S&P 500 Ends Winning Streak Amid Inflation Concerns; EUR/USD and AUD Under Pressure | Daily Market Analysis

Key events:

- USA - ADP Nonfarm Employment Change (Apr)

- USA - S&P Global US Manufacturing PMI (Apr)

- USA - ISM Manufacturing PMI (Apr)

- USA - ISM Manufacturing Prices (Apr)

- USA - JOLTs Job Openings (Mar)

- USA - Crude Oil Inventories

- USA - FOMC Statement

- USA - Fed Interest Rate Decision

- USA - FOMC Press Conference

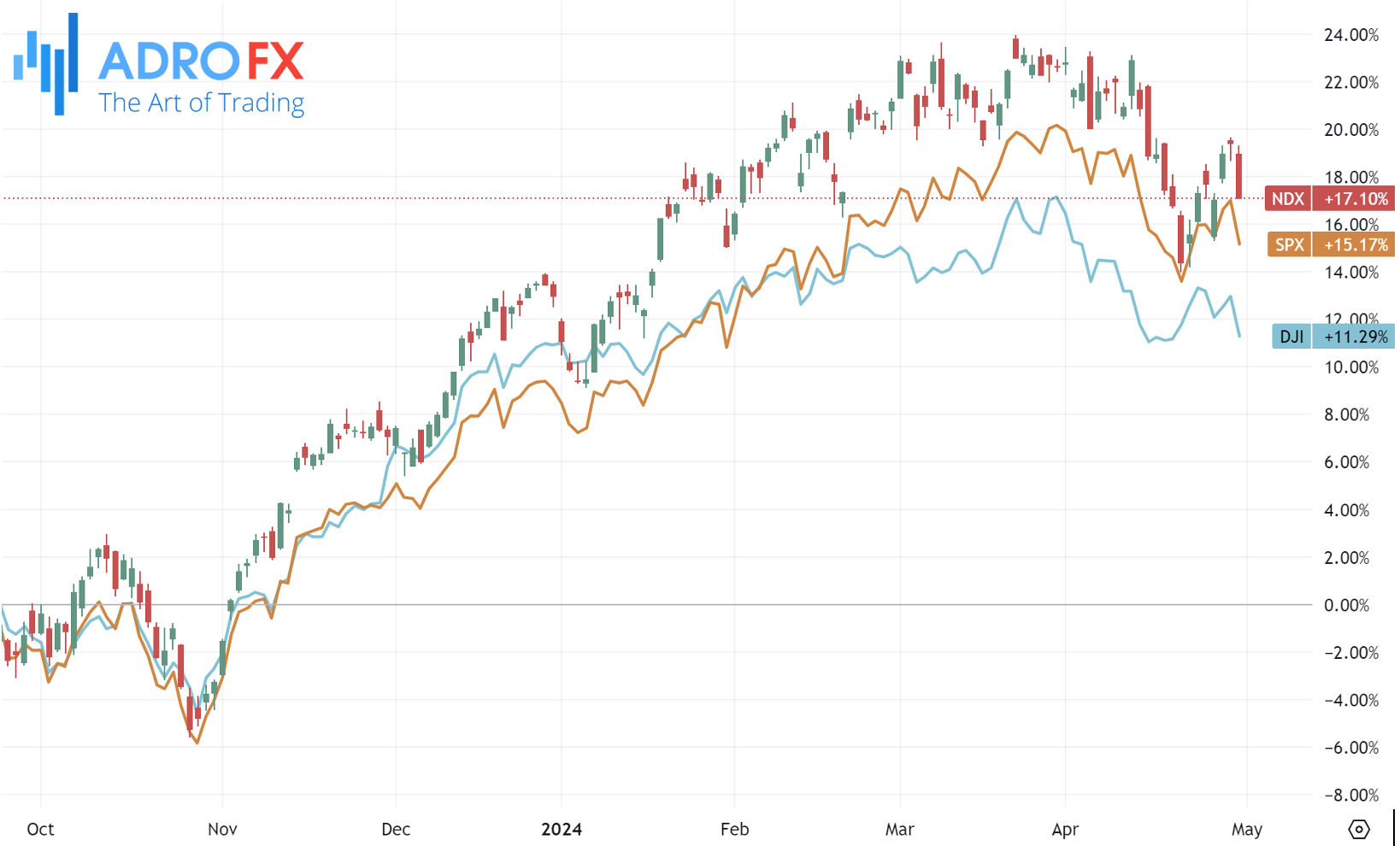

On Tuesday, the S&P 500 experienced a decline, breaking its streak of five consecutive months of gains, fueled by concerns over inflation sparked by data indicating wage pressure. This downturn coincides with the onset of the Federal Reserve's two-day meeting.

