What is a Margin Call and How to Avoid It?

Margin trading allows a trader to participate in trades that require more funds than they have on deposit. Accordingly, the trader's gain from such transactions increases. But margin trading has a downside – increased risk. It can be minimized by following the rules and taking into account a broker's trading conditions on margin so as not to get a margin call.

Basically, a margin call is a notification sent by the broker to the trader when the conditions of margin trading are not fulfilled. It is a reduction in the amount of the deposit to the level that the broker has designated as the minimum allowable. In this situation, the trader needs to promptly replenish the deposit to the required level or... do nothing, hoping that the market situation will change in their favor. Conditions for margin trading can vary quite a lot, they depend on the trading conditions of a certain broker.

It is important to understand when a margin call occurs and how to correctly behave in such a situation. In fact, this is encountered by many traders, and there are those who lose funds due to illiterate actions on their part. Because if the trader does not react to the notice and the situation continues to worsen, the broker is entitled at its own discretion to close the trader's positions without any financial and tax liabilities. This can lead to serious losses. In this article, we will examine with examples of what a margin call is and how not to encounter its unfortunate consequences.

What is a Margin – Definition

So, you want to trade with more capital than you have in your account. The broker gives you the required funds (provides the leverage), and the collateral is a part of the amount on your balance. For example, if your account has $1,000, $400 as collateral (margin). The broker would not charge you these funds but freezes them in your account, that is, you have free use of $600 (the so-called free margin available for trading).

Obviously, if you begin to lose deposit rapidly on an open position, there is also a risk for the broker to lose the funds lent to you. Therefore, you will not be able to lose more than the amount of margin, that is why there is a margin call.

The situation when the quotes moved in the direction opposite to your predictions is not uncommon. As soon as your losses reach a certain value, the broker sends you a message by phone, e-mail, or push notification in the trading platform, informing you that you need to add funds to your account. This is when the margin call comes in. Note that a margin call is an alert, the broker does not do anything yet, and you have time to react. The main thing is not to delay a decision, allowing you to minimize your losses.

When a Trader Gets a Margin Call – Examples

Here are some real examples of when a trader gets a margin call. These are frequent situations that many traders face. It is important to be able to prevent them, and if the situation is already unfortunate, to react properly.

Example 1 – General

Suppose you have decided to buy 10,000 shares of a large company. The price per share is $5. Therefore, you will need $5x10,000=$50,000 to buy the target number of shares. But you only have $25,000 in your account, so what can you do? You can borrow the other half of the amount from your broker (1:2 leverage). And you do so successfully. Alas, the stock quotes subsequently fall by 28%. You incur losses and the amount of margin decreases proportionally, reaching a pre-critical level. The broker sends you a margin call with a demand to take measures that allow you to avoid forcible liquidation of positions by the broker in the future if the value of the shares decreases.

Example 2 – With the calculation

In this example, let's assume you buy $10,000 worth of shares of the same company. You only had $5,000 in your account, so you borrowed another $5,000 from your broker. Your forecasts didn't come true, the quotes dropped and now you're not holding $10,000 worth of stock, but only $7,000. This is where it's important to calculate your equity percentage. This is done using the formula:

Current Stock Value – Borrowed Amount = Your Equity.

Your Equity / Current Stock Value x 100 = Percentage of Equity.

Now let's do the calculations for our example. Using the first formula: $7,000-$5,000=$2,000, that's your current equity. By the second formula: (2000$/7000$=0,28) x100=28. 28 is the percentage of equity in the trade, and the rest of the capital belongs to the broker based on the margin provided.

Now let's turn to your broker's margin trading terms. Many brokers require that the equity percentage of the trader should be at least 20-30% of the open position. In this case, the equity percentage is below 30%, so the broker will send you a notification - a margin call. The notification will contain a requirement to deposit such an amount that the amount of funds on the deposit will give you at least 30% of your equity in an equity trade. It's not hard to calculate, here's the formula:

Current stock price x required minimum equity percentage = required minimum equity.

Minimum Equity Requirement – Current Equity = amount to be added.

In our example, the layout of the first formula: $7000x0,30=$2100. According to the second formula: $2100-$2000=$100. So, you will have to deposit $100 on your account, in order to meet the margin requirements of your broker.

