Markets Awaits CPI Report and Fed Meeting Minutes | Daily Market Analysis

Key events:

- USA – Core CPI (MoM) (Mar)

- UK – BoE Gov Bailey Speaks

- Canada – BoC Interest Rate Decision

- USA – Crude Oil Inventories

- Canada – BOC Press Conference

- USA – FOMC Meeting Minutes

- UK – BoE Gov Bailey Speaks

The US stock market is showing mixed dynamics in anticipation of the inflation report and minutes of the latest Federal Reserve meeting.

Investors are waiting for key consumer price data this week, which may influence the Fed's decision at its next meeting in May.

Technology stocks have contributed to indices and hopes this year that the Fed is close to halting a rate hike, but the sentiment is changing. Futures traders are now betting that the Fed will raise interest rates another quarter percentage point next month.

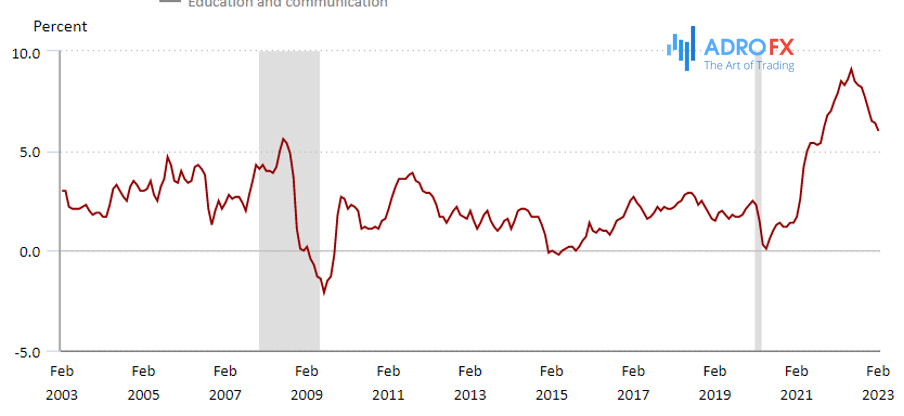

The US Bureau of Labor Statistics (BLS) is set to release the Consumer Price Index (CPI) data for March today at 12:30 GMT. Despite the US Dollar (USD) performing better than its major rivals after the upbeat March jobs report, it is struggling to gain bullish momentum. The Federal Reserve's (Fed) next policy action is uncertain, and inflation developments could provide hints. On an annualized basis, the forecast for the Consumer Price Index data is a decline to 5.2%, while the Core CPI, which excludes volatile food and energy prices, is expected to slightly increase to 5.6% from the previous month's 5.5%. Additionally, the expected increase in the headline CPI data for February is 0.3% MoM, lower than the 0.4% increase in February. The Core CPI is also projected to increase by 0.4% during the same period, down from 0.5% previously. The US CPI data is crucial for the Fed to decide whether another rate hike is necessary to bring inflation back down to the 2% target. The Fed is taking a cautious stance following the collapse of Silicon Valley Bank, which raised concerns over the negative impact of rising interest rates on financial stability. At the last policy meeting on March 22, the Fed hiked its policy rate as expected but acknowledged that tighter credit conditions could weigh on economic activity, hiring, and inflation. Economists at Commerzbank predict a potentially extended recovery in the US Dollar.

If the monthly core inflation reading is lower than expected, it could revive expectations for the Federal Reserve to maintain its policy rate at the upcoming meeting. Federal Reserve Chief Jerome Powell stated in the post-meeting press conference in March that the story on disinflation remained the same, and although they had not yet seen progress on core services inflation ex-housing, they need to remain alert when considering further rate hikes due to the potential impact of credit tightening on the economy. On the other hand, the March jobs report indicated that Nonfarm payrolls increased by 236,000, just below the market expectation of 240,000. Meanwhile, the Unemployment Rate decreased to 3.5%, and the annual wage inflation, as measured by the Average Hourly Earnings, fell to 4.2% from 4.6%. While the US labor market is still relatively robust, there are indications of a slowdown. As a result, the March CPI data may assist investors in determining whether or not to anticipate one more Fed rate increase. The CME Group FedWatch Tool presently shows that the probability of a 25 bps rate hike is roughly 70%.

If the CPI data disappoints, the US Dollar is likely to decrease, which could cause the EUR/USD pair to gain bullish momentum. Conversely, if the US CPI reading is unexpectedly high, another 25 bps Fed hike is likely to be confirmed, which could boost the USD and force the EUR/USD pair to decline. The index is still under pressure and is continuing to decrease after a brief uptick on Monday. It is now testing the 102.00 zone ahead of the release of important US inflation figures for March later in the North American session.

At the same time, US yields are continuing to recover gradually amid increasing speculation of another 25 bps rate hike by the Federal Reserve at the May 3 meeting. Aside from the release of inflation readings, investors will pay close attention to the publication of the FOMC Minutes from the March meeting, while MBA Mortgage Applications will complete the calendar on Wednesday.