Wall Street Down Reacting to Credit Suisse Turmoil | Daily Market Analysis

Key events:

- USA – Building Permits (Feb)

- USA – Initial Jobless Claims

- USA – Philadelphia Fed Manufacturing Index (Mar)

- Eurozone – ECB Monetary Policy Statement

- Eurozone – ECB Interest Rate Decision (Mar)

- Eurozone – ECB President Lagarde Speaks

The U.S. stock market fell after Credit Suisse reiterated concerns about the banking system.

Shares of Credit Suisse Group (SIX: CSGN) fell 15.8% after Saudi Arabia's National Bank, one of its biggest investors, said it could no longer provide financial assistance to the Swiss financial company due to regulatory requirements.

Credit Suisse has been struggling lately with a crisis of customer confidence, financial problems, and losses on investments. It was recently reported that the bank's shares fell 22% in Zurich, and the cost of buying insurance against the risk of default hit a new record high.

According to S&P Global Market Intelligence, the collapse spread to shares of other European banks such as BNP Paribas (EPA: BNPP), Societe Generale (EPA: SOGN), Commerzbank (ETR: CBKG) and Deutsche Bank (ETR: DBKGn), which fell 8-10%. Customers withdrew billions from Credit Suisse last year, resulting in the bank's biggest annual loss since the 2008 global financial crisis.

One of the main reasons for Credit Suisse's weakness is its investment activities. The bank, like many others, tried to make money on fast-growing but risky investment products, such as upcoming technology companies and suffered heavy losses when those investments failed to materialize.

In addition, Credit Suisse also faced threats from regulators who required the bank to comply with strict rules and regulations related to capital and liquidity. This has resulted in Credit Suisse having to sell most of its investment assets to boost its capital and liquidity, further worsening its financial position.

However, there are some signs that Credit Suisse may begin to recover. The bank's CEO, Ulrich Koerner, said Monday that the bank saw a "material influx" of money, even as markets were spooked by the collapse of Silicon Valley Bank (NASDAQ: SIVB) and Signature Bank (NASDAQ: SBNY) in the United States. Koerner also said that outflows from the bank "significantly decreased" after customers withdrew 111 billion francs in three days.

However, despite Körner's promises, shares of Credit Suisse and other European banks continue to fall, and the cost of Credit Suisse's default risk insurance has reached a new record high. This may indicate that investors are still unsure of the bank's financial strength and fear that recent problems could lead to serious consequences for the financial sector as a whole.

Credit Suisse and other European banks are in a difficult situation, and their future fate depends on how well they can cope with the challenges facing them. Special attention should be paid to strengthening the financial strength of banks and increasing investor confidence to ensure the stability of the financial system as a whole.

The story of the banking crisis in the U.S. is spilling over to Europe. So far we want to believe that the situation is not out of control, but it is already very disturbing.

Many thought Europe would freeze over last winter, but in fact, it may be on the verge of a systemic banking crisis. After all, CS is Switzerland's second-largest bank by assets.

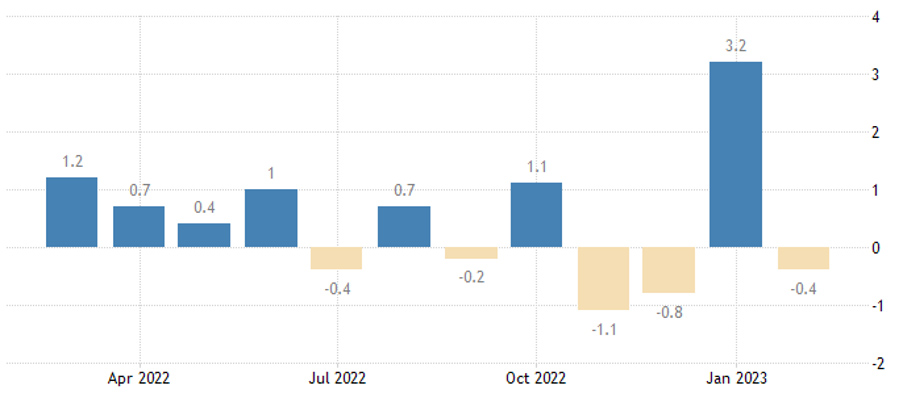

At the same time, fresh economic data fueled hopes for a less hard-line stance by the Federal Reserve. U.S. retail sales fell 0.4% in February, a larger-than-expected contraction after rising 3.2% in January.

Producer prices for the year through February rose 4.6%, compared with expectations for a 5.4% increase.

Futures traders are now divided on what the Fed's next move will be. About half are betting that there won't be an interest rate hike next week, while half think the central bank will raise rates by a quarter of a percentage point, according to the Fed Rate Monitor tool.

Bank stocks recovered slightly Tuesday after falling sharply Monday due to the sudden collapse of SVB Financial and Signature Bank over the weekend. On Wednesday, regional banks came under pressure again.

Major banks also fell, such as JPMorgan Chase & Co (NYSE: JPM), down 4.6%, and Bank of America Corp (NYSE: BAC), down 2.4%.