How to Use Murrey Math Levels in Forex Trading

Any trader dreams to see what the crowd can't see, to find that precious tool, which will help to earn where others see only losses.

The Murrey levels indicator may not be perfect, but it is very close to it.

Beginner traders rarely use Murrey levels due to their perceived complexity (compared to the classic RSI, MACD, and Stochastic). But trading at Murrey levels will dramatically increase the efficiency of almost any trading system.

What are Murrey Math Levels and How Do They Work?

Murrey Math Trading Lines is a sophisticated mathematical tool that displays price support and resistance levels. The indicator shows the overbought and oversold areas, giving an idea of possible reversal points. But at the same time, it gives an idea about the strength of the current trend.

In simple words, Murrey level is a Swiss knife in the world of indicators that shows both trend strength and possible reversal points at the same settings.

The mathematical concept of Murrey was developed in 1995 and is described in detail in the book "Murrey trading system for all traded markets".

Murrey's mathematics is based on the observations made by William Delbert Gann, a famous American trader, who developed a technical analysis tool known as Gann Angles. Opinions about the value and significance of this person's work vary greatly. He is called one of the most controversial traders. Gann based his strategies of market forecasting on the methods used in geometry, astronomy, and even astrology, and ancient mathematics.

Anyway, it was he who inspired Murrey to create a system for forecasting market prices.

The mathematical basis of Murrey's indicator is based on simple principles, which makes it universal and applicable to any strategy. The basic element of Murrey trading is the assumption that the price movement of any market will recover in multiples of 1/8. That is, prices fluctuate in 1/8 intervals.

The Murrey level is based on Gann Square with "price-time" coordinates: the vertical line represents the price change line and the horizontal line represents the time range. The time frame (trading period) is automatically set to the daily chart.

How does the "Price-Time Square" work? The creator of the algorithm originally determined the boundaries of peak prices, dividing the range (from maximum to minimum) into 8 squares. According to the regularity, if the line left one zone, it immediately appeared in the other one at a certain angle: the index of 45° was considered the strongest, and the deviation (correction) of 50 % from the extremum was important. The theory made it possible to trace the changes in the trend lines and to choose the most "significant" ones.

The complexity of Gann's system consisted of the usage of mystic numbers, ancient symbols, and astrological ratios. Murrey simplified the "Price-Time" square by dividing it into 9 key lines: main, basic, and inferior.

The Murrey levels improve the efficiency of analyzing the current trend, trading within the current price direction, timely successful trades, and market exits. The tool has proven itself in analyzing the movements of asset prices: currencies, stocks, futures, options, precious metals, and raw materials. When studying the Dow Jones Index, Murrey's theory gives additional information about the probable trend directions.

What does it look like in practice? For example, a trader has chosen USD/JPY. In the interval, the minimum value was 115.625.

Considering the table data, the obtained figure is lower than 250 in the first column, but less than 25 - the value of the second column. According to the theory, the market rhythm is 100, and the price of 115.625 is considered the basic one.

The trader needs to correctly determine the "main octave" 100*3/8=37.5; divide the average value by 8: 12.5/8=1.5625. The resulting number represents the central level, the other lines are lined up above and below.

The frequency of price fluctuations is determined by the scale of the square, on a longer time interval the aspiration of prices to resistance levels is weaker, but it is more important. The small square shows the short-term "rhythmicity" of the market, it does not give an opportunity to earn good yield.

The principle of constructing a square by obtaining similar patterns of asset price movements at different intervals is called a fractal. Combinations of gaps and levels are called octaves.

Description of The Murrey Math Levels

The structure of Murrey levels has 12 horizontal levels. Eight of the intervals are considered basic, the horizontal bands have high resistance/support price significance. Four ranges are auxiliary.

The strongest influence on the trend formation is exerted by the upper and lower levels, the 0/8 and 8/8 lines cause the market reversal.

The 7/8 and 1/8 levels, located near it, are the stops and the price reversal. If the price rapidly reaches the penultimate line and stops, it should expect a change of direction. By creating a slight resistance, the levels are used to strengthen the assets and correct the wave.

Trading at the 2/8 and 6/8 Murrey levels implies a reversal of the price line towards the 5/8 and 3/8 boundaries, the trend has a powerful effect.

The 0/8 and 8/8 Murrey levels are the final resistance levels. They correspond to the overbought and oversold levels of classical indicators. It is believed that these are the strongest levels, which prevent further price movement. If the price approaches these boundaries, the trader should wait for a bounce of the price at any time.

The 1/8 and 7/8 levels are called weak reversal levels. Nevertheless, we should also pay attention to them, because the price usually tends to the 4/8 level after the bounce. This brings us to potentially beneficial trading conditions.

