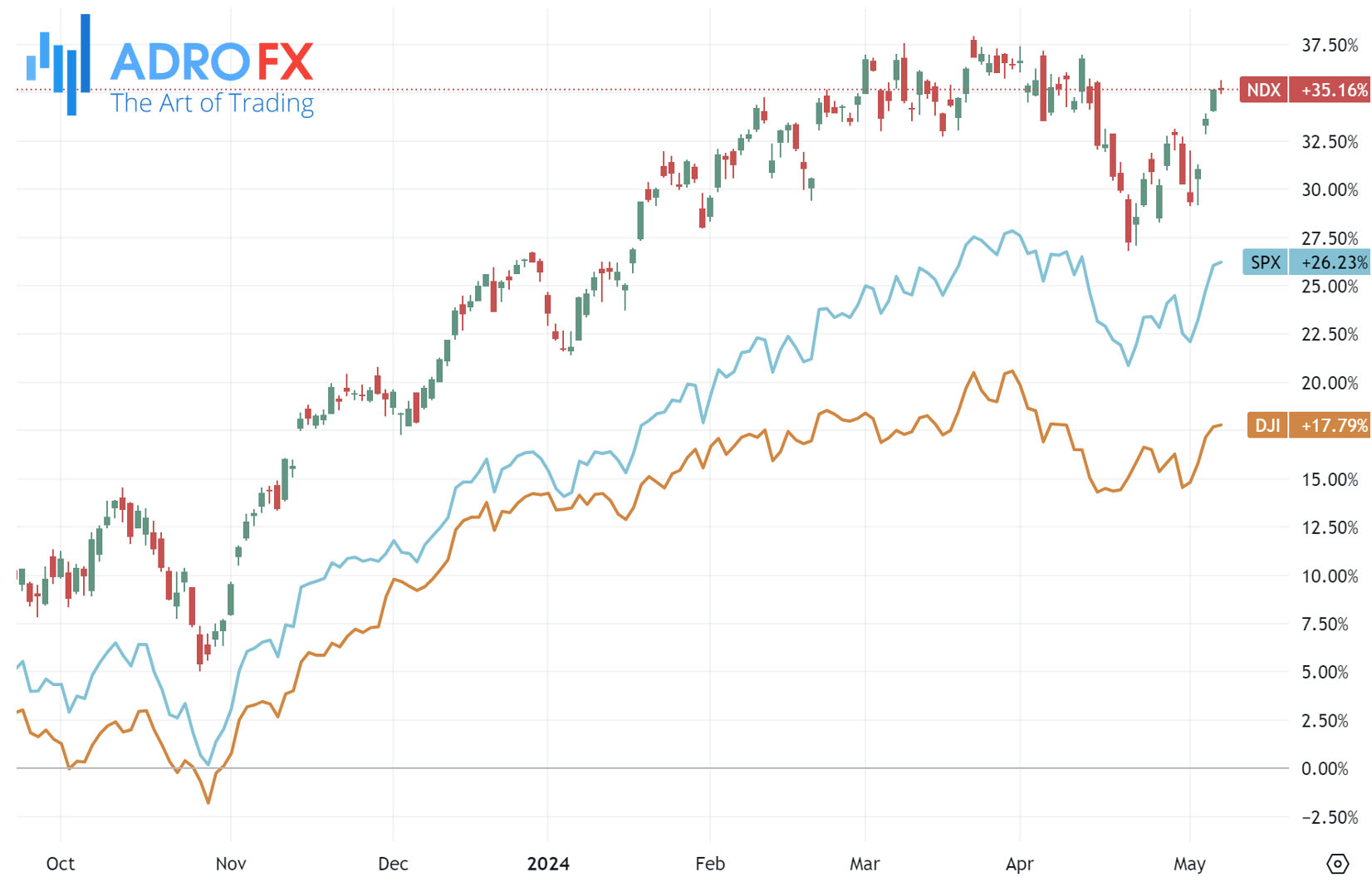

On Tuesday, the S&P 500 managed to secure a modest gain, supported by a decline in Treasury yields, as investors grappled with a multitude of corporate earnings reports, notably including disappointing subscriber growth figures from Disney.

