Global Markets Navigate Volatility: Earnings, Economic Data, and Geopolitical Events Shape Trends | Daily Market Analysis

Key events:

- USA - Martin Luther King, Jr. Day

- Eurozone - Industrial Production (MoM) (Nov)

- Eurozone - Trade Balance (Nov)

- Canada - Wholesale Sales (MoM) (Nov)

- Canada - BoC Business Outlook Survey

On Friday, US stocks closed with minimal changes, fluctuating between slight gains and losses. Mixed bank earnings offset the impact of cooler-than-expected inflation data, which had initially fueled optimism for potential interest-rate cuts from the Federal Reserve.

Data released on Friday revealed an unexpected decline in US producer prices for December, attributed to lower costs of goods like food and diesel fuel. Meanwhile, prices for services remained unchanged for a third consecutive month, contrasting with Thursday's higher-than-expected consumer inflation figures.

As a result, expectations for a Fed rate cut of at least 25 basis points in March increased to 79.5%, up from 73.2% in the prior session, according to CME's FedWatch Tool. The data also contributed to a decline in Treasury yields, although recent comments from some central bank officials have tempered expectations of imminent rate cuts.

The Dow Jones Industrial Average experienced a 0.31% decline, dropping 118.04 points to 37,592.98. The S&P 500 recorded a slight gain of 0.08%, adding 3.59 points to reach 4,783.83, while the Nasdaq Composite rose by 0.02%, gaining 2.58 points to close at 14,972.76.

Among notable individual stock performances, Bank of America saw a 1.06% decline as its fourth-quarter profit contracted due to $3.7 billion in one-off charges. Wells Fargo's announcement of an anticipated 7% to 9% decline in net interest income in 2024 led to a 3.34% drop in its shares.

Conversely, Citigroup rose by 1.04% despite reporting a $1.8 billion fourth-quarter loss and signaling expectations of further job cuts. JPMorgan Chase (NYSE: JPM) experienced a 0.73% decrease despite reporting its best-ever annual profit and forecasting higher-than-expected interest income for 2024.

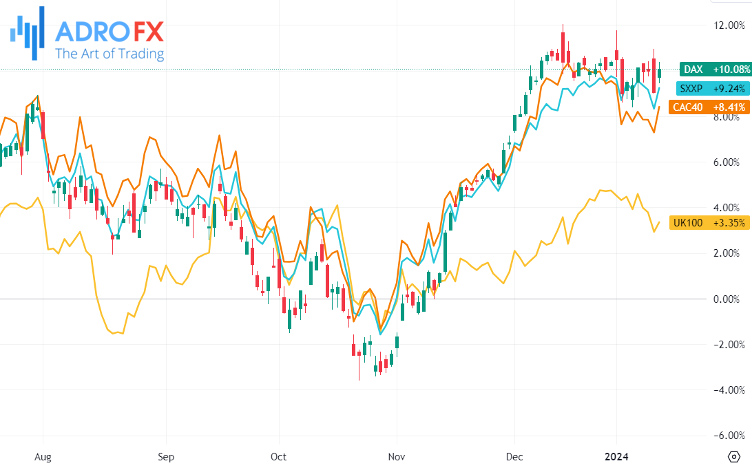

At the same time, major European equity indices demonstrated widespread gains on Friday, making strides towards the end of the trading week following better-than-expected growth in the UK Gross Domestic Product (GDP).

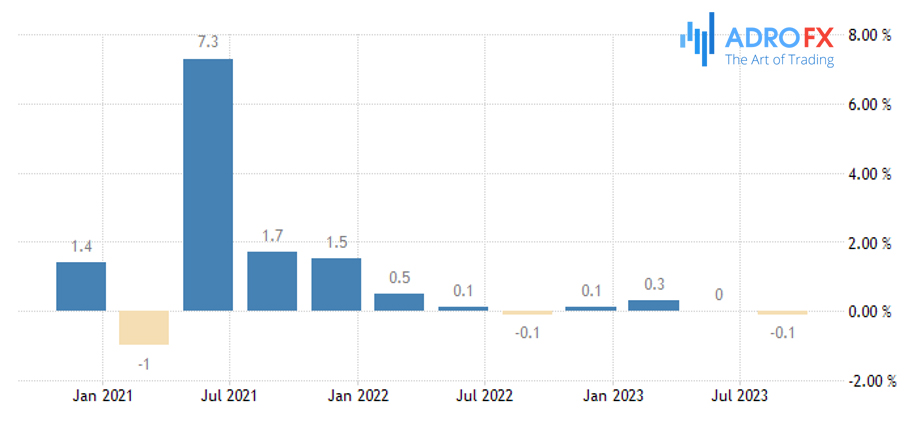

In November, UK GDP exceeded expectations, registering a 0.3% growth compared to the anticipated 0.2% rebound from October's -0.3%. Despite a downgrade to previous months, indicating a potentially deeper slowdown in Q3 of -0.1%, recent robust services PMI numbers suggest a resilient economic rebound towards the end of 2023. This implies the likelihood of modest growth in Q4, contributing to some modest gains for the pound throughout the week. However, the accuracy of these projections relies on the assumption that recent updates from UK retailers accurately reflect the year-end economic performance.

Germany's DAX showed a robust performance, climbing by 0.95% and closing at €16,704.56. Meanwhile, France's CAC 40 experienced a gain of 1.05%, rising by 77.52 points to €7,465.14.

The pan-European STOXX600 index added just under 4 points, marking a 0.84% increase and reaching €476.76. London's FTSE 100 major index rose by 0.64%, closing up 48.34 points at £7,624.93.

The US dollar relinquished its early gains following weaker-than-expected PPI readings for December, leading to a notable rise in short-term yields across the board.

The escalation of air strikes by US and UK forces on Houthi assets in Yemen has driven gold prices higher. Concerns over further tensions in the Middle East spurred some safe-haven buying, amplified by US dollar weakness.

The joint military response from the US and UK to ongoing attacks on commercial shipping has pushed crude oil prices to their highest levels in two weeks. This overnight development raises concerns about the Red Sea's short-term safety for commercial traffic, increasing the risk of a major flare-up. The potential disruption may lead to stickier inflation pressure in the short term as freight costs rise, either due to trade traffic diverting around the Horn of Africa or companies opting for more expensive air freight.

Looking ahead, the upcoming week holds key economic indicators for Europe. Monday is set to reveal European Industrial Production data for November, while Tuesday will bring insights into the UK labor market and wage earnings. October's UK Employment Change recorded 50,000, and Average Earnings, including and excluding bonuses, are projected to decline. Average Earnings Including Bonuses is expected to decrease from 7.2% to 6.8% for the annualized quarter ending in November.