US Stocks Find Stability Amid Inflationary Relief; Currency Markets Navigate Rate Expectations | Daily Market Analysis

Key events:

- UK - GDP (MoM) (Feb)

- Germany - German CPI (MoM) (Mar)

Thursday saw US stocks stabilize following the previous session's significant declines, as investors found solace in the monthly producer prices report, which presented a more subdued inflationary scenario.

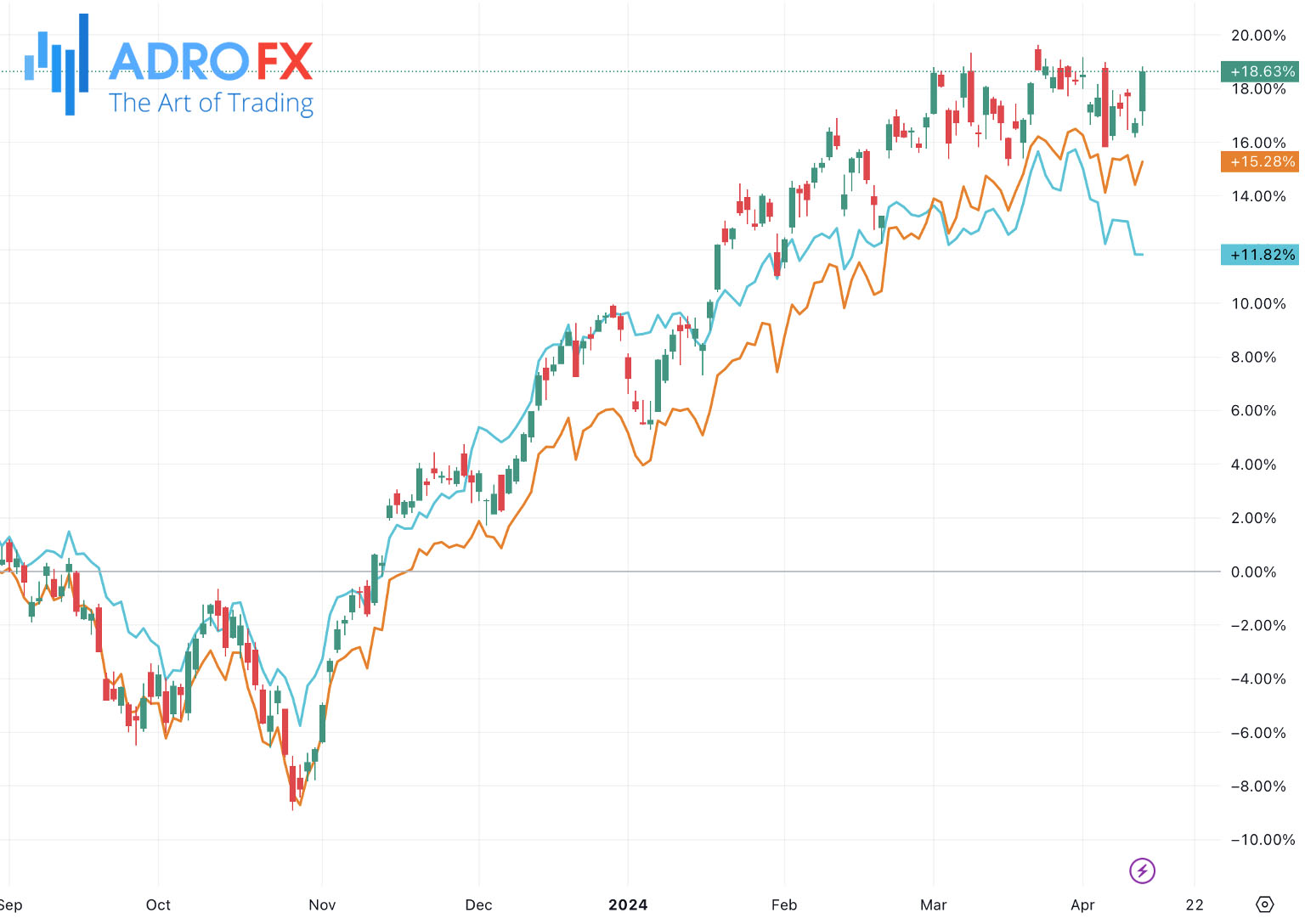

Dow Jones Industrial Average dipped 140 points, or 0.4%, while the S&P 500 retreated 12 points or 0.2%, and the NASDAQ Composite advanced 25 points, or 0.2%.

