What Is a Pip In Forex Trading - Guide 2021

Forex, the interbank market for currency exchange transactions, is a complex system of financial and economic relations. To work in this field to the fullest extent, it is necessary to know a lot of special concepts. As a rule, investors learn the science and practice of Forex trading throughout their professional life. However, there are some basic points, which a beginning trader must master rather quickly and to perfection. First of all, a private trader must find out exactly what are pips in forex, as well as how the real value of one pip is calculated. Besides, it is useful to get acquainted with the peculiarities of pip trading.

In this article, we will answer all of those questions and even more.

Forex Pips Explained

A pip in forex trading is an important concept that is widely used. Most beginners know that a pip is a point that makes up one ten-thousandth of a whole number in a quote. Pips are also used to refer to the spread. But the meaning of the term is deeper and wider.

How to explain the term "pip" in simple words? A Pip is a minimum value of how much a price movement can go up or down, for example, how much the price of one currency has changed in relation to another. It's that number that's in the fourth place after the comma in prices, rates, and so on. If we are talking about currency pairs where USD is present, then it is one ten-thousandth of a dollar. Usually, it is 1/100th of a percent, which is also equal to a basis point.

In the past, due to the imperfection of calculating machines and the complexity of making deals, it was really the minimum value. Now that precise pricing methods have been introduced in trading, this value of a pip is more traditional.

Now it's a standard unit for all forex market participants.

For the beginning trader on forex, it is the concept of a pip that becomes a problematic phenomenon. No theoretical material can give a complete picture for the final understanding of this phenomenon. But in the case of the real currency pair on the chart, everything becomes simple and clear.

Let's take two currency pairs: EUR/USD and USD/JPY. In the case of the EUR and USD, the following happened: in the morning this currency pair was holding at 1.2130, but by the end of the day the USD slightly lost ground and fell to 1.2180. So the Euro jumped up 50 pips. But if we take the USD/JPY under the same conditions, the first price was 108.30, and then it became 108.85, so we can say that the change amounted to 55 pips.

Many brokers prefer four-digit quotes, but some intermediaries give preference to 5-digit quotes. In this case, there are five numeric elements after the point. It should be noted that exactly five-digit quotes in the forex market are more accurate, especially in conditions of floating spread. But everything can be easily checked and calculated, so 1 point of change in the four-digit quote corresponds to 10 pips in the five-digit variant.

Indeed, close attention is required from the trader during trading activities, especially when it comes to setting stop and limit orders and using additional programs and indicators. Because it is easy to confuse the number of required pips, which are necessary to close the current position.

There is also such a notion as the basis point, which was introduced specifically to denote changes in interest rates. The basis point is ‱ and is calculated as one-hundredth of a percentage point.

Here are two definitions:

A percentage point is a value equal to 1%. For example, a 5% decrease in the key rate by 1.5 percentage points would mean a new value of 3.5% (5%-1.5%=3.5%).

Basis point - a value of one-hundredth of a percentage point, used to express the relative change in interest rates.

Why do we need such a fuss? The point is that errors can occur due to ambiguous interpretation of the amount of interest rate change. For example, the phrase "the bond interest rate decreased by 1%" can be interpreted differently. Namely:

As its "direct" decrease by 1%, by subtracting 1 from its previous value. If, for example, before the change, its size was 8%, after the change it will be 8%-1%=7%. In this case, it is said that the change in price was one percentage point;

As its relative change by 1% from the previous value. That is, if it was 8% before, after a decrease of 1%, its amount was: 8% - ((8/100)*1%)=7,92%. In this case, there was a price change of one basis point.

How Do You Calculate the Value of a Pip?

First of all, there are so-called trader calculators, using which you can calculate, among other things, the cost of a pip. But how to understand the essence of these calculations, a pip is how much funds, for example? Let's find out.

The cost per pip in forex trading is directly related to the size of the position. Let's calculate the pip value for a minimum forex position size of 0.01 lots. Let us remember that one lot on the Forex market equals one hundred thousand units of the base currency (that is, for example, for the EUR/USD pair, one lot is worth 100,000 euros, and for the GBP/USD pair, one lot is worth 100,000 British pounds).

If the dollar is the base currency (for example, for pairs USD/CHF or USD/CAD), then the calculation is carried out as follows:

Let's say the USD/CAD exchange rate is currently 1.2440;

We calculate the value of one pip using the formula:

(0,0001/current rate) x cost of 0,01 lot

In this case one lot costs 100000 USD, and 0,01 lot, respectively, 100000 x 0,01 = 1000 USD. We get (0.0001/1.2440) x 1000 = 0.08 USD.

If the dollar is not the base currency (for example, for pairs EUR/USD or GBP/USD), then we calculate by the following algorithm:

Suppose the EUR/USD exchange rate is currently 1.2231;

Calculate the value of one pip by the formula:

0.0001 x the value of 0.01 lot

In this case one lot costs 100000 Euro, and 0,01 lot costs 100000 x 0,01 = 1000 Euro. As a result, we have the value of one pip 0,0001 x 1000 = 0,1 (note that although we substituted the value in Euros, the final result is still obtained in dollars).