Meanwhile, the Dow Jones Industrial Average saw an uptick of 31 points, equivalent to 0.1%, mirroring the S&P 500's marginal increase, while the NASDAQ Composite experienced a slight dip of 0.1%.

The stock market found some footing amidst the backdrop of declining Treasury yields, as optimism for a potential rate cut resurfaced in light of lackluster jobs data and recent remarks from Federal Reserve Chair Jerome Powell suggesting that the central bank's next move may not involve a rate hike.

In Asian trading on Wednesday, gold prices inched up marginally, failing to garner significant support from safe-haven demand, partly due to skepticism arising from comments made by Federal Reserve officials, causing markets to reassess expectations for interest rate cuts.

However, gold did experience some safe-haven interest this week amid escalating tensions in an Israel conflict, with ceasefire negotiations showing little progress.

Nevertheless, the allure of safe-haven assets was tempered by renewed concerns over elevated U.S. interest rates and a strengthening dollar, creating downward pressure on gold prices.

The Australian Dollar took a nosedive after the Reserve Bank of Australia announced its decision to keep the interest rate steady at 4.35% on Tuesday. Initially, investor sentiment leaned towards a potentially more aggressive stance from the RBA, especially following last week's inflation data, which exceeded expectations. However, the RBA's acknowledgment that recent progress in curbing inflation has stalled led to a reevaluation, with the central bank maintaining its forward guidance of refraining from committing to any specific actions.

In March, Australian monthly inflation unexpectedly surged, contrary to market projections of stagnation. RBA Governor Michele Bullock underscored the importance of remaining vigilant regarding inflation risks, expressing confidence that the current interest rates are appropriately positioned to guide inflation back towards its target range of 2-3% in the latter half of 2025 and towards the midpoint in 2026.

Meanwhile, the USD/CAD pair continued its upward trajectory for the second consecutive session, hovering around 1.3750 during Wednesday's Asian trading hours. This upward momentum can be attributed to the strength of the US Dollar, driven by the prevailing hawkish sentiment surrounding the Federal Reserve and expectations of sustained higher interest rates.

Conversely, the Canadian Dollar weakened against the US Dollar, influenced by the latter's strength impacting crude oil prices, thereby impacting the USD/CAD pair. This correlation is particularly significant due to Canada's status as the largest oil exporter to the United States.

The price of WTI crude oil extended its losses for the second consecutive day, trading around $77.80 per barrel at the time of writing. Attention among oil traders will now shift to the US Crude Oil Stocks Change report due later on Wednesday, with the Energy Information Administration expected to announce a decline in the weekly measure of the change in the number of barrels in stock of crude oil and its derivatives.

Furthermore, despite higher-than-expected Ivey PMI figures from Canada, the CAD struggled to gain traction. Canada's seasonally-adjusted Ivey PMI for April rose to 63.0 from 57.5, surpassing the forecast of 58.1. This marked the ninth consecutive monthly increase, reaching its highest level in two years.

The EUR/USD pair continues to slide for the second consecutive session, trading around 1.0750 during Wednesday's Asian session.

In the Eurozone, Retail Sales (MoM) saw a notable surge of 0.8% in March, rebounding from the upwardly revised 0.3% decline observed in February. This exceeded the anticipated increase of 0.6%. It marked the most significant uptick in retail activity since September 2022, suggesting strength in the European consumer sector. Additionally, Retail Sales (YoY) rose by 0.7% compared to the revised 0.5% drop recorded in February. This signals the first growth in retail sales since September 2022, indicating a positive shift in consumer spending patterns.

Amid these developments, market expectations are mounting for the European Central Bank to initiate a reduction in borrowing costs starting in June. Chief Economist Philip Lane of the ECB, as reported by the Business Standard, stated that recent data have bolstered his belief that inflation is gradually approaching the 2% target. While several ECB officials seem inclined to support easing measures next month, President Christine Lagarde has not yet suggested further cuts at this juncture.