BIS Forecasts Coming Deterioration in Capital Markets | Daily Market Analysis

Key events:

- Canada – BoC Interest Rate Decision

- USA – Crude Oil Inventories

The Bank for International Settlements (BIS) is worried about various problems, thereby sparing our local central banks from this excitement.

The immediate concern at the BIS is that central banks will have to conduct anti-crisis measures in markets suffering from rising interest rates, which will diminish the effect of efforts to curb inflation, leading to shrinking monetary liquidity and debt portfolios.

As an example, the bank cited the recent crisis in Britain, where an ill-conceived stimulus plan with a treasury-backed £45 billion tax cut forced pension funds, which had pursued a reckless hedging strategy with derivatives, to sell billions of pounds worth of government bonds to meet margin calls.

It turned out to be extremely unsuccessful. As a result, the Bank of England had to conduct an emergency market support program and buy bonds for 65 billion pounds just as it was about to start selling them. However, the actual volume of purchases was a little less than 20 billion pounds. This exceptionally unfortunate situation due to a series of rash decisions is unlikely to be repeated in many other countries, but similar risks are present in the global economy.

As two BIS economists noted in a quarterly review published:

"When these risks materialize and the economy suffers significant collateral damage, central banks will be forced to provide emergency support. And while there will be good reasons to do so, it will run counter to the course of monetary policy and spur higher risk appetite in the longer term."

There is a catch here. We can draw a parallel with the expectation that the Fed will step in and prevent markets from collapsing. Banks and other investors counting on emergency central bank support will be inclined to take more risks. If they are right, they will make money. If not, the central bank will save them.

BIS economists are very good at worrying, but they do worse at working out solutions. Apparently alerting them to threats is considered mission accomplished. With bad advice, it is difficult to find good solutions, although sometimes we realize that the advice was bad belatedly.

The U.S. jobs data released Friday showed that the number of NFP in the U.S. increased by 263,000 last month, whereas economists had predicted 200,000. Investors were again worried after the data that upward pressure on payrolls could act as a counterweight to the Fed's efforts to rein in inflation and force the U.S. central bank to continue raising rates.

The day before last, there was a new batch of "bad" good news. Service sector activity rose above expectations. Industrial orders also rose above expectations. In short, the U.S. economy is showing more resilience than expected, which means continued wage pressures on inflation. Against this backdrop, the Dow Jones Industrial Average dropped more than 500 points in anticipation of further action from the Fed.

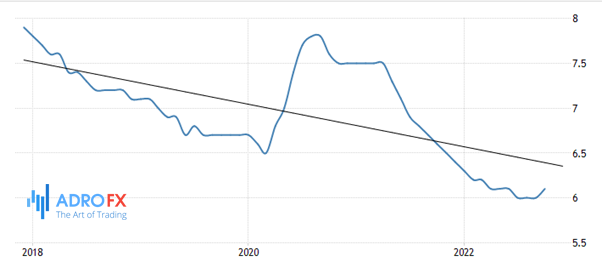

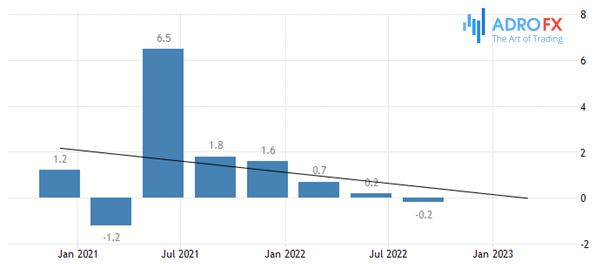

The European labor market is also resilient. Eurozone data released Friday showed unemployment falling to a record low of 6.5% in October from 6.6% the previous month, although leading European economies are facing energy shortages this winter due to the war in Ukraine.

European Commissioner Paolo Gentiloni, in charge of economic policy in Brussels, said that the European economy will slip into recession this winter and growth is not likely to resume until spring.

The U.K. National Bureau of Statistics reported last week that the country's GDP shrank 0.2 percent in Q3, marking the beginning of an expected recession. Economic activity contracted after five quarters of growth. The rest of Europe will soon meet the same fate.

However, the European Commission now forecasts positive GDP growth for the whole of 2023, following a contraction of activity in the fourth quarter of this year and Q1 of next year.

It will not be easy for the European Central Bank (ECB) to raise interest rates: on the one hand, it needs to curb inflation, but on the other not to crush economic growth. The regulator is likely to raise rates by 50 basis points next week. French and Irish central bank governors have joined the ranks of those calling for a slowdown in the pace of rate hikes after they were raised 75 basis points twice.