What You Should Do Upon Margin Call

Regardless of the type of trading you undertake, the assets you use, your strategy, or your broker's trading conditions, there is one factor that cannot be completely eliminated. It is a risk. In margin trading, the risk is directly related to the situation when a margin call occurs. But it is not dangerous to encounter a margin call, it is dangerous to react incorrectly. Below we provide an algorithm for three possible reactions.

Deposit more funds

The most obvious reaction is to deposit the necessary amount to establish or exceed the required percentage of equity. Note that the trading conditions and the notification itself specify the period in which you need to deposit funds into your account. It does not have to be done instantly, but it is better not to delay (and be sure to take into account in your calculations the period it will take to deposit funds into the account if they do not come immediately).

If you for some reason do not deposit the required amount, the broker will have the right to sell your securities at its discretion without prior notice.

Close a position

It is a matter of liquidating one or more open positions and thus replenishing your deposit. This approach with a margin call can be a beneficial alternative to funding your account. Perhaps some positions are losing and should have been closed long ago. Often it is even technically easier and faster to sell a few shares than to deposit additional funds into a trading account.

Do nothing

Waiting for the assets you purchased to increase in value, accordingly, the percentage of equity will increase, and you will eventually stop incurring losses and begin to be in the black. This is not the option we recommend. Because if your initial predictions for this position had come true, you would not have received a notification. Nevertheless, sometimes traders who are absolutely sure that the market situation is about to change do so.

Margin Requirements of Forex Brokers

Above we mentioned that margin trading requirements differ from broker to broker. It is caused by their internal policy which cannot be influenced by a trader. On average the margin amount is 0.5-3%. However, at some brokers for some assets, it can be higher, for example, 7% and even 15-20%.

Many brokers' margin is not fixed, but dynamic. It means that it depends on the conditions you trade with. For instance, it depends on the currency pair and leverage. Sometimes it is even affected by the trading platform you use.

How to Avoid a Margin Call – 3 Simple Rules

You know what a margin call is. You also know when it occurs. You even know how to react to it. Now we have one more important question to address — how to avoid it? No doubt, many traders face it sooner or later, but that does not mean you should not try to prevent a margin call.

The main defense is to be aware of your broker's clear margin requirements regarding the assets you are trading. When you know your margin and limits, you understand up to when you can hold a position open and when it makes no sense to take a risk and wait. Below we offer three rules to minimize your risk of getting a margin call:

Rule 1: Allocate risk. You can't invest in only one asset or one type of stock. Try to diversify your investment portfolio, and make it heterogeneous.

Rule 2: Avoid using your full financial potential in margin trading. That is, do not take margin with leverage "at a premium" without some reserve in the account.

Rule 3: If you trade in securities with high volatility, try to avoid taking a margin. In this case, trading becomes particularly risky.

How to Calculate Margin

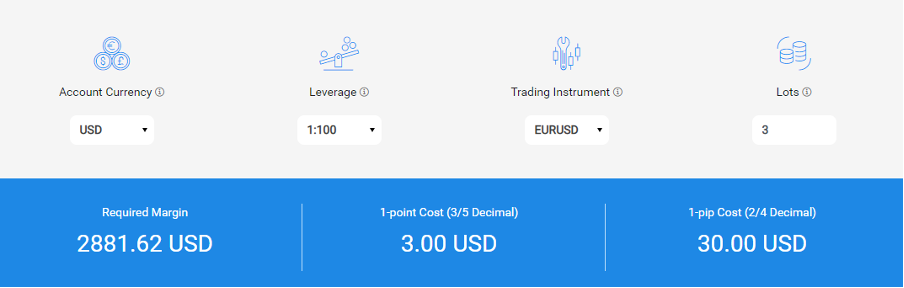

To avoid getting a margin call, you need to know exactly the level of margin for your trading conditions. If it is not a fixed amount or percentage, you can use an online calculator. Many brokers offer such a service. It is not recommended to use calculators of other brokers to calculate the margin at a particular broker, because there can be differences in the algorithm of calculation. The AdroFx calculator can be a good example - there is detailed instruction on this page.

