Tuesday's Stock Gains Driven by Energy and Tech Sectors as Investors Await Inflation Reports | Daily Market Analysis

Key events:

- New Zealand - RBNZ Interest Rate Decision

- USA - Core CPI (MoM) (Jun)

- USA - CPI (YoY) (Jun)

- USA - CPI (MoM) (Jun)

- Canada - BoC Interest Rate Decision

- USA - Crude Oil Inventories

Stocks recorded gains on Tuesday, primarily driven by the energy and big tech sectors, while investors eagerly awaited upcoming inflation reports. The Dow Jones Industrial Average increased by 317 points or 0.9%, the S&P 500 rose by 0.7%, and the Nasdaq saw a 0.6% increase.

The energy sector experienced a boost as oil prices surged due to an improved demand outlook. There is growing anticipation that the oil market will tighten in the latter half of the year, supported by declining crude production and Saudi Arabia's commitment to reducing output by one million barrels per day in July. Additionally, reports of potential stimulus measures in China, the largest global energy importer, further buoyed sentiment surrounding energy stocks.

Bank of America's upgrade of 3M Company (NYSE: MMM) to Neutral from Underperform resulted in a nearly 5% jump in its stock. The industrial and consumer products manufacturer is expected to benefit from the resolution of legal issues, which is anticipated to enhance its performance. Last month, 3M reached an agreement to settle allegations of contaminating public water systems with PFAS, also known as forever chemicals.

With the earnings season set to commence on Friday, JPMorgan (NYSE: JPM) led the banking sector higher after receiving an upgrade from Jefferies to Buy from Hold. Jefferies cited the strength of JPMorgan's balance sheet and its potential for earnings as reasons for the upgrade. Regional banks, which have faced scrutiny since the banking crisis earlier this year, also experienced gains. US Bancorp (NYSE: USB) saw an increase of over 3.5% after Bank of America upgraded its stock to buy from neutral. Bank of America stated that US Bancorp is well-prepared to handle sector headwinds and is expected to achieve superior earnings growth and stock performance.

In the tech sector, Amazon (NASDAQ: AMZN) stood out as one of the few stocks in positive territory, benefiting from its two-day prime day sales event. Meanwhile, Microsoft (NASDAQ: MSFT) struggled to make gains, despite growing optimism surrounding its pending $69 billion acquisition of Activision, the maker of the Call of Duty game. A federal judge ruled against US regulators' attempt to temporarily block the deal based on antitrust concerns.

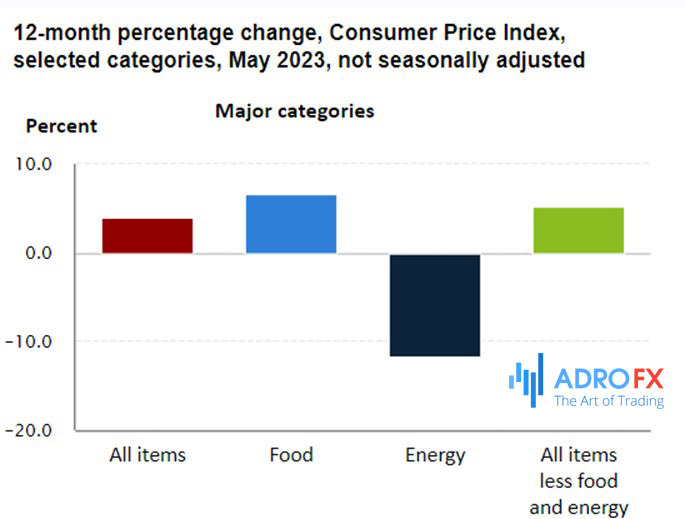

The focus of US and European stock futures is centered solely on the upcoming release of US CPI (Consumer Price Index) data. Analysts strongly anticipate that the US inflation data will exceed the expectations of most speculators.

This implies that the US CPI data is likely to align closely with or even fall below the forecasted figures. The forecast for the US CPI month-over-month (m/m) change is 0.3%, while the year-over-year (y/y) change, which holds the utmost significance, is expected to be 3.1%, compared to the previous reading of 4.0%.

If the actual number approaches or matches the forecasted 3.1%, it will be perceived as positive news for the market, as the Federal Reserve's inflation target stands at 2%. Conversely, if the reading falls below 3.1%, market participants will likely celebrate it as a significant shift in the inflation trend. However, it is crucial to pay close attention to the future trajectory of the inflation reading. Although today's data will exhibit a substantial decline, driven by tighter monetary policy, economic slowdown, and lower oil prices, these factors will have less influence on the inflation number going forward. Consequently, the disparity between the Fed's target and the actual reading may not double its current magnitude.

Gold prices are expected to exhibit volatility throughout the day. While the support level at $1,900 is robust, it may face a substantial test if the inflation data does not show signs of easing. A considerable decrease in the inflation reading would bolster gold prices, potentially leading to a test of the $1,950 level. On the other hand, if the reading indicates persistent inflationary pressures, gold prices could rise further. This would raise the likelihood of the Federal Reserve increasing interest rates, possibly multiple times.