What is Zig Zag Indicator: Settings and Strategies

When analyzing price movements on the chart before placing orders, traders can be hindered by minor price fluctuations - market noise. It is difficult for them to see significant trends, and it is easy to make a false forecast. There are numerous indicators designed for outlining the cycles and waves on a chart, and Zig Zag is one of them. It allows you to cut off the price noise and more accurately identify the key trend, significant price changes, reversals, and other important trend changes. In general, with the Zig Zag indicator, it is possible to assess the market situation more effectively. Let's take a closer look at its working principle, installation, calculation formula, and settings.

What is Zig Zag Indicator?

The Zig Zag indicator is built into the MetaTrader terminal by default. This is the standard version of the tool that has minimal functionality and a basic set of settings. Besides the standard Zig Zag, there are also versions with alerts and multiple time frames mode.

The Zig Zag draws an uninterrupted curve line on the chart, which consists of separate segments. All segments are inseparable from each other and correspond to the micro-trends of the chart.

If you look closely at the plotted lines, you can easily determine that the places where the segments connect correspond to the minimum or maximum of the graph for a certain period. Therefore, it is convenient to draw levels, find extrema, fractals, etc. using the Zig Zag.

The main purpose of Zig Zag is the determination of market trends without taking market noise into account. That is why this indicator is sometimes called a noise filter when searching for a trend.

In particular, it simplifies the construction of trend lines, facilitates the search for support and resistance levels, and shows price rebound from levels. Traders, relying on Zig Zag information, look for forex market signals to place either short or long positions.

At the same time, the Zig Zag marks price changes in the past – based on this information, the trader can get a more accurate forex market forecast. But Zig Zