Strong Inflation Data Dampens Rate Cut Hopes, Weighing on Stocks and Boosting the Dollar | Daily Market Analysis

Key events:

- UK - GDP (MoM) (Aug)

- USA - PPI (MoM) (Sep)

The S&P 500 finished lower on Thursday as unexpectedly strong inflation figures complicated expectations for potential Federal Reserve rate cuts.

The Dow Jones Industrial Average dropped by 151 points, or 0.4%, while the S&P 500 declined 0.4%, and the NASDAQ Composite slipped by 0.2%.

Meanwhile, the NZD/USD pair remained around 0.6095 in early Friday’s Asian trading. However, further gains could be limited, as stronger US inflation for September diminishes the likelihood of aggressive Federal Reserve rate cuts, boosting the US dollar. Traders are also awaiting the release of the Producer Price Index (PPI) and the preliminary Michigan Consumer Sentiment Index, scheduled for later on Friday.

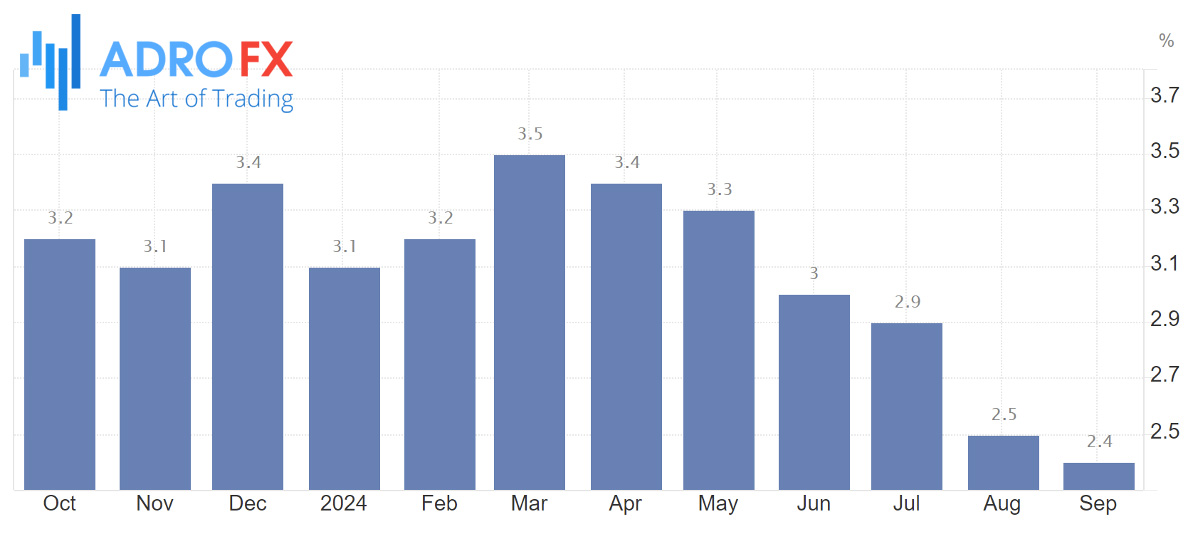

US inflation data for September came in higher than expected, with the Consumer Price Index (CPI) showing a year-over-year increase of 2.4%, slightly down from August’s 2.5%. Core CPI, excluding food and energy, rose by 3.3% year-over-year, surpassing the forecast of 3.2%. This hotter-than-anticipated inflation report is likely to support the US dollar while limiting NZD/USD’s potential upside.

While the small inflation uptick won’t necessarily prevent the Fed from additional rate cuts this year, the chances of a more substantial 50-basis-point cut have significantly decreased following a strong US nonfarm payrolls report earlier this month. According to the CME FedWatch Tool, markets now predict an 83.3% likelihood of a 25-basis-point cut in November.

John Williams, President of the New York Fed, mentioned on Thursday that more rate reductions are expected as inflation moderates and the economy remains stable. Additionally, Chicago Fed President Austan Goolsbee expressed his anticipation for further cuts in the coming year, citing that inflation is approaching the Fed's 2% target and that the economy is near full employment. On the other hand, Atlanta Fed President Raphael Bostic remains open to skipping a November rate cut if economic conditions don’t align with the Fed's goals.

As for the New Zealand dollar, the dovish stance of the Reserve Bank of New Zealand may limit the near-term upside for the NZD/USD pair. Markets are betting on additional easing at the RBNZ's upcoming November meeting, with swaps signaling another 45-basis-point cut. However, positive economic developments from China, New Zealand’s key trading partner, could provide some support for the NZD.

In the Japanese Yen market, the currency struggles to maintain overnight gains against the US dollar and remains under pressure. The decline in Japan’s real wages and household spending, coupled with subsiding raw material price pressures, casts doubts on the Bank of Japan’s plans for future rate hikes. With Japan’s snap election approaching on October 27, the JPY is losing its safe-haven appeal. However, subdued US dollar movements are preventing a significant decline in the USD/JPY pair.

In the USD/CAD market, the pair continued its rise, trading around 1.3745 during early Friday's Asian session. The stronger-than-expected US inflation data and hawkish Federal Reserve comments provided support to the US dollar ahead of the release of the US PPI and Canadian jobs report later in the day.

The Canadian unemployment rate is forecasted to rise from 6.6% in August to 6.7% in September. An uptick in unemployment and easing inflation could accelerate expectations of a more substantial rate cut by the Bank of Canada, exerting downward pressure on the Canadian dollar and pushing the USD/CAD pair higher.

Meanwhile, GBP/USD struggled on Thursday, hovering just above the 1.3000 level before closing 0.1% lower. The US dollar strengthened following the release of unexpectedly high US inflation data, causing the pound to lose ground. Looking ahead, traders will be closely watching UK GDP figures for August, which are expected to show a 0.2% monthly growth, along with rebound forecasts for manufacturing and industrial production.

Gold prices extended their recovery on Friday, building on gains from the previous day’s mixed US macroeconomic data, climbing away from the $2,600 level - a nearly three-week low. However, the Greenback’s strength, along with anticipation of China’s potential announcement of further fiscal stimulus measures, could limit gold’s upside. As traders await the US PPI data, caution is advised for those betting on a stronger bullish run for the precious metal.

This week, attention is also focused on third-quarter earnings reports from major banks, with JPMorgan Chase, Wells Fargo, and Bank of New York Mellon set to release their figures on Friday. Earnings reports from Goldman Sachs, Bank of America, and Citigroup will follow next week.