Examples of calculations for four-digit quotes are given above. For a five-digit quote, the point value is calculated in the same way, but 0.00001 is used instead of 0.0001. Or, even simpler, one pip in a four-digit quote is equal to ten pips in a five-digit quote.

As you can see, it is important to understand what is a pip in forex trading and to explore the mechanics of calculating a pip, at the beginning, it can seem confusing. Fortunately, we can use a forex calculator which will quickly do all the calculations for us.

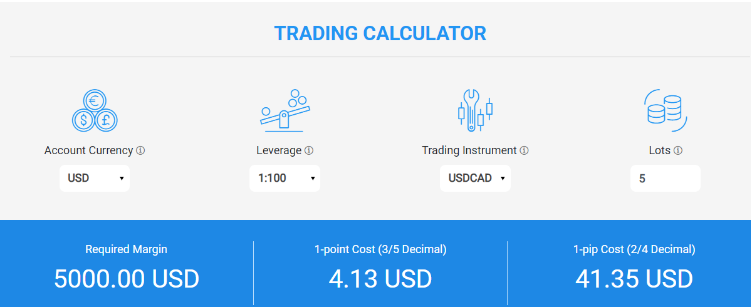

When you open the forex calculator you will normally see a table where you need to choose different options.

In the calculator, you have to select the account currency. Then you just have to choose the leverage of interest, the trading instrument, and the number of lots. Then the program will automatically show you the results based on the current exchange rates of the currency pair. Here you will see the margin requirements and the cost of one pip and one point.

That's what the results from the forex calculator look like:

Applied value for the investor's trading analysis is the calculation of the value of his potential gain or potential loss. Based on these values, the trader can calculate the volume of the position, suitable for his rules of risk management and his amount of trading capital.

These calculations require the following steps to be taken:

- Calculate the pip value of a traded financial instrument in the account currency for a standard volume of 1 lot;

- Calculate the possible loss in the account currency: calculate how much a trader will lose when a Stop-Loss is triggered. It can be done by the formula:

Stop Loss value for standard volume (in the account currency) = Pip value in account currency x Stop Loss value in pips;

- Calculate the trade volume based on risk management rules.

Monitoring the pip value for various currency pairs can help you make better trading decisions on your positions. You will be able to place a Stop-Loss and know the exact risk you're taking placing this or that order. In addition, you'll be able to fine-tune your trading strategies based on this data.

Trading Pips

Trading pips (pipsing) in forex is commonly referred to as a trading technique that involves making quick speculative trades. The return on each such position is usually 1-5 pips. The apparent advantage of this short-term strategy is that it is much easier for a trader to foresee rate changes for a few points than to predict longer-term price movements. Experienced investors practice pipsing many times during the trading day, which brings good earnings with minimal risks.

Beginner traders also use this strategy, positively evaluating its simplicity and efficiency. Trading pips becomes a good income factor if the trader manages to correctly catch the rate fluctuations within a certain time. Another advantage of this method is that it does not require any special knowledge and skills. The trader's intuition - his ability to feel the dynamics, the pulse of the market - plays a huge role here.

The earnings potential of pipsing is largely predetermined by the size of leverage used by a forex investor. It is recommended to use the maximum leverage offered by a broker. Attracting funds from a brokerage company, a trader can vary the size of a trading lot in a wide range of values, while possessing a relatively small capital on deposit.

What About Currencies That Are Not Quoted to Four Decimal Places?

Until recently, for all currency pairs in the Forex market, except for pairs with the Japanese yen, the size of one pip in forex trading was 0.0001 (the fourth digit after the comma). And for the pairs with the Japanese yen 0.01 (the second digit after the decimal point).

However, currently, some brokers switched to the so-called five-digit quotation. Such quotation implies greater accuracy and allows brokers to switch to floating spread. At a five-digit quotation the size of one pip is 0.00001 (the fifth decimal place), and for the pairs with Japanese yen 0.001 (the third decimal place).

But why are pairs with the Japanese yen quoted differently? The reason is that at the end of the World War II the yen was fixed at 350 yen per one dollar. And in 1995 the rate was 79 yen to one dollar. And in all these sixty years Japan has never conducted denomination of its national currency. That's why in order to make the value of one pip of Japanese currency comparable to one pip of other currencies their cross-rates are displayed with the accuracy of 0.01 (in four-digit quotation) or 0.001 (in five-digit quotation).

What Does Pip Stand For?

Basically, pip is a slang name, that is, it is most often used by traders in communication with each other. In official sources, for example, on brokers' websites, the term "point" is used more often.

In case you have been wondering what pip originally means, we've got you covered. This slang word comes from the abbreviation, which stands for "percentage in point" and means "the relevant percentage". Let us now move to the next part and see how to count pips in MetaTrader 4.

