Markets Reaction to the New US Inflation Data | Daily Market Analysis

Key events:

UK - CPI (YoY) (Aug)

US - PPI (MoM) (Aug)

New Zealand - GDP (QoQ) (Q2)

Australia - Employment Change (Aug)

U.S. inflation in August was again stronger than expected, paving the way for another big interest rate hike by the Federal Reserve next week.

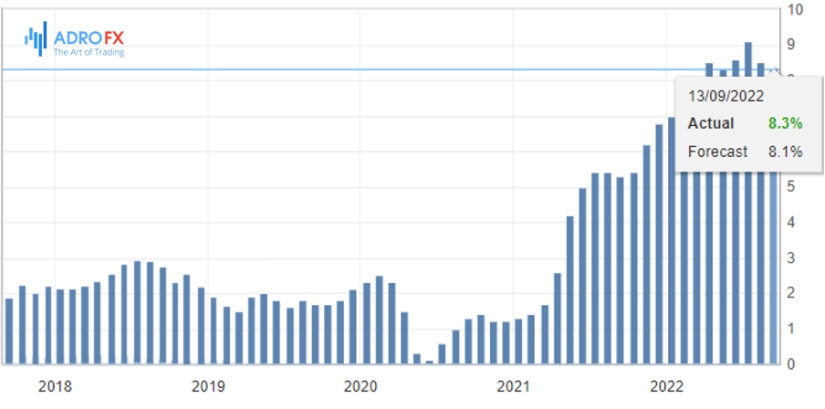

The consumer price index (CPI) rose 0.1 percent in August and 8.3 percent from a year earlier, the Bureau of Labor Statistics reported Tuesday. Analysts had expected prices to fall 0.1 percent thanks to a steady decline in gasoline prices from their summer peak.

U.S. Consumer Price Index (CPI) YoY

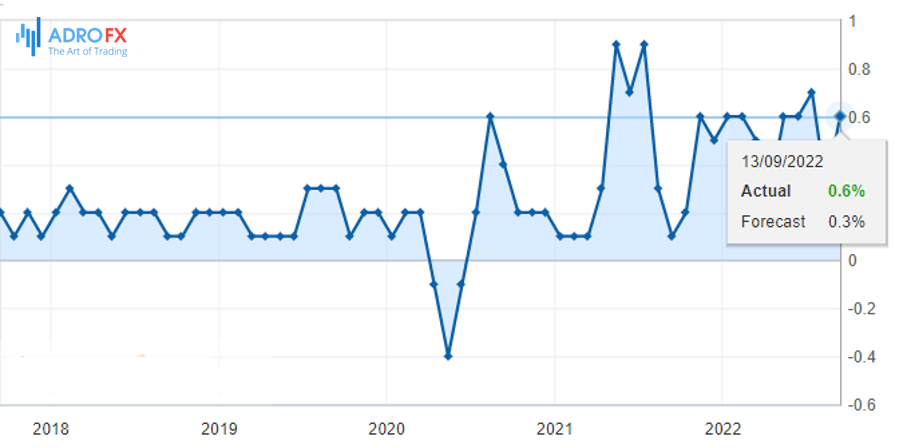

However, that factor was suppressed by a large increase in the less volatile elements of consumer spending. The so-called core consumer price index rose as much as 0.6%, twice as much as expected, pushing the annual core inflation rate from 5.9% in July to 6.3%. That's the highest rate since the 40-year high reached in March.

U.S. Core Consumer Price Index (CPI) MoM

"This is a much worse CPI report than anyone expected," Justin Wolfers, an economics professor at the University of Michigan, wrote on Twitter. - The decline in core inflation due to lower energy prices is there, but the core rate - best reflected by core inflation - is much higher than everyone had predicted and hoped."

Gasoline prices fell 10.6 percent over the month, but that was partly neutralized by rising natural gas and electricity prices, indirectly caused by the energy crisis in Europe over the war in Ukraine. The effect of cheaper energy was then completely offset by rising housing and health care prices, which rose 0.7% and 0.8%, respectively.

While the current spike in inflation may have first manifested itself in energy prices, it is now increasingly spreading to other areas of spending. According to ADM ISI strategist Mark Ostwald, only 2 sectors - leisure and education - are now posting annual inflation rates of less than 5%.

The dollar immediately appreciated over a cent against the euro on this news as market participants began to believe there will be another 75 basis point rate hike at next week's Fed meeting.

The EUR/USD chart showing yesterday`s rise of the dollar against the EUR

The same calculation sent stock futures in the opposite direction, sending the Dow Jones futures down 1.8%, the S&P 500 futures down 2.3%, and the Nasdaq 100 futures down 2.9%. All 3 indices showed strong gains on Monday and were poised for continued gains before the data was released.

The chart above is showing the recent drop of major US indices

Crude oil futures, which had been rising over the past couple of days amid a weaker dollar, also went sharply in the opposite direction, falling more than $1 a barrel and down 0.7% for the day, while gold futures fell 1.5%, reaching their lowest level in a week.

Oil and gold tend to react negatively to interest rate hikes, a trend that looks set to continue when the Federal Open Market Committee of the Fed meets again in a week.

"The market is likely to be wary of a 100 basis point rate hike at next week's meeting," Ostwald wrote in a note to clients. He noted that market participants "once again went down the long-standing path of unconcerned positivism and were once again confused by reality."