The Last Employment Data for 2022 to Define the Fed's Next Step | Daily Market Analysis

Key events:

- UK – Manufacturing PMI (Dec)

Rising inflation and higher interest rates couldn't help but affect the housing sector - and perhaps it's the labor market's turn. On the other hand, the Non-Farm Payrolls (NFP) reading has beaten economists' estimates for the past eight months, which means another positive surprise is not out of the question.

The U.S. jobs report for December 2022, to be released by the U.S. Bureau of Labor Statistics (BLS) on Friday, is the first important release of the beginning of 2023 as the Federal Reserve (Fed) faces the dilemma of tightening monetary policy.

Here are a few possible developments:

- About 200K, within expectations

Economists expect an increase of 200,000, down from the 263,000 reported in November, but still representing a healthy expansion of the labor market. Before the pandemic, U.S. jobs were growing at just under 200,000 a month.

While such growth is positive for workers, it would be too high for the Fed in the current tight labor market. The central bank is focused on "non-housing core services inflation." This multi-valued term refers to price increases that first, are not related to energy and food, but are volatile items influenced by world markets, second, are not related to the housing sector, which is updating with delays, third, are not related to commodity prices, which are falling.

This inflation on basic services not related to housing refers to activities such as accounting, gardening, hairdressing, visiting the doctor, etc. - Wage-related inflation is rising. For wage growth to slow down, the labor market would have to expand at a rate of less than 100,000, or there would even be job losses.

In this "expected" scenario, markets would fluctuate, and the U.S. dollar could appreciate slightly in response to uncertainty about the Fed's future actions. The U.S. dollar is attracting safe haven flows.

The dollar could reverse its gains after the initial reaction.

However, this scenario is unlikely because NFP rarely meets expectations and tends to surprise market participants.

- Optimistic scenario, 250K+

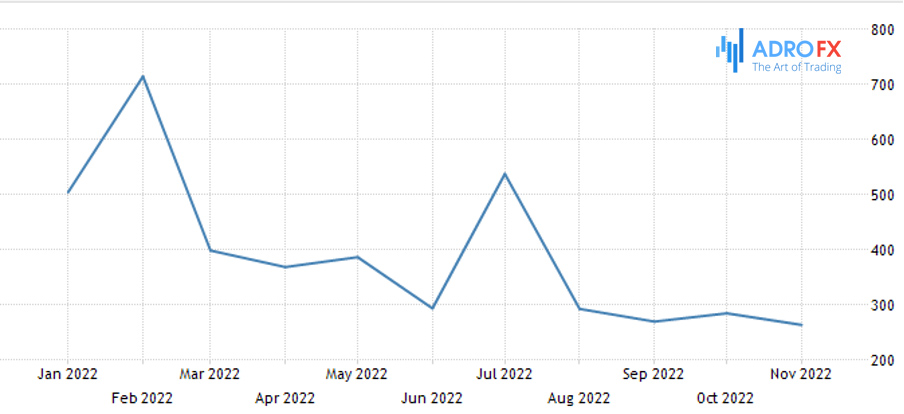

The U.S. labor market is in a very tough spot as evidenced by the Nonfarm Payrolls, weekly jobless claims, and JOLTs job openings. There are still about 1.7 job openings for every job seeker, and the deficit refuses to abate. This is a reason to expect a stronger-than-expected NFP.

Nearly all of the year-end releases exceeded analysts' expectations. The only miss was in March, but since then, eight consecutive reports have exceeded forecasts. Will economists be too pessimistic again?

The consistently low weekly jobless claims numbers point to another optimistic report that would defeat projections of about 200,000 jobs - as in the October and November publications.

You could say that this scenario is very likely, mostly based on a winning streak of data. But there are other data to look at as well.

- The most unfortunate scenario, less than 100K

As we know, about 100,000 people have been laid off in the technology sector in recent months. It's hard for some to shed tears for high-paying programmers, and some must have found other jobs. Nevertheless, their layoffs also affect others in the industry and beyond. This accumulation may begin to be reflected in the data.

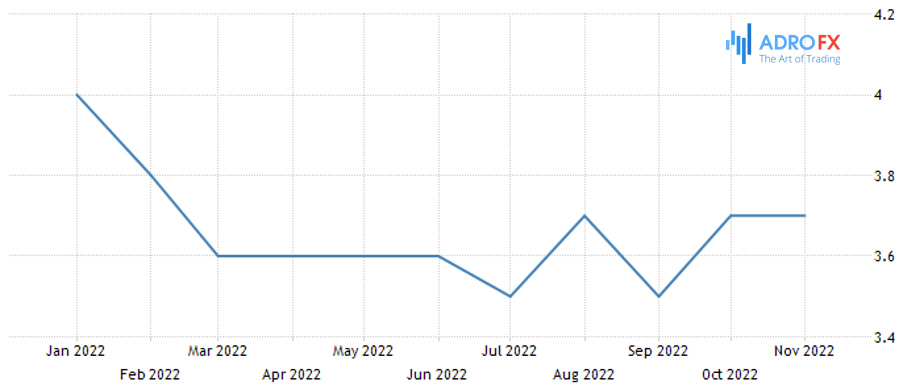

Another reason to expect weaker results has to do with the discrepancy between the two surveys that the Bureau of Labor Statistics publishes in the nonfarm payrolls report. Behind the main NFP figure is the establishment survey, and it was reliable. On the other hand, the household survey is used to calculate the unemployment rate, and it shows little growth in jobs since March 2022.

The unemployment rate is only 3.7%. Nevertheless, it comes on top of a decline in participation rates due to the lingering COVID, early retirement, and possibly the remnants of the "Great Dismissal."

Will the "Establishment Survey" converge with the "Household Survey" and show not so much growth in employment? It hasn't yet, but a review of previous numbers could show a less flattering result.

If the United States reports less than 100,000 jobs growth or even a loss of positions, the dollar will fall and stocks will begin to rise on hopes that the Fed's policy tightening cycle will end soon. Price action will be brisk without waiting for inflation data. The focus will be on jobs.

This scenario is very likely, as job growth above pre-pandemic levels cannot last forever.

The latest NFP report for 2022 is crucial for the next Fed meeting, and that report will probably be gloomy – a fitting end to the holiday season. Nevertheless, surprises in both directions are commonplace.