Dow Hits New High, European Markets Soar, and Central Banks' Dilemma | Daily Market Analysis

Key events:

- USA - ISM Manufacturing PMI (Nov)

- USA - ISM Manufacturing Prices (Nov)

- USA - Fed Chair Powell Speaks

US stock futures experienced a slight decline in overnight trading on Thursday, following the Dow Jones Industrial Average's attainment of a new 2023 peak, concluding its most successful month in over a year. The Dow surged by 520 points or 1.47% during the regular session, reaching 35,950.89, surpassing its previous 2023 high from August. The S&P 500 saw a 0.4% increase, while the Nasdaq Composite slightly decreased by about 0.2%.

November marked a record-breaking month for stocks, breaking a three-month losing streak. The S&P and Nasdaq posted impressive gains of 8.9% and 10.7%, respectively, marking their best monthly performances since July 2022. The Dow surged by 8.8%, achieving its most successful month since October 2022.

A series of manufacturing PMIs from European countries is anticipated to provide insights into the region's economy. Meanwhile, futures point to a higher opening for European bourses.

Recent data from both the eurozone and the US indicated an easing of inflation, fostering expectations of rate cuts by central banks. Money markets are pricing in over 100 basis points in rate cuts next year from both the Fed and the ECB.

The disconnect between financial markets and central banks has intensified as central banks resist talk of rate cuts, while markets respond to the relatively more benign inflation data of recent weeks.

Fed policymaker Christopher Waller, a prominent and hawkish voice, added uncertainty this week by expressing increasing confidence that inflation would return to its 2% target. This emboldened markets to entertain rate-cut bets.

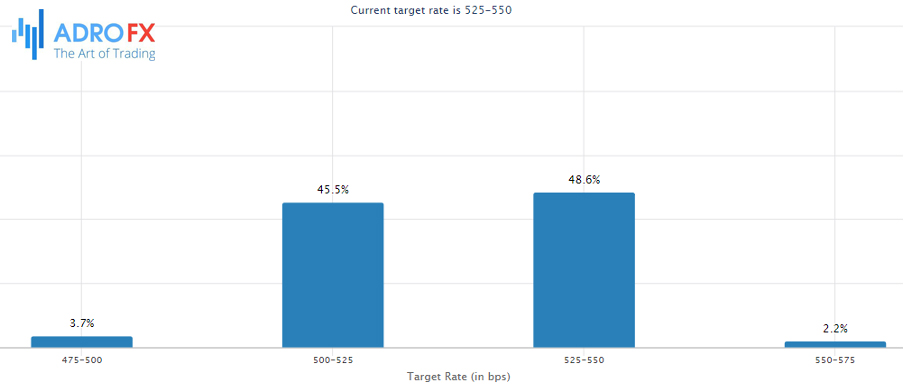

Currently, markets are placing a 45.5% likelihood of the central bank cutting rates in March, according to the CME FedWatch tool, up from 27% a week earlier.

Against this backdrop, all eyes turn to Powell as he takes the stage on Friday. Whether Powell opts for policy comments or addresses rates remains uncertain. His statements, or lack thereof, are poised to influence the markets.

In other news, Tesla (NASDAQ: TSLA) has unveiled its long-delayed Cybertruck. The stainless steel vehicle, featuring flat planes, comes with a starting price of $60,990, exceeding CEO Elon Musk's 2019 estimate by more than 50%.

European markets have concluded the month on a strong note, experiencing their best gains of the year, except for the FTSE100, which lagged due to underperformance in BP, Shell, and AstraZeneca. In contrast, the FTSE250 achieved its best month in 2023, propelled by robust performances from easyJet, Carnival, and commercial real estate, benefiting from eased interest rates.

The US dollar, after a period of declines, is showing signs of a month-end rebound, recovering from 3-month lows earlier this week and its worst monthly performance since November last year. Concurrently, US bond markets have witnessed their most significant rally since the 1980s.

The pound, however, has demonstrated its strongest monthly performance against the US dollar since November last year. While it experienced a slight dip today, this can be attributed more to US dollar strength than any inherent weakness. The Lloyds business barometer survey for November reached its highest level this year, marking the best reading since February 2022.

On the other hand, the euro has concluded the month on a weaker note as EU CPI slowed more than expected in November, dropping by -0.7% month on month and rising 2.4% year on year, down from October's 2.9%.

Core prices also decelerated significantly at 3.6%, reinforcing the idea that recent economic weakness across the bloc is influencing lower prices. The latest revision to French Q3 GDP at -0.1% suggests the French economy could be entering a recession.