Is Disney Stock a Good Buy? 5 Reasons to Buy Disney Stock Right Now in 2021

The U.S. economy has admittedly begun to recover from the global pandemic. The measures taken had a significant positive impact on it: President Biden allocated more than 1.9 trillion dollars to support it. Most of this funds will end up in the accounts of average Americans, which should have an impact on demand in the U.S. economy. And some of that capital is bound to end up in the stock market.

If at the end of last year the main income was received by the companies working remotely, and the largest industrial enterprises, on the contrary, incurred losses, then today the situation is gradually beginning to change. And perhaps now is the best time to capitalize on the growth after the fall and recession.

Last year was both the best and worst year for Disney stock. The company struggled with periodic closures of theme parks and resorts, and its movie business almost came to a halt. At the same time, however, its Disney + streaming service has performed well, overcoming some of the shortcomings of its other business segments.

Still, there is light at the end of the tunnel, and things are looking up for the company. Over the past few weeks, there is growing evidence that Disneyland and the company's other revenue streams can improve, as some of them are opening up. Let's take a look at some of the company's fundamentals, technical picture, as well as some of the reasons to buy Disney stocks.

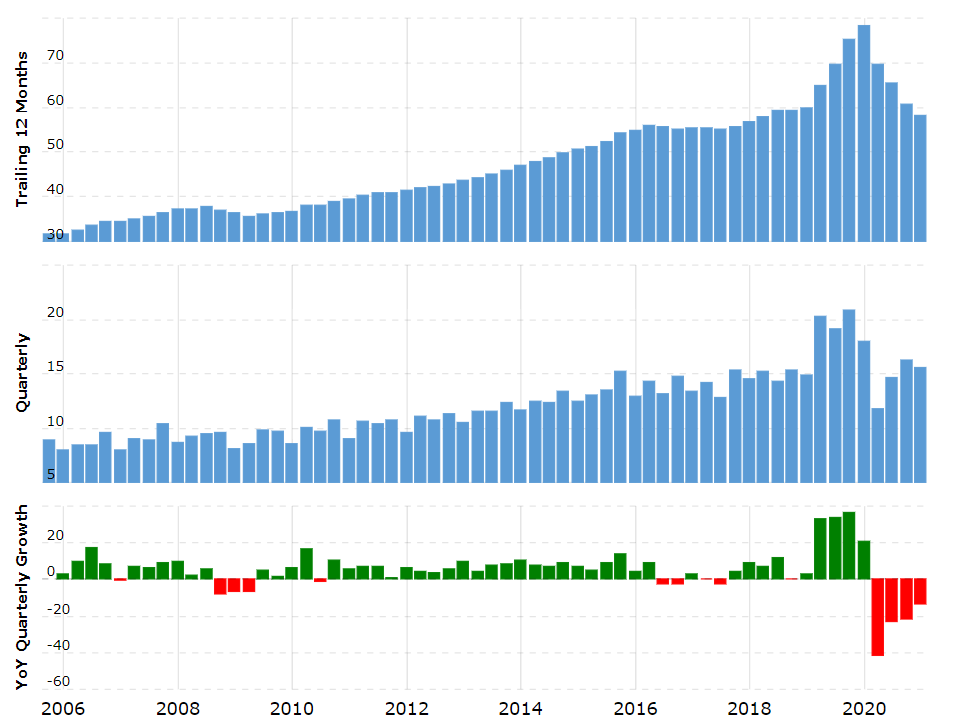

Latest Quarterly Results

Before you make up your mind to buy Disney stocks, let us look at some of the key indicators of the company.

Disney reported second-quarter results, showing lower-than-expected revenue and subscribers for its streaming service.

In the past quarter, 8.7 million people subscribed to the Disney streaming service. Investors were not satisfied - in the previous quarter the increase was 21.2 million.

In a nutshell, here are Walt Disney's key quarterly results:

- Total revenue fell 13% compared to the same period in 2020, to $15.6 billion. \In the previous quarter, the drop was 22%.

- Media and Entertainment Distribution revenue grew 1% to $12.44 billion.