The 2/8 and 6/8 levels help us predict a possible price reversal. These levels are considered to be strong support or resistance levels, which can help us turn the price around. Moreover, unlike the breakout of the 1/8 and 2/8 levels, these levels are more interesting for trading, because they confirm a trend that has just begun.

The 3/8 and 5/8 levels are the boundary of the trading range. The price often consolidates between these levels and creates a sideways movement zone.

The 4/8 level is the baseline. Its strength is comparable to the 0/8 and 8/8 levels. Depending on how the price breaks out at that level (quickly and surely or with great difficulty and not at the first attempt) the indicator either confirms the trend or indicates a possible reversal point.

The 3/8 and 5/8 levels are the top and the bottom of the price range (channel). Usually, assets spend 43.75% of the time in the above-mentioned channel and experience a state of uncertainty. If the price is between the marks for 10-12 bars, the right decision will be to open positions in the opposite direction. Exit outside the channel's borders signals the preservation of trends, you should enter in the trend direction.

The description of the 4/8 line as the center of the square according to Murrey's theory is the best point to buy or sell. The price rebounds from the middle bar - the trader makes an income.

Since the Murrey levels rebuild when the trend breaks strongly, two pairs of additional levels allow catching the significant moment:

- 1/8, +1/8 - extreme support/resistance. Levels breakout signals the end of the current trend and the need to open trading positions on the reversal. At the same time, the lines have weak statistics of real reversals, more often the reversals are characterized by temporal corrections (to the levels [0/8], [8/8]) following the line in the initial direction.

- 2/8 и +2/8. "Ultimate" support/resistance. When the price breaks out the level, the trader changes their reference points, goals, and analyses. The Metatrader indicator automatically changes levels after the formation of a strong trend, that is, it calculates octaves by the new local max/min.

How to Recalculate Octave

To display the full dynamics of the former, active levels, you will need to download the Murrey indicator with the accumulated history of redraws.

The reason that forms new calculations is the narrowing, and widening of the range of value fluctuations per unit time (volatility); breakout of auxiliary levels [+2/8] and [-2/8]; complete recalculation, and setting new goals.

The displacement and the mutual replacement of the basic levels (0/8, 4/8, 8/8) are often observed.

Murrey Math Levels Patterns

Murrey levels patterns are recurring price behavior patterns used by traders to increase the gain probability.

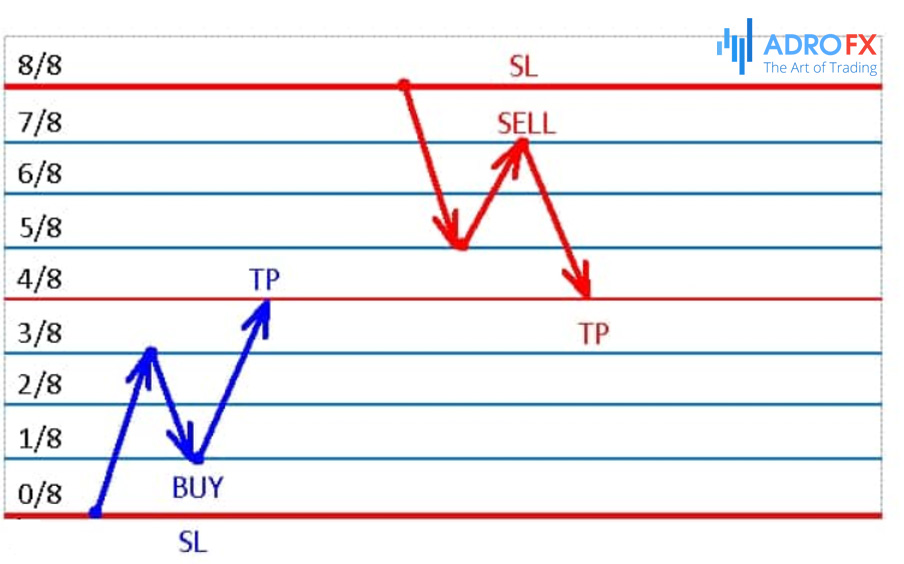

The 0/8...4/8...1/8...8/8 pattern. The price moves from the 0/8 line to the 4/8 level, recoils from the 1/8 line, and moves toward the 8/8 level. After a pullback to the 1/8 level, it is better to open a long position.

The return target is set on the border of 8/8, where the Take Profit should be set.

Stop Loss is set at the 0/8 level (several pips lower). If the price touches the 2/8 level, the order should be moved to breakeven.

The 8/8...4/8...7/8...0/8 pattern. That is similar to the bullish pattern: the price rebounds from the 4/8 level to the 7/8 level, reverse, and moves to the 7/8 direction, and the investor opens a short position.

The Take Profit order is set at the 0/8 level and the Stop Loss is 5-10 pips behind the 8/8 level. When the price reaches the 6/8 level, the Stop Loss is moved to breakeven.

