The Collapse of the Silicon Valley Bank: What Happened and Where Will It Lead?

The main topic of the world media кrecently was the collapse of Silicon Valley Bank (SVB) in California. In 2020-2021, this bank was actively attracting deposits and investing depositors' funds in bonds, but as the Federal Reserve (Fed) tightened its monetary policy, the yield on them began to fall far behind securities of new issues, and prices began to fall. U.S. regulators are still trying to understand the scale of the problem, but it is already known that several regional U.S. banks are at risk.

![]()

So, what you need to know about the causes of this collapse, who was most affected, and how it may or may not affect the banking system in the U.S. and around the world.

What Happened

The fall in U.S. bank stocks began as early as March 9. The occasion was the high employment data in the U.S., which was seen by investors as a negative signal - when the labor market is stable, the Fed has more room to raise the rate to curb inflation. The situation escalated sharply on Friday when SVB reported an emergency sale of $21 billion in Treasuries and corporate bonds from its portfolio, resulting in a loss of $1.8 billion.

The bank had built up deposits from $60 billion to $200 billion between 2021 and 2022 and invested most of that funds in long-dated bonds, the value of which fell because of a surge in interest rates in 2022. Investors realized that SVB could no longer provide a return on deposits and began dumping shares of its parent holding company, SVB Financial Group. On March 10 they collapsed by almost 70%, after which trading was halted. Depositors began withdrawing funds en masse on the same day; as a result, U.S. regulators introduced external administration at SVB.

Selling of several other regional banks in the United States began, as it became clear - the problem has a systemic nature. Investors were most active in dumping First Republic, Signature Bank, and Western Alliance. These banks also had huge queues of depositors on that day.

What Caused the SVB Collapse?

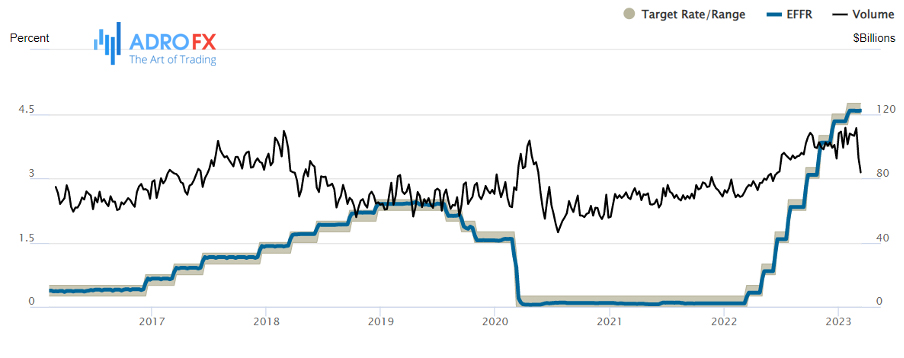

The bankruptcy of SVB was caused by a series of unfortunate events for the financial institution: it all started with the aggressive policy of the U.S. Federal Reserve, which in the past began raising its key rate to curb consumer price growth and bring inflation under control. Let's look at this and other reasons to understand what led to this dire situation.

The increase of the interest rates by the U.S. Federal Reserve

SVB Bank was hit hard by the downturn in tech stocks last year, as well as the U.S. Federal Reserve's aggressive plan to raise interest rates to fight inflation.

Over the past couple of years, the bank has bought billions of dollars worth of bonds, using, as usual, customer deposits.

These investments are generally safe, but their value has fallen because the interest rates on them have been lower than similar bonds that would have been issued under today's higher interest rates.

This is usually not a problem because banks hold such bonds for a long time - until they have to sell them in an emergency.

The gradual decline in funds from SVB investors

But SVB's customers have been mostly startups and other technology-oriented companies, which have become increasingly cash-strapped over the past year.

Venture capital funding was drying up; companies couldn't get additional tranches of funding for loss-making ventures, so they had to use existing funds - often deposited at Silicon Valley Bank, which was at the center of the tech startup universe.

So Silicon Valley customers started withdrawing funds from their deposits.

This wasn't a big problem at first, but as a result of the withdrawals, the bank had to start selling its assets to meet customer demands.

SVB sold its bond portfolio at a loss

Since Silicon Valley's customers were mostly business and wealthy people, they were probably more afraid of the bank going bankrupt because their deposits exceeded $250,000 (€234,575) or the deposit insurance limit set by the U.S. government.

This required the sale of usually safe bonds at a loss, and these losses increased to the point where Silicon Valley Bank became effectively insolvent.

The bank tried to raise additional capital through outside investors, but could not find them.

The banking panic sunk the bank

An unusual technology-focused bank was wiped out by the oldest problem in banking and one of the few means guaranteed to bring about a bank's collapse: a bank raid.

Bank regulators had no choice but to seize Silicon Valley Bank's assets to protect the bank's remaining assets and deposits.

What Should We Expect from the Fed Now?

Investors are reconsidering their forecasts concerning further monetary policy tightening by the Fed following the unexpected banking crisis, believing that the American Central Bank will not be as aggressive as expected, taking into account the current situation.

