The Fed's Dilemma and Relief over Credit Suisse | Daily Market Analysis

Key events:

- UK – CPI (YoY) (Feb)

- Eurozone – ECB President Lagarde Speaks

- USA – Crude Oil Inventories

- USA – FOMC Economic Projections

- USA – Fed Interest Rate Decision

- USA – FOMC Press Conference

The Federal Reserve began its two-day monetary policy meeting yesterday while the market is still under stress after three weeks of severe financial instability on both sides of the Atlantic.

Some analysts, like those at Goldman Sachs, believe the collapse of 3 U.S. banks and growing signs of stress in the mortgage-backed securities market will force the Fed to at least pause its policy tightening, as others warn that inflation and the labor market are still too "hot" to afford that luxury.

On Tuesday, the pressure on mid-sized regional banks seemed to ease a bit, and most stocks rose. For example, First Republic showed a modest bounce after The Wall Street Journal and Bloomberg reported that work is underway in government and private circles to find a longer-term solution to the bank's problems.

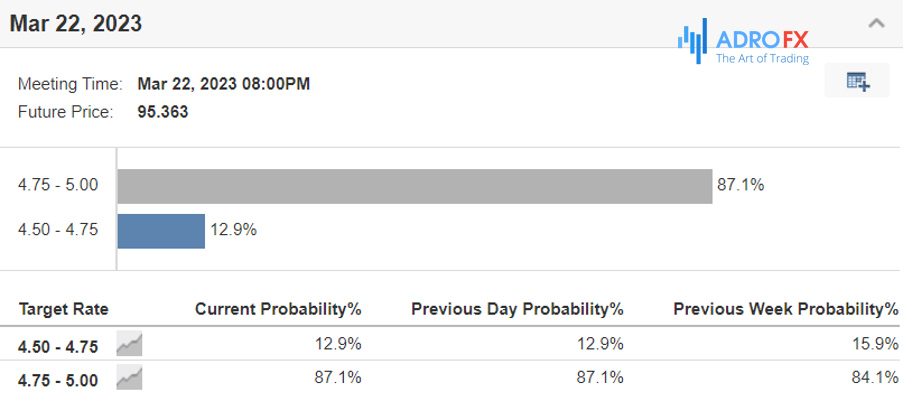

Investors are eagerly awaiting the Fed's decision. According to the Fed's federal funds rate monitoring tool, markets believe a 0.25 percentage point rate hike is most likely.

In light of the banking crisis, some analysts and investment bankers suggested that Powell might leave things as they are at the upcoming meeting.

That's very dangerous, though, because it would undermine the credibility of the Fed, which as we recall made the stupid mistake of calling inflation transitory along with the ECB in 2021.

It is essential not to repeat the mistakes of the past. To avoid this, the Fed would be wise to raise rates by 0.25 percentage points, thereby making a balanced decision. Failure to raise rates would indicate the Fed's vulnerability to market forces and the banking crisis.

A 0.5 percentage point increase would increase fears among investors and show that the Fed is indifferent to the negative impact of high interest rates on the economy. A moderate rate hike is optimal because it would indicate a measured response to current economic conditions.

Since the Fed will (almost) certainly raise rates by 0.25 percentage points, it will be especially interesting to hear Powell's comments on whether the turning point is really near or if we should wait for another rate hike.

At the moment the market seems to be betting on a bullish momentum between now and the next Fed meeting. This is reflected in the rally in the NASDAQ Composite, gold futures, bitcoin, and silver futures.

At the same time, global markets regained composure after the shock caused by Credit Suisse's hasty forced merger with UBS last weekend. European bank stocks, in particular, continue the recovery that began Monday after regulators made clear they would not copy the Swiss approach of imposing losses on additional Tier 1 capital to shareholders. ECB Banking Supervisor Andrea Enria has 2 opportunities to speak later to further calm nerves.

The Swiss move - while legal - was seen as a violation of the spirit of the Basel 3 banking reforms and provided bondholders with a greater inclination to support legal objections to the deal on other grounds.

The Swiss government hastily wrote a new regulation to avoid a shareholder veto of a deal by a bank it felt was vital to national interests.