An alternative to both patterns is to move the Stop Loss on reaching the next level, to the previous boundary. An analog of a Trailing Stop is formed, giving the trader a yield if the pattern does not work out.

Less often there are patterns half the size of the discussed ones: 0/8...3/8...1/8...4/8 (bullish) and 8/8...5/8...7/8...4/8 (bearish), trading with small trajectories is done by the same scheme.

The Murrey Math Levels Indicator

The Murrey levels indicator displays a set of parallel lines, colored zones, inscriptions, or marks of support/resistance boundaries. The system possibilities are determined by the choice of the basic, modified MetaTrader platform.

The settings of the basic version of MT4 include 2 parameters:

- P=64 – number of candlesticks used to calculate line positions;

- StepBack=0 – offset level, set in candlesticks;

- The P (steps) and StepBack buttons allow for more fine-tuning of the indicator for specific charts.

Modified versions of the indicator are capable of showing readings of a different time frame. By default, the period MMPeriod=1440 is set in minutes, it corresponds to a daily chart (in a day 60x24=1440 minutes).

How to Use Murrey Math Levels in Trading

The most obvious trading strategy based on Murrey levels is trading on reversal. In this case, a trader watches when the price approaches the overbought or oversold level and places a trade on the incipient trend. However, such trading signals are relatively rare, and the indicator itself works not only on reversals but also with an already active trend.

To create a full-fledged strategy, it is necessary to prepare a system of capital management, to determine the setting of Stop Loss and Take Profit.

It is also important to remember: Murrey levels are designed for medium-term trading, using a scalping strategy will not give a positive result. There are a variety of trading options, at the stage of studying the Murrey levels, two will suffice. Let`s have a look at them.

Murrey Levels Strategy

The most effective trading strategy based on Murrey levels involves the use of a low-frequency filter of a Moving Average or a higher time frame (a 1 higher period than the set one).

The MA period is determined by the trader's personal preferences, the extended period is characterized by the slow-moving of the MA. Murrey himself used periods of 5, 20, 50, and 89 days, and preferred the Exponential MA.

He considered the "touch and bounce" signal to be the most reliable. Tracing the dominant trend, you should wait for the price to break out the paired level (closing candle above or below).

Then a limit order, located at the Murrey level or at a distance of 50%, should be placed to open a trade following the trend. Take Profit is better placed at the next paired level.

Often market participants set Take Profit at 0/8 or 8/8, Profit/Loss (gain factor) - 1.6. Lower values increase the risk of losing the deposit, and higher values improve the efficiency of the trading strategy.

Upon reaching the 0/8 or 8/8 price, the line's further behavior is monitored. If the candle closes above or below the strong level, there are 2 ways to go:

- Breakout of the oversold or overbought area. The trader's task is to place a new limit order on the trend;

- The price does not break out of the oversold or overbought area- the investor has to wait for the reversal. The reversal order is usually placed after the close above 0/8 or below 8/8.

If the price hits the Take Profit, the correct decision is to place a pending Buy order at a price below the current price level (Buy Limit) at 6/8 or above the current price level (Sell Limit) at 2/8.

What Else Should You Know About Murrey Math Levels?

Trading based on Murrey levels is a self-sufficient trading system, which is based on mathematically justified support and resistance levels. According to Murrey, "all markets behave in the same way, obeying the herd instinct", which is why the indicator completely corresponds to the first tenet of technical analysis (the market discounts everything).

Murrey levels are equally effective in any time frame. It is both reversal and trending, which allows using it even during sideways price movements when other indicators show doldrums and do not provide trading signals. Well, many thanks to Murrey for such an outstanding gift.

Murrey's theory often allows us to find an intermediate balance between technical and fundamental analysis. For example, before important news or statistics are released, the right decision will be to determine the price position, whether there are strong levels near it, which strengthen the trend or hinder a strong reaction.

However, mathematical indicators are not able to correctly "calculate in time" the result of speculations, not subject to market theory.

The system also does not contain recommendations for the selection of extrema. The trader marks the points independently, the received set reflects their personal "perception of the market".

The price/time square is useful for novice traders because it automatically singles out the important price corridors, allows for defining the targets, and setting Stop Losses. If the market is moving strictly according to technical analysis, the Murrey levels are relevant when looking for reversal areas.

However, if the trend duration is doubtful (for example, when bouncing from the values [-6/8] or [-5/8]), one should look for confirmation using additional indicators.

Conclusion

Trading using Murrey math levels may not be the trader's Holy Grail, but it is a powerful and self-sufficient system capable of delivering outstanding results. This indicator requires proper training and understanding of the market, as well as the ability to read a "naked" price chart and work with candlestick patterns.

The potential effectiveness of the trading system is quite high if you approach the analysis carefully and follow all the recommended rules.