How to Trade the Fed Rate Decision - Guide for 2022

The Fed funds rate is one of the most important benchmarks for investors and traders all over the world. Its adjustment significantly affects exchange rates and the economic situation of countries. Let's take a closer look at how all this can affect the stock and forex markets in the U.S. and around the world. It will help us understand why investors and traders pay so much attention to this indicator.

How to Trade Gold — The Ultimate Guide

Gold is one of the most traded commodities in the world along with oil, natural gas, and grain. But this precious metal is also one of the most interesting assets because it is considered to be a major safe-haven asset and is used to hedge the risk of inflation. In addition, gold is widely used in various industries including jewelry, dentistry, medicine, cell phone manufacturing, etc.

The Ultimate Beginner’s Guide to Trend Trading

Forex trend trading is exactly the way many traders use to make a profit on the currency exchange. Trend trading has many advantages: the ability to take a large number of pips due to a strong, directional price movement, a high probability of profit, and good accuracy of signals. These are the reasons that allow traders to use trend trading effectively.

Market Correction: What Does It Mean?

Any price movement can move in one direction only for a limited period of time. After that the quote changes its trend, goes to a sideways trend or starts an opposite trend. It is quite difficult to predict such changes, that is why modern traders invent more and more methods of market analysis. By understanding when a correction begins, traders can determine the probability of the next reversal and place appropriate orders.

The Ultimate Beginner's Guide to Investing

There are a lot of myths surrounding investing. Some say that it is too complicated for a beginner, and you can't figure it out on your own. Others portray the image of a successful investor who travels all the time and does almost nothing. So, let's find out how things really are.

Moving Stop Loss to Breakeven in Forex Trading

All traders on the forex market want to be successful. But how is this financial success evaluated? In most cases, we compare the size of incurred losses with the return value. However, this indicator by itself cannot be sufficient motivation. In case of a series of losing trades, we run the risk of falling into one of the psychological traps.

The Volatility of Currency Pairs - Everything You Need to Know in 2022

Most traders and investors are often confronted with such a purely market concept as "volatility". This term is used to analyze price movements as well as to characterize the trading instruments themselves in any financial market. Below you will learn what is the volatility of currency pairs - the concept, definition, characteristics, and how to use it when making trading decisions. What is the volatility of currency pairs? Volatility is a statistical financial index that describes the amplitude of price movements of a single trading instrument.

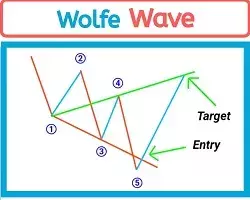

Wolfe Wave Pattern Trading Guide

The Wolfe Wave pattern is a trading method, which was originally invented by Bill Wolfe and is described in detail and clearly in his book. Wolfe's method, of course, was developed specifically for the stock market of those years, but now you can see his markup on currency pairs and other instruments as well. Thus we can safely say that Wolfe waves can be applied boldly to the forex market.

What Is The Market Facilitation Index and How to Use it in Forex Trading

Trading volume is the main measurable indicator in determining price levels in the market. The trading volume increases at the highest activity and can influence the price trend, either strengthening it or changing its direction. Actually, the main reason for studying this indicator is an objective analysis of the market situation at the moment. Most traders prefer the Market Facilitation Index (MFI) indicator, as it perfectly copes with the above tasks. Let's take a closer look at the functionality, setup, and application of this tool.

What is the Best Time Frame to Trade Forex

The choice of time frame for trading is one of the problems every trader faces at the initial stage. It is necessary to grasp the subject in detail and define: what is a time frame, what are its purposes, what kinds of time frames exist, what time frame is better to trade in, and what time frame should be chosen by a beginner. In this article, we will provide an insight into the notion of time frame, learn which one is the best for beginners, as well as will find out how to add a custom time frame.