Analysts of Goldman Sachs Group retracted the forecast that envisaged the increase of the Fed rate by 25 basis points at the March meeting, taking into account the bankruptcy of two banks and increased risks in the financial industry.

The measures taken by U.S. regulators "will give enough liquidity to banks facing deposit outflows and increase depositor confidence," said Goldman senior economist Jan Hatzius.

However, he no longer expects the Fed to raise rates at next week's March meeting and notes there is "considerable uncertainty" about the future trajectory of rates.

The Fed's next meeting will be held March 21-22, and most analysts believe it will result in a 25bp rate hike. Market participants estimate the probability of such a scenario at 85%, assuming a 15% chance that the rate will be left at the current level of 4.5-4.75%. Before the SVB turmoil, the market considered the most probable scenario to raise the rate by 50 bps at once.

Who Was and Will Be Affected by SVB Crisis?

First of all, this will be a real disaster for many small and not only startups - the shares of many whose funds are stuck in SVB have begun to plummet. In particular, Roblox Corp has already reported hundreds of millions of dollars in deposits stuck in SVB - the latter's shares have fallen 10%. Whatever the case may be, the collapse of SVB is already affecting the startup market, and further, in the opinion of many, the situation will only worsen.

Since SVB's customers were distributed all over the world, the consequences of the bankruptcy will be felt globally. Already, most tech startups are in a critical state, as their accounts were blocked overnight, and there is no understanding of whether uninsured funds will be available.

Experts believe that the probability of the return of funds to startups is quite high, but the main question is when exactly this will happen because even a month in a crisis will be a significant problem for any startup.

Even cryptocurrency was affected by the collapse of SVB.

On the night of March 13, quotes on one of the most popular cryptocurrencies, bitcoin, jumped sharply from $20,280 to more than $22,670 in a heartbeat..

The second most capitalized and fifth among all cryptocurrencies in the world, USDC Stablecoin experienced a 10% drop on March 11 and lost its peg to the dollar because part of its reserves was stored in this bank.

The token has long been considered one of the safest stablecoins, and this is the first time it has lost its peg to the dollar since its launch. Even when the USDC exchange rate normalizes, this case will forever undermine the credibility of cryptocurrency stablecoins. After all, if the most stable player in the market couldn't hold on, who can be trusted now anyway?

The consequences of the SVB collapse are still to be curbed, but it is already clear that it has affected other American banks - it led to a decrease in the Nasdaq and the entire S&P 500 index.

Experts fear the speed with which the regulators reacted to the situation with the bank. Perhaps, they were aware of the problems of the credit institution, and the bank only postponed the moment. There is a probability that in the coming weeks, some serious accounting irregularities will be revealed in SVB.

What Is The Scale Of The SVB Problem

According to SVB Financial Group's annual report, SVB had about $151 billion in uninsured deposits as of December 2022, First Republic Bank, another major U.S. regional bank that also suffered, had about $120 billion in uninsured deposits, and Signature Bank had $80 billion.

The well-known financier and head of the hedge fund Scion Asset Management Michael Burry (the prototype of the hero of the movie "The Big Short") noted the similarity between the collapse of shares of SVB Financial Group and the collapse of the Enron Corporation in the early 2000s. Burry has been forecasting a "widespread catastrophe" for the U.S. stock market since 2022, comparing the situation to the dot-com crash. He was echoed by renowned American economist Nouriel Roubini who in 2021 harshly criticized the Fed's policies and warned of significant "distortions" in the U.S. financial system. Both experts are known for their accurate forecasts. In particular, they managed to predict the financial crisis of 2008-2009, as well as predicted the emergence of a "global inflation wave" and the fall of markets in 2022. Now they predict a prolonged systemic crisis.

Still, experts note the resilience of JPMorgan, Wells Fargo, and Citigroup in their review of the situation. Their shares were "generally unchanged" that Friday, so the articles and reviews are more optimistic in their estimates and forecasts.

What's Next?

At present, most experts do not expect any problems to spread more broadly to the banking sector.

There may be some pockets of instability caused by this, such as the drop in the cryptocurrency market on the morning of March 11, which, however, showed signs of recovery later in the day.

SVB was a big bank, but had a unique business, serving almost exclusively the tech world and companies funded by venture capitalists. It did a lot of work with exactly the part of the economy that had been hit hard the previous year.

Other banks are much more diversified across multiple industries, client bases, and geographic regions.

Nevertheless, experts do not rule out economic consequences, particularly in the U.S. tech startup sector, if the capital currently remaining at Silicon Valley Bank cannot be quickly released.

About AdroFx

Established in 2018, AdroFx is known for its high technology and its ability to deliver high-quality brokerage services in more than 200 countries around the world. AdroFx makes every effort to keep its customers satisfied and to meet all the trading needs of any trader. With the five types of trading accounts, we have all it takes to fit any traders` needs and styles. The company provides access to 115+ trading instruments, including currencies, metals, stocks, and cryptocurrencies, which make it possible to make the most out of trading on the financial markets. Considering all the above, AdroFx is the perfect variant for anyone who doesn't settle for less than the best.