The Dow Jones Industrial Average saw a drop of 570 points, equivalent to a 1.1% decrease, while the S&P 500 fell by 1.5%, and the NASDAQ Composite experienced a 2% decline. Notably, the S&P 500 registered a 3% loss for the month.

The rise in US labor costs during the first quarter surpassed expectations, primarily driven by increasing wages and benefits. This development has reignited worries about inflation, particularly at a time when investor optimism regarding Federal Reserve rate cuts appears to be waning.

According to the Employment Cost Index, labor costs surged by 1.2% in the last quarter, following an unrevised 0.9% increase in the previous quarter. On a year-on-year basis, labor costs escalated by 4.2%.

This report follows recent data indicating a buildup of price pressures in the first quarter, further contributing to concerns surrounding inflation.

EUR/USD's downtrend extends into the second consecutive day, with the pair hovering around the 1.0650 mark during Asian trading hours on Wednesday. With European markets mostly closed in observance of Labour Day, market participants eagerly await the Federal Reserve's latest policy decision.

Despite robust Eurozone data released on Tuesday, the Euro struggled to maintain its upward momentum. The Eurozone GDP expanded by a higher-than-expected 0.3% in the first quarter. Additionally, the Harmonized Index of Consumer Prices (HICP) demonstrated steady year-over-year growth, meeting expectations. However, core HICP, which excludes food and energy prices, softened but still surpassed estimates.

Investor sentiment remains bullish regarding the European Central Bank potentially implementing interest rate cuts in June, as a majority of ECB policymakers have signaled support for such actions.

On Tuesday, the Japanese Yen experienced significant losses against its American counterpart, reversing a substantial portion of the previous day's gains driven by potential intervention by Japanese authorities. The primary factor contributing to the JPY's weakness is the interest rate differential between Japan and the United States, which is anticipated to remain significant for the foreseeable future. This, coupled with increased demand for the US Dollar, propelled the USD/JPY pair higher during intraday trading.

Following the publication of the AiG Industry Index on Wednesday, signaling ongoing contraction in Australia's private business activity for March, the Australian Dollar remains in a slump. Despite this, market sentiment suggests that the Reserve Bank of Australia will uphold its current interest rates of 4.35% in the upcoming meeting scheduled for next week.

The Australian Dollar experienced further downward pressure subsequent to the release of disappointing Aussie Retail Sales data on Tuesday, prompting speculation regarding its potential impact on the RBA's interest rate stance. However, optimism sparked by higher-than-anticipated domestic inflation figures from the previous week has led to conjecture that the central bank might postpone any decisions regarding interest rate cuts.

The NZD/USD pair encounters selling pressure near the 0.5880 level during the early Asian session on Wednesday. The Kiwi depreciates following worse-than-expected New Zealand employment data.

In the first quarter of this year, New Zealand witnessed a significant surge in its unemployment rate amidst an extended recession exacerbated by high-interest rate conditions. According to Statistics New Zealand's report on Wednesday, the nation’s Unemployment Rate climbed to 4.3% in Q1 from 4.0% in Q4, surpassing market expectations of 4.2%. Concurrently, Employment Change figures registered a decline of 0.2% in Q1, contrasting with the previous reading's 0.4% rise and falling short of the projected 0.3% increase.

The spike in the unemployment rate may prompt the Reserve Bank of New Zealand to maintain its high rate for an extended period in a bid to mitigate inflationary pressures. Market sentiment indicates that the RBNZ is inclined to uphold a restrictive Official Cash Rate, with any prospects of rate cuts unlikely until 2025.

As the Federal Reserve commences its two-day policy-setting meeting, market expectations lean towards the central bank maintaining its benchmark interest rate within the current range of 5.25%-5.50%, where it has remained since July.

Investors are particularly keen on Federal Reserve Chair Jerome Powell's subsequent remarks following the monetary policy statement. These remarks are anticipated to carry significant weight, with investors eagerly seeking insights into whether Powell is inclined to align with the market's less dovish perspective on the rate outlook.