Decoding Volume: Exploring Volume Spread Analysis (VSA) in Forex Trading

In the world of forex trading, understanding the dynamics of supply and demand is paramount for success. Volume Spread Analysis (VSA) is a unique market analysis method that explores the relationship between trading volume and price movements. Developed as an extension of Richard D. Wyckoff's work by Tom Williams, VSA provides valuable insights into the actions of major market players and offers signals to enter the market effectively. This article delves into the concepts, advantages, and signals of VSA, highlighting its applicability and limitations in the forex market.

Understanding VSA

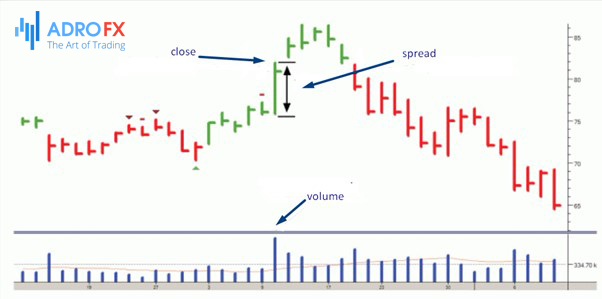

VSA (Volume Spread Analysis) is a proprietary market analysis method that looks at the relationship between the opening/closing price range and trading volume. VSA can also be referred to as comparing the distance between the high and low of a bar/candle to the total trading volume in the forex market.

Thus, a trader tries to find out the difference between supply and demand created by the major players in the market (professional traders, institutions, banks, and other market makers). If you know how to accurately interpret their actions, it will give you good signals to enter the market.

The VSA is an evolutionary extension of the work of Richard D. Wyckoff, who began trading stocks in 1888.

In the late twentieth century, Tom Williams improved on Wyckoff's research and developed his own methodology.

Livermore was the first to use volume data to analyze the mood of bulls and bears to find entry points. But he was not the creator of this trading method as such. The main contribution was made by another trader - Wyckoff.

He was distinguished by his academic approach to trading. He personally met with leading traders and interviewed them. One such interviewee was Livermore with his thoughts on volumes, from which Wyckoff would later derive the basic tenets of the VSA concept.

But neither Livermore nor Wyckoff used a combination of Volume Spread Analysis. It was Williams who coined the term for methods based on Wyckoff's work. Williams' books and computer software helped to promote VSA as a powerful tool for analyzing market volumes among forex traders and made the concept an alternative to the classic analysis variants.

What the VSA Shows

To determine the balance between supply and demand, the VSA examines the interaction of three variables on a forex chart to determine the supply/demand balance and identify the likely short-term direction of the market.

These variables are:

- Candle/price bar volume;

- Total price change for the session (highs and lows);

- Closing price.

Using these three pieces of information, a skilled trader will find the best entry points into forex. The significance and importance of volume seem to be poorly understood by most novice traders, but it is a very important component of technical chart analysis.

Wall Street likes to compare a price chart without volume to a gas tank without gasoline. The volume gives half the information, and the other half is found by studying the price difference.

How VSA Works

Every market moves according to the supply and demand created by professional players. If demand is greater than supply, the market rises. If supply is higher than demand, the market goes down. Seems simple, but in practice, financial markets are not easy to calculate. Supply and demand work differently in financial markets.

The VSA teaches that all market strength can be read in a bearish candle, conversely, market weakness can be read in a bullish candle. Professional and institutional investors trade forex often and in large volumes.

Their purchases and sales are represented on the chart by bullish and bearish candles with a large range. By comparing the closing price, overall price range, and trading volume, traders determine if the bulls/bears have succeeded in breaking through the support/resistance lines and if this momentum has enough power to reverse the trend.

Where You Can Use VSA

The VSA focuses on price and volume and tends to track the actions of professionals. Consequently, in any market where there are good turnover and market makers, the VSA trading concept remains valid.

Almost all financial markets nominally meet these requirements. However, in the forex market, volume is a complex quantity. Traders argue a lot about whether VSA can be used in the forex market.

The reason is that the foreign exchange market is decentralized, unlike the stock market. As a result, actual volumes are not available. But we can simply analyze the volumes of each bar and candlestick. It works quite well in forex trading.

Concepts of VSA

In broad terms, volume allocation analysis is a school of trading thought that insists on the crucial role of volumes in understanding price movements in financial markets.

Thus, five basic concepts of VSA emerge:

- Technical analysis is not self-sufficient. The argument in favor of technical analysis is the postulate that price already discounts everything. However, reading the market solely by price is not enough. Markets depend primarily on supply and demand, hence on the psychology of their final participants. Therefore, volume analysis is a good way to understand how supply and demand affect prices.

- It's all about perceived rather than real value. The fundamental analysis says we can always understand the real value of an asset by examining the intrinsic value of a financial instrument - stocks, currencies, commodities, etc. Volume traders say that to fully understand what is happening in the markets we have to start from perceived value. Not the actual value, but how the bulls and bears see it now. Because traders are constantly valuing companies above their book value, considering other types of analysis besides fundamental analysis.

- Price and volume are interrelated.Past prices are an important aspect of understanding movements in financial markets. However, price analysis is not enough. Proponents of VSA say it is more important to understand exactly where the funds is now and where it will be now, we need it. Volume determines the "hunger" or "saturation" of the market, which affects the strength and direction of price impulses.