AdroFx trading calculator

In order to make the calculations, you need to enter the following data: the instrument you are interested in, the lot size, the leverage that you intend to use, and the account currency. Once you enter this data, you'll get a detailed calculation specifying not only the margin for that particular contract, but also the spread, the swap short and swap long, and the commission fee.

Margin Risks in Forex Trading

Now that you have a clear idea of what a margin call is and how it is calculated at forex brokers, it is worth discussing the risks associated with margin trading as such. There are three types of risks for traders who trade on (and beyond) margin.

Systemic Risk

Systemic risks are risks associated with factors beyond the control of the forex market, which neither the market, the brokers, nor the traders can influence. Examples of such risks are regional and international legislative acts, political conflicts (sanctions), economic crises, wars, workers' strikes, and inflation. This is the major group of risks in the forex market.

Liquidity risk

The forex market is generally quite liquid, but it is not a constant value. There are plenty of situations that can lead to low liquidity. Even weekends and holidays can cause an overall drawdown. A drop in the liquidity of a selected asset can be caused by many factors affecting the position of a particular company. Often such factors are predictable, but not always.

Leverage Risk

Leverage is an important factor in margin trading. Leverage gives a trader the opportunity to engage in trades for an amount far greater than they currently have at their disposal. So leverage of 1:100 lets you trade up to $10,000 instead of $100. The return from such a position will naturally increase. Of course, the broker will take its percentage, but for the trader, the income will be higher anyway.

The third risk of margin trading is connected with it. When you buy 10 shares with your own funds and quotes went down, you lose deposit on these 10 shares. But if you bought 1,000 shares with your broker's leverage, you will lose funds not from 10 shares but 1,000 if your forecasts are wrong. That is, the potential for loss also increases. Remember, if a broker offers high leverage, you do not have to use it.

Are There Any Advantages of Margin Trading

The likelihood of receiving a margin call and losing some funds if you do not comply with the broker's conditions is the real risk of margin trading. As we showed above, it is not the only one. However, this type of trading has advantages, which do not compensate for the risks but allow you to trade with a significant gain if you approach it in the right way. Here are these advantages:

- Margin trading allows you to use an extensive list of assets to achieve a yield.

- You can earn in a variety of market situations, such as when stocks drop in value.

- You can use margin trading as a method of risk diversification when making up an investment portfolio.

Examples of Using Margin

- You have done a comprehensive analysis of the market situation and are confident that ABC will not be able to meet its financial goals this quarter due to the progress of its competitors. So using your margin account, you borrow 10 shares of ABC stock from your broker and sell them for $500 per share, earning $5,000. Three months later, the company's stock has fallen, just as you predicted. Now you buy 10 shares at $400 per share, paying $4,000. After buying the stock, you return it to your broker. Your gain is $1,000.

- You are interested in the currency pair EUR/USD, which is currently (let's assume) trading at $1.1128, with a buy price of $1.11284 and a selling price of $1.11276. You analyze the market and are certain that the EUR will rise in value relative to the USD. So you want to buy a whole lot. But you don't have that much funds, because a lot costs 100,000 units, in this case, 100,000 EUR or 111,284 USD at the marked rate. The problem is solved by using a margin, which allows you to participate in such trades without having funds for a full lot. For example, if the percentage for the EUR/USD pair at your broker is 2%, you only need 2,225.68 USD (2,000 EUR) to participate in a trade.

Summary

A margin call is a notification from your broker telling you that there is dangerously little deposit left in your margin account and you need to fund it. An alternative solution is to close one of your positions. A margin call is an unpleasant, but not critical situation that many traders who trade in margin accounts face. After all, margin trading involves high risk (especially if you use high leverage). But earnings potential, in this case, is also high. If you choose a broker with favorable marginal conditions and follow the rules for margin trading, you can minimize your risks and reckon on a good return.

About AdroFx

Established in 2018, AdroFx is known for its high technology and its ability to deliver high-quality brokerage services in more than 200 countries around the world. AdroFx makes every effort to keep its customers satisfied and to meet all the trading needs of any trader. With the five types of trading accounts, we have all it takes to fit any traders` needs and styles. The company provides access to 115+ trading instruments, including currencies, metals, stocks, and cryptocurrencies, which make it possible to make the most out of trading on the financial markets. Considering all the above, AdroFx is the perfect variant for anyone who doesn't settle for less than the best.