In March, US producer prices rose by a slightly lower-than-expected 0.2%, compared to a 0.6% increase in February, coming in below economists' projections of a 0.3% gain. Over the 12 months ending in January, the PPI saw a 2.1% uptick, slightly below the anticipated 2.2%, following a 1.6% rise in February.

While prices continued to climb, the rate of ascent was less steep than anticipated, offering relief to investors who were concerned after Wednesday's higher-than-anticipated consumer price report hinted at prolonged elevated interest rates.

The CPI data aligns with the Federal Reserve's reiterated warnings about persistent inflationary pressures, indicating a potential delay in interest rate adjustments for 2024. Additionally, the report of a greater-than-anticipated decline in new unemployment benefit claims last week suggests a robust labor market.

Following Wednesday's CPI data and hawkish minutes from the Fed's March meeting, expectations for a 25 basis point rate hike in June plummeted among traders. Market sentiment now reflects an 81.8% probability of the Fed maintaining rates unchanged in June, up from 37.1% the previous week, as per the CME Fedwatch tool. Conversely, the likelihood of a June rate cut has dwindled to 17.5%, down from 61.1% observed last week.

During Friday's Asian session, the Japanese Yen remained within a narrow trading range against the US Dollar, consolidating its losses from the week to reach its lowest level since 1990. With the Bank of Japan offering limited guidance on future interest rate hikes and expectations that the Federal Reserve won't cut rates before September, the significant interest rate gap between the US and Japan is likely to persist, further weakening the safe-haven appeal of the JPY.

Conversely, the USD maintained its position near its year-to-date peak, fueled by anticipations of prolonged higher rates from the Fed due to persistent inflationary pressures. This sentiment supports the USD/JPY pair, although bullish activity remains tempered amid verbal warnings from Japanese officials regarding potential market intervention to curb further JPY depreciation. Despite these warnings, the fundamental landscape favors further upside for the currency pair, with any substantial corrective pullback likely viewed as a buying opportunity.

Meanwhile, the USD/CAD pair also traded within a narrow range during the Asian session, holding near its recent high attained on Thursday. The breakout above the 1.3600-1.3610 supply zone earlier in the week favors bulls and hints at the possibility of further appreciation in the near term. However, heightened tensions in the Middle East, particularly regarding potential Iranian retaliation over an alleged Israeli strike on its embassy in Syria, have lifted crude oil prices, supporting the commodity-linked Canadian Dollar and acting as a headwind for the USD/CAD pair. Despite this, concerns over growing non-OPEC output, primarily led by the US, may cap gains for crude oil. Additionally, expectations of delayed interest rate cuts from the Fed should bolster the USD, providing further support to the currency pair's downside.

In the realm of GBP/USD trading, the Pound Sterling remained under pressure near 1.2550 during the early Asian session, as market sentiment anticipates a potential interest rate cut from the Bank of England before the Fed takes similar action. Despite hawkish comments from BoE policymaker Megan Greene suggesting that rate cuts in the UK are unlikely in the near term due to persistent inflation pressures, the GBP failed to gain traction. The upcoming UK GDP figures for February may offer insight into the country's economic health and could8 provide some support to the GBP if they exceed expectations.

The European Central Bank held its key interest rates steady at 4.0% for the fifth consecutive meeting, hinting at a possible rate cut in June. This speculation, combined with uncertainty surrounding the Fed's next moves, has exerted downward pressure on the Euro and supported the EUR/USD pair.

With expectations of an ECB rate cut before the Fed, the EUR/USD pair trades with a negative bias near 1.0728, with investors awaiting German inflation data and the preliminary US Michigan Consumer Sentiment Index figures for further direction.