- Volume is the cause of any movement. We have already dismissed fundamental and technical analysis as the only explanation for movements in financial markets. VSA suggests looking at price movement in relation to volume as the main factor. For example, no matter how good the performance of the market or an individual issuer may seem, if the trading volumes have been at a peak for a long time, we can expect an impending slack or reversal.

- Different traders have different roles in forex. The basic idea of the concept is that different types of traders carry different types of information, we can base our trading strategy on this idea.

VSA defines three different types of traders:

- Retail;

- Commercial;

- Professional.

Retail traders are those who have small accounts and trade casually. Commercial traders are investment banks whose function is to place orders in the market to meet customer needs.

Professional traders are qualified investors who seek to win and almost always try to stay slightly behind the market to go in a steady trend. By calculating which type is making the weather now, a trader is more accurate in predicting future price movements in forex.

Advantages and Disadvantages of VSA

Advantages of VSA for forex trading:

- Versatility. VSA is suitable for all markets: commodity, stock, forex, etc.

- Efficiency. This approach is really unique in behavioral research. It helps to bypass the limitations of classical fundamental and technical analysis.

- Accuracy. Volumes give an idea not only about the direction but also about the strength of the future trend.

Disadvantages of VSA for forex trading:

- Lack of clarity. There are no clearly defined rules in theory. There is a concept of market strength and weakness, but everything is quite vague. This is an obvious disadvantage for beginners. It takes a long time to sweat over a demo account to master everything.

- Bad for high-frequency trading. In short time frames, classic technical analysis is much more effective.

Signals for VSA Trading

Upthrust reversal pattern

The Upthrust pattern is the canon of using the concept. An uptrend pattern can appear on the candlestick chart as a large uptrend candlestick on super high volume with a further downward movement.

Such anomalous candlesticks are not uncommon in forex and are associated with the manifestation of aggressive trading. These situations often occur after the broadcasting of important news.

The appearance of the pattern of upward movement sends a signal to many traders about the beginning of a reversal movement.

Shakeout

The term Shakeout consists of two words - Shake and Out. The term requires no explanation. It reflects what happens behind the candlestick formations. The big forex players often use the Shakeout to drive the weaker players out of the promising bull market. When trading on margin with leverage, their skinny deposits simply can't withstand the drawdown from the resulting ripples.

Shakeouts can be found on any type of chart, across different time frames and markets. The classic VSA pays a lot of attention to shakeouts.

Level Attack

On a price chart, a pattern is represented by powerful candles or bars with high volume, which "break" the current price patterns.

For example, observing this during a sideways movement, you can say that the consolidation period is coming to an end. The main point: the candle should break out at a really strong level. The levels should be fully formed.

Stopping Volume

The harbinger of the end of the imminent change of the trend on the forex market. Often there is a sharp increase in liquidity against the background of rapid growth, which is quickly followed by a state of uncertainty and a decline in volumes.

It is important for forecasting. The main mistake beginners make is to see a mistaken continuation of the trend, mistaking a reversal for a consolidation. Big players can manipulate the market with such a trick, knocking down stop-losses en masse and changing the trading volume. Be careful.

Demand/Supply Testing

It can be found on any trading instruments and time frames. It is a fairly reliable indicator that shows the current state of affairs in forex.

In such cases, we can see how the uptrend bumps into a hidden resistance level, to which many sell orders were most likely attached. A simple "squeeze" does not work, so the market moves to the accumulation stage.

Tips for Using VSA

The peculiarities of VSA analysis are related to the fact that one cannot get the exact data on volumes in forex. Still, we can give you a few tips on this:

- Compare price readings from several brokers. They should not deviate below the average for the forex market.

- Treat VSA with caution during average volumes. During consolidation periods, the accuracy is less than during the peaks.

- Always expect a clear confirmation. Analyze forex volumes separately from price.

- Also, VSA will be more accurate in the stock market and less certain in the currency market. Therefore, the same strategies may work differently on different instruments.

Conclusion

Volume Spread Analysis (VSA) offers a distinctive perspective on forex trading by emphasizing the significance of volume and its correlation with price movements. By analyzing volume, candlestick patterns, and price changes, traders can gain valuable insights into market strength, identify reversal points, and make informed trading decisions. While VSA has its advantages, such as versatility and accuracy, it requires time and experience to fully grasp its nuances. Traders should exercise caution during periods of average volumes and seek confirmation for more reliable results. Although VSA finds strong applicability in the stock market, its effectiveness in the forex market may vary. By incorporating VSA principles into their trading strategies and considering the unique characteristics of different instruments, traders can harness the power of volume analysis to enhance their forex trading endeavors.

About AdroFx

Established in 2018, AdroFx is known for its high technology and its ability to deliver high-quality brokerage services in more than 200 countries around the world. AdroFx makes every effort to keep its customers satisfied and to meet all the trading needs of any trader. With the five types of trading accounts, we have all it takes to fit any traders` needs and styles. The company provides access to 115+ trading instruments, including currencies, metals, stocks, and cryptocurrencies, which make it possible to make the most out of trading on the financial markets. Considering all the above, AdroFx is the perfect variant for anyone who doesn't settle for less than the best.