Increased Volatility Ahead | Daily Market Analysis

Key events:

- UK - Average Earnings Index +Bonus (Aug)

- UK - Claimant Count Change (Sep)

- UK - BoE Gov Bailey Speaks

We have a dashing month ahead of us. Over the next 30 days, there will be a number of important events that will keep traders on edge.

Passions will really heat up this Thursday when the September CPI is scheduled to be released. The decline in oil and gasoline prices over the past month should help cushion the massive inflationary pressure seen over the summer, but the lagging housing and rental data will keep up the upward pressure on CPI.

Friday morning will bring out the next batch of data to gauge demand in the economy - last month's retail sales report. It will be interesting to see how the rise in gas station prices will affect those same numbers in November.

This week is also the start of the Q3 corporate quarterly report season. Some say that it is PepsiCo (NASDAQ: PEP) that kicks off the earnings season, but most financial gurus will tell you that JPMorgan Chase (NYSE: JPM) is the one that should do the honors. Be that as it may, the corporate reporting season is absolutely going to be a central theme, and what matters most is not the earnings numbers, but the companies' outlook for the future. The bears also want to clarify the issue with current earnings forecasts.

According to FactSet senior analyst John Butters, the current forecast for S&P 500 earnings per share for this year is $224 and for 2023 is $241. Air carriers, consumer companies, semiconductor manufacturers, and, of course, banks will report their financial results.

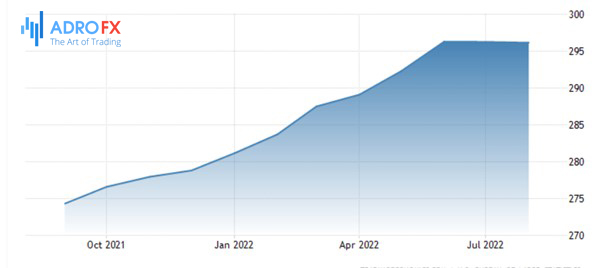

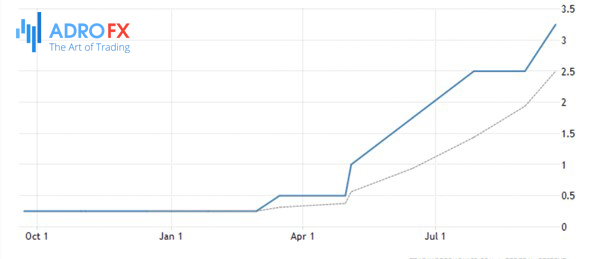

What other events are coming up in the next 30 days? Only three weeks remain before the Federal Reserve Board meets. After September's rather strong jobs report, traders are now pricing in an 81% chance of another 0.75 percentage point interest rate hike at the FOMC meeting on November 1-2.

In that case, the Fed Funds rate would reach 3.75–4.00%, not far from the "ultimate" level the market expects. For investors, this means that they would only need to put cash into a money market mutual fund to secure a return above 3.75%.

And that's not all.

On Tuesday, November 8, there will be a midterm election in the United States. At this point, Republicans have more than an 80% chance of keeping their majority in the House of Representatives, and the uphill battle for the Senate continues.

A month ago, the odds of Democrats maintaining their dominance in the Senate were estimated at 2 to 3, but Republicans have since gained ground, probably because the economy continues to hurt voters, and gasoline prices are climbing again.

The next 30 days are going to be very busy, aren't they? But why is the 30-day time frame so important to traders? Because that's how far ahead the VIX volatility index looks. The VIX futures curve understandably exhibits an inversion — the October contract trades higher than the November and December contracts.

Many market analysts are waiting for a deep backwardation in VIX futures, which they believe will indicate a stock market capitulation. But that is a separate topic.

Market participants should be prepared for higher volatility with the key macroeconomic data and important corporate reports coming out in the next 30 days, a key Fed meeting, and the midterm elections that have been so much talked about. A real feast for those who want to bet on the VIX.