How To Count Pips in MetaTrader 4

We have already learned how to calculate the value of a pip in forex trading, now let's see how pips appear in the MetaTrader 4 trading terminal. In this way, we will fully understand the essence of a pip.

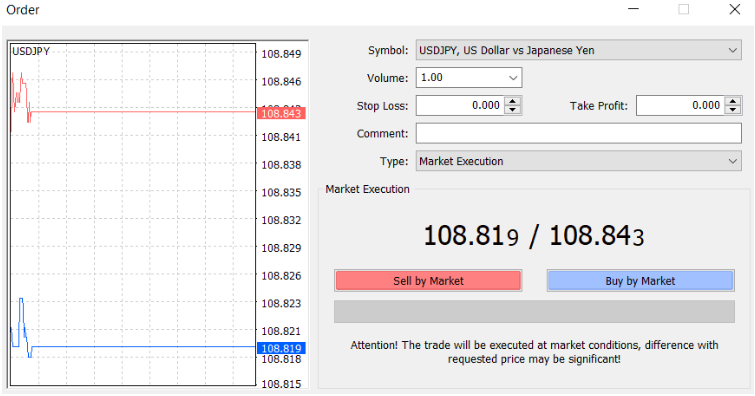

We first open a new order window in MetaTrader 4 for a currency trading instrument, for example, for the trading pair USD/JPY. We find two fractional digits with a comma, it could be, for example, 108.819 / 108.843:

And we can see that the last digit is smaller than the others. It is a decimal pip, that is, 1/10th of a pip. The difference between the two bid and offer prices is 3 points. It turns out that in MetaTrader 4, the last smallest digit is a tenth of a pip, and it is the penultimate.

And we can see that the last digit is smaller than the others. It is a decimal pip, that is, 1/10th of a pip. The difference between the two bid and offer prices is 3 points. It turns out that in MetaTrader 4, the last smallest digit is a tenth of a pip, and it is the penultimate.

In fact, a trader hardly needs to make any complicated calculations. The system will do it for him. But it is necessary to understand why we need pips in forex trading and how to work with them properly.

Of course, if you are an absolute novice, it is better to open a demo account at AdroFx and understand everything during the practice. By opening such an account, which operates based on MetaTrader, you can freely watch the price fluctuations, open and close positions, and trade at real prices. A demo account is a perfect solution because it allows you to trade with the virtual funds in a risk-free environment. The gained experience will be extremely helpful when you get ready to start trading live.

CFD Pips

On the stock exchange, one pip is the minimum value of price change, and it is always equal to 1 cent. But a point on the stock exchange is one dollar, i.e. 100 cents. Accordingly, you do not need to be a genius, and no complicated mathematical calculations are needed to understand that 1 point on the stock exchange is equal to 100 pips. For example, if a company's share price fell from $53 to $48, we can say that the stock fell by 5 points. It would seem that if a point is equal to a dollar, then why do we need it at all?

The fact is that a point in the stock market is not only an integer change in dollars but also a measure of how the value of a stock has changed as a percentage. For example, if a stock is worth $30,000, a 3-point drop represents only a change of 0.01% (3: 30,000x100), whereas, at a price per share of $10, a 3-point change is as much as 30%.

However, the stock market is not just about stocks. A 1-point change in the stock index is no longer tied to the dollar. If they say that the Dow Jones fell by so many points, it does not mean that the shares of all 30 companies in the index lost a dollar each, or that they all fell by a dollar. A point here is a conventional unit of measurement for the index as a whole, and even if the index is down by a certain number of points, some stocks within it may have even gone up. The index itself can't have any currency value, it's a mathematical value expressing the aggregate trend, and that's why special points are used here.

But the stock market doesn't stop there either. There are also separate points for bonds: in this case, it is a 1% change in the bond rate, which again, does not correlate in any way with an integer dollar expression. As for the futures market, there is a 2% change in the price of a cent, i.e., $0.0002.

Summary

All in all, this article should have addressed all the possible questions regarding the notion of a pip in forex trading and by now, you know how to calculate pips and how to benefit from that knowledge. Even though this information may seem too simple for some, it's still crucial to go through since any novice forex trader must have a thorough understanding of the basic concepts that define the mechanism of the forex market. Understanding what is a pip in forex trading will help traders to plan their trades reasonably and correctly evaluate the results.

About AdroFx

Established in 2018, AdroFx is known for its high technology and its ability to deliver high-quality brokerage services in more than 200 countries around the world. AdroFx makes every effort to keep its customers satisfied and to meet all the trading needs of any trader. With the five types of trading accounts, we have all it takes to fit any traders` needs and styles. The company provides access to 115+ trading instruments, including currencies, metals, stocks, and cryptocurrencies, which make it possible to make the most out of trading on the financial markets. Considering all of the above, AdroFx is the perfect variant for anyone who doesn't settle for less than the best.