Divergence in Forex Trading Explained

Divergence is a strong signal in forex, trading which can show the upcoming market changes. At the least, divergence signals can indicate a correction. At most, they can signal a market reversal. When a trader sees the divergence signs, it means they should get ready for placing sell orders.

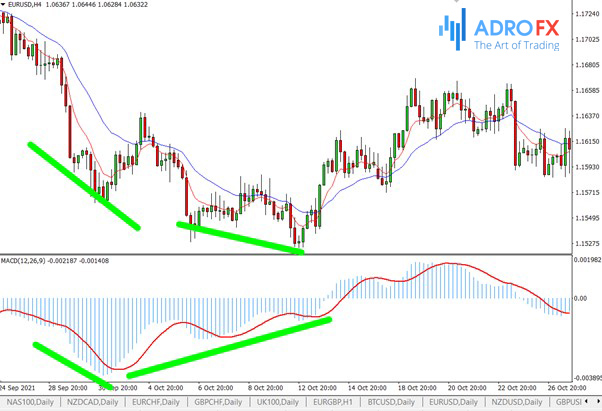

Just open the trading history on the chart and you can see that similar signals (divergence or convergence) were observed before each market reversal movement. Forex divergence can be seen as a discrepancy between the direction of the asset's movement on the main chart and the direction of the selected indicator's chart.

What Indicators are Best to Detect Divergence?

The divergence is best identified on the charts of the following indicators:

- MACD;

- Stochastic;

- RSI;

- CCI.

These indicators are oscillators. But most often professionals use RSI and MACD indicators, which are among the easiest and most effective to use.

How Сan You Identify Divergence?

Let's look at an example. We see that the chart of the price of an asset is growing, and there is an uptrend. This may indicate that the market is growing and further growth and strengthening of the asset are expected.

At the same time, the indicator which chart is located under the main price chart of the asset behaves quite differently. It begins to fall.

The main chart shows the prices at which buyers and sellers are ready to place orders. The indicator, located under the main chart, shows the ratio of buyers and sellers in the market.

At the beginning of the divergence, there were more buyers than at the end. But at the end of the divergence movement on the oscillator chart the number of those who want to buy the financial asset decreases, while the prices of this asset, strange as it may seem, increase.

What This Situation May Mean?

First of all, we can assume that the asset will not rise in price. And there will be at least a corrective movement of the market or even a reversal. The divergence between the price chart of the asset and the indicator may signal the market decrease. And this signal is pretty strong. The divergence does not mean that the price must immediately reverse or correct, but the movement must take place soon.

How to Enter the Market upon a Divergence Signal?

There are several effective ways to enter the market after detecting a divergence signal. First, you can try to catch a strong level at which the market reversal or its correctional movement is sure to happen. Moreover, a strong level is not difficult to find. It is possible to trade on the strategy "Double Top". In this case, the trader must find at least two tops (maximum price values) on the main chart of the market asset price and draw a line by these tops. Then on two minima draw another line (this will be the support line) and open a trade at its breakout. We can wait for confirmation signals on the divergence-convergence and enter the trade on the highs. But we are not looking for a strong level. There is a special recommendation for beginner traders: we have to learn to correctly find strong levels, at which a correctional movement or reversal is sure to occur. Strong levels on the main price chart should. And at the same time on the indicator chart, which is located under the main chart, a strong level is also determined by at least two maximum tops. Some sources of forex trading sometimes refer to convergence as a divergence. But It is called a bullish divergence.

Bullish Divergence (Convergence)

The bullish divergence or convergence is built not on the maximum values, but on the minimum ones on the main chart of the asset price and the indicator chart. All of the aforementioned indicators (MACD, RSI, Stochastic, CCI...) are also used as an indicator for finding a bullish divergence or convergence.

How to Identify Bullish Divergence

On the main chart of the price of a commercial asset, there is a consecutive decrease in the minimum values. At the same time, you can see a completely different picture on the indicator chart: the price chart starts a consecutive growth. The growth of the indicator chart is also fixed at its minimum values.

So, what is the matter? What is going on? At this very time on the market, the sellers sell the asset, and the price of this asset is falling. But the number of sellers is decreasing. Such a situation could lead to a reversal of the movement of the chart. A bullish divergence is a very strong buy sign. But the presence of a bullish divergence does not mean that the market will immediately reverse. But the trader should be ready.

At least, a correction movement will take place. At the same time, the market may not change.

How to Enter the Market During a Bullish Divergence?

- You can look for a strong level and enter the trade at a strong level;

- You can trade on the "Double Bottom" strategy;

Now we look for the confirming signals.

Types of Divergences

There are several types of divergence in trading:

A-class Divergence

It is considered to be the strongest and the most significant for a trader. A-class divergence gives the most vivid and confident signals of the market movement change.

A-class divergence can be observed on a rising chart as well as on a falling one.

A bearish divergence looks like this:

On the main price chart, the new maximum top is higher than the previous one. On the oscillator chart, the new maximum top is lower than the previous maximum.

The bullish divergence is different;

On the main chart of the financial asset price, the new minimum top is below the previous one. On the oscillator chart, each subsequent top on the minimum line is located higher than the previous one.

B-class Divergence

The B-class divergence is a less strong signal than the divergence of the A-class price chart indicators. The confirmation of the B-class divergence signal should be supported by additional indicators.

A bearish B divergence looks like two peaks placed approximately on the same level. A bearish B divergence is a Double Top.

At the same time on the oscillator chart, you can see that each subsequent top of the asset price is positioned lower than the previous one.

A B-class bullish divergence is based on the minimum values on the main chart and the oscillator chart and differs in the following characteristics.

A Double Bottom is formed on the main chart of the price of a commercial asset, the peaks of which are placed approximately on the same line of lows.

On the indicators of the oscillator, every second trough is higher than the previous one.

C-class Divergence

C-class divergence is the weakest signal of market changes. It can be regarded as a lagging signal, and it is usually not paid much attention to.

A bearish C-class divergence can be seen by two tops on the oscillator, located on the same price line. On the main price chart, each next peak is higher than the previous one.

The bearish C-class divergence has levels lined up according to the maximum price values.

A bullish C-class divergence is lined up by the minimal values of the main chart price and the auxiliary oscillator.

It is also considered a very weak, insignificant signal.

A bullish C-class divergence pattern looks as follows: the oscillator chart shows a "Double Bottom", on the main chart each successive minimum is lower than the previous one.

Triple Divergence

The triple divergence between the tops or troughs on the main chart and the oscillator shows a high possibility of changing the price of a commercial asset.

About AdroFx

Established in 2018, AdroFx is known for its high technology and its ability to deliver high-quality brokerage services in more than 200 countries around the world. AdroFx makes every effort to keep its customers satisfied and to meet all the trading needs of any trader. With the five types of trading accounts, we have all it takes to fit any traders` needs and styles. The company provides access to 115+ trading instruments, including currencies, metals, stocks, and cryptocurrencies, which make it possible to make the most out of trading on the financial markets. Considering all the above, AdroFx is the perfect variant for anyone who doesn't settle for less than the best.