- The Parks, Experiences, and Products division saw its revenue plunged 44% to $3.2 billion, while revenue from the division had fallen even more the quarter before, by 53%.

- Net income reached $1.1 billion compared to $0.52 billion a year earlier.

- Earnings per share were $0.49 versus $0.25 a year earlier.

- The free cash flow of the company decreased by 67% from $1.9 bln to $623 mln.

In the three months to April 3, the number of paid subscribers to the Disney+ streaming service increased by 8.7 million to 103.6 million.

The resulting increase was significantly less than the previous quarter when 21.2 million people subscribed to the service. In addition, the result fell short of experts' expectations - the consensus had expected an average increase to 110.3 million.

After launching in November 2019, Disney+ quickly gained popularity. Audience growth was helped by the COVID-19 pandemic and the forced self-isolation of the population. By March 2021, more than 100 million people had subscribed to the service.

At the same time, the pandemic halted the shooting of new content. The lack of new products made it harder for Disney to attract new users, which slowed the growth of its customer base.

The gradual end of the restriction period was good news for the heavily pandemic-stricken theme park division, which used to be Disney's main source of revenue. At the same time, however, it hit the company's streaming service.

Despite the difficulties, the company has confirmed plans to increase the number of Disney+ subscribers to 230-260 million by 2024.

Disney's two theme parks in California reopened on April 30, so the revenue generated in the past few weeks is not reflected in the second-quarter financial results. Nevertheless, the opening of the parks could raise expectations for the third fiscal quarter.

Disney Dividends

The company has been paying dividends for 60 years, but it hasn't always raised them in line with business growth. For most of its history, Disney has kept its payout unchanged for a few years, then increased it - and then stopped again. The result has been slow but steady dividend growth, though not as clear as companies that increase their payouts to shareholders every year.

In July last year, due to the pandemic, Disney decided not to pay a semi-annual dividend for the second half of fiscal 2020 in order to put the funds into the streaming business. At the moment, the situation has not changed since the situation is not that perfect.

Still, once the business is in the proper shape, the company will start paying its dividends again.

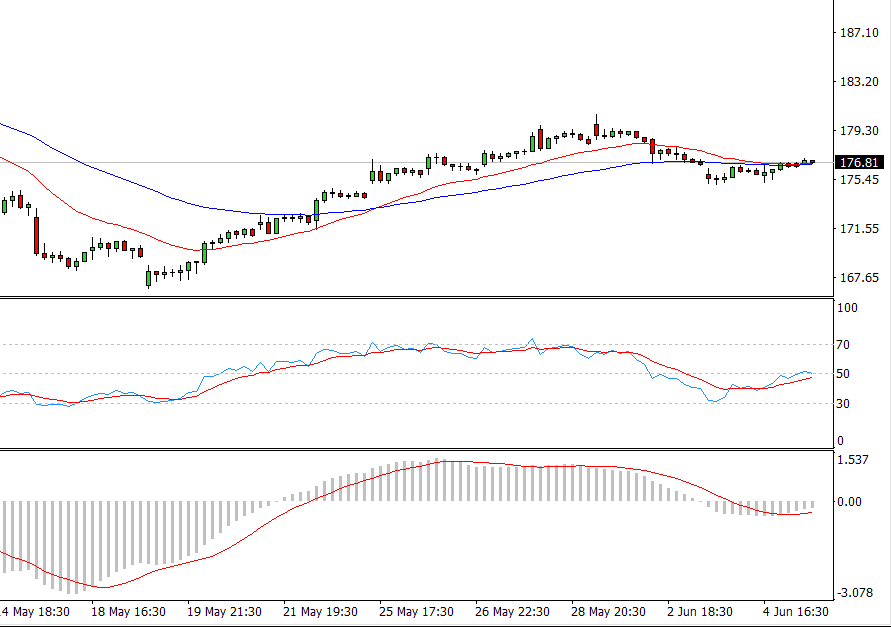

Technical Analysis

The upward trend that began at the end of March continued until the end of 2020 when the annual record of $183.4 was set. A correction began in early 2021, but the stock began to recover in late January. The price is also above the 50-day moving average.

At the moment, the price is near the record high, which acts as technical resistance. Meanwhile, the RSI indicator is still far from being overbought and the MACD curves have crossed, which is a signal that the stock is regaining its uptrend.

\

In the medium term, buyers need to consolidate above $183.5, which opens the road to $190. In this area, a local correction is possible, after which a new target is $200.

For a new growth phase, it will need to consolidate above $190-192, which will open the way to the test of $200-203. Then, as positive news comes in about the impact of the pandemic on the theme parks diminishing, we could expect a raise to $210.

A negative signal would be a descent under $170, which could trigger a further decline to $160. It is possible if the number of new cases starts to rise or quarantine restrictions are tightened.

Five Reasons to Invest in Disney Stock

Apart from the abovementioned technical analysis and the statistical figures, we can pay attention to some of the reasons to buy Disney stocks:

- The company's strong business model

Disney's business model is very stable, and at its core is the production of motion pictures. The company masterfully turns one financially successful movie into an entire series. In addition, each success of a particular movie is refracted many times within the company, generating earnings through merchandising, theme parks, streaming videos, various shows, etc.

- ESPN will remain an important source of revenue

When discussing the earnings potential of Disney's cable broadcasts, ESPN always comes into the spotlight because it is the most beneficial of the company's channels. The channel's steady loss of subscribers is a consequence of competition from Internet streaming providers. Nevertheless, ESPN will long bring Disney earnings: firstly, Americans love sports, and secondly, ESPN is the most popular sports channel in the world. Yes, Disney may have to rethink its channels for delivering content to consumers, but the long-term outlook seems quite bright.

- Disneyland reopens

Disney stock surged 6.4 percent on March 8 on the news that the company's theme parks in California will reopen on April 30. Disneyland and Disney California Adventure Park have been closed since last March.

Although the reopening calls for limiting visitor numbers to only 15 percent of the parks' full capacity, analysts expect that losses can be covered.

Disney opened its theme parks in Florida last July. Disneylands in Shanghai, Paris, and Hong Kong were reopened during the past reporting quarter.

At the same time, Disney said that even with quarantine restrictions, sales at all the parks exceeded opening costs.

Moreover, a decline in COVID-19 cases in California and an increase in vaccinations may also encourage more and more people to visit Disney parks this summer.

By the way, according to Statista, Disney theme parks are among the top four most visited in the world.

- Disney + is quickly gaining popularity

After launching in November 2019, Disney+ quickly enjoyed a surge in audience success. In fact, audience growth was largely boosted by the COVID-19 pandemic and the forced self-isolation of the population. By March 2021, more than 100 million people had subscribed to the service.

At the same time, the pandemic halted the shooting of new content. The lack of new products made it harder for Disney to attract new users, which slowed the growth of its customer base.

The gradual end of the restriction period was good news for the heavily pandemic-stricken theme park division, which used to be Disney's main source of revenue. At the same time, however, it hit the company's streaming service.

We should not forget that as the pandemic recedes, people will want to return to the parks and movie theaters. That's positive for the core business, but streaming could suffer. It's likely that these changes will cancel each other out, which will ultimately restore Disney's financial health. In the long term, the outlook of the majority of experts remains moderately positive.

Despite the difficulties, the company has confirmed plans to increase the number of Disney+ subscribers to 230-260 million by 2024.

- Abandoning physical commerce in favor of online one

Disney recently announced that it will close at least 60 physical stores in North America this year and focus on online sales.

Given the pandemic and universal shift to e-commerce, it is a sensible move. For example, a study by McKinsey & Co, an international consulting firm, shows that consumers intend to continue shopping online after the pandemic.

According to the U.S. National Retail Federation, online shopping grew 21.9% last year and could grow 18-23% this year.

Therefore, Disney benefits from "meeting" its fans where they are likely to shop now and in the coming years - from the comfort of their homes.

Risks of Investing in Disney

No doubt, any investment has its disadvantages and associated risks, no matter what sector you choose to invest in - media, tech, or retail commerce. Speaking particularly about buying Disney stock, the first and the main problem is the epidemiological situation in the world. Yes, right now everything seems to be recovering, but no one can guarantee that in a month there will be no surge in new coronavirus cases or that there will be a new disease similar to SARS-CoV-2. In case the situation gets worse, there will be new halts in the entertainment business, which includes the closure of the parks and the cancellation of all the sports events.

And there is one more possible issue we can mention - the absence of dividends (at the moment). If the company does not manage to take care of the balance sheet increasing the earnings, there will still not be enough funds to pay the shareholders their remunerations.

How Can I Buy Disney Stocks?

There are two options for buying Disney stock, including:

- Buying stock directly from Disney - Some popular brands and companies, including Disney, have a direct purchase investment plan. The plan allows you to buy stock directly from Disney. Keep in mind, however, that direct stock purchase plans often include minimum investment rules and high entry fees. The minimum investment amount for Disney stock is $200. This price is currently above the cost per Disney share ($177). Alternatively, you can invest $50 a month. In addition, Disney charges a registration fee of $20, and $1 for each subsequent investment.

- Buying Disney stock through an online brokerage firm - An online brokerage account is simply an investment account that is easy to open. Most brokerage accounts do not charge an account opening fee. Moreover, some brokers do not charge a commission for buying Disney stock. Because of this, we recommend it as a plan to buy Disney stocks rather than buying directly from the company.

After you have chosenthe CFD broker to work with, you need to download the trading terminal from the company's website so you can proceed further and start buying Disney stocks.

Now, let's see how to buy Disney stocks on the MetaTrader 4 platform. The first thing you need to do is to open the trading platform and login into the account with the help of the login and password.

Then click on the Market Watch tab and find the Disney symbol in the list of the available assets. Right-click on the one that you need and choose here the New Order option.

In the window that appeared you can choose the volume of the position (the number of Disney stocks you want to buy), set the Stop-Loss and Take-Profit. Once all the parameters are set, click on the Buy by Market button.

Pay attention that you can track the open positions in the Trade tab on the left bottom of the trading terminal.

Why Trade in Disney CFDs?

Buying Disney stock CFDs has some advantages over other, more traditional forms of investment:

- Trading on the rise and fall of the market

By trading CFDs, traders can speculate on both rising and falling markets. It means more trading opportunities, as traders can benefit from both buying and selling CFDs on a wide range of assets. For example, when an investor buys a company's stock, he will only succeed if the stock price goes up. By comparison, when trading CFDs, an investor may also capitalize on selling shares if he believes that a company's stock price will decrease.

- Investing in assets of different classes

By opening an account with an online CFD broker, such as AdroFx, a trader can invest in different asset classes on an online trading platform. Through a single account, traders can trade CFDs on currencies, stocks, indices, spot metals, commodities, and cryptocurrencies, opening up a multitude of investment opportunities.

- Margin Trading

Through the use of leverage, investors can trade the markets with a small initial deposit. Essentially, leverage is a loan that a trader takes from his broker, which allows him to open larger CFD positions in the markets by investing less capital. This capital is locked into the account as margin. It makes trading CFDs more affordable and beneficial compared to other methods of investing.

- No stamp duty

CFD trading is considered more financially potential than other forms of investing also because there is no stamp duty when buying Disney stocks. Since CFDs are a derivative financial instrument, the investor does not physically purchase the underlying asset, so he does not have to pay stamp duty.

Conclusion

For investors interested in owning one of the most sustainable and widespread streaming businesses, backed by arguably the world's most powerful content creation engine, it's probably not too late to buy these shares. Sure, it could be a bumpy ride. But given the company's early momentum toward streaming, Disney seems poised to become a dominant player in streaming that can reward investors generously in the long run.

About AdroFx

Being a well-established brokerage company, AdroFx offers the best trading conditions to its clients from 200 countries. Founded by experts with a couple of decades of overall experience, AdroFx is one of the best platforms on the market for shares trading, particularly CFDs on Disney stocks. Either a newbie or experienced trader, both will find here what they are looking for since the company provides various trading accounts for different trading styles and goals.

Apart from buying Disney stock, you can benefit from trading currencies, indices, precious metals, and cryptocurrencies.Sign up right now and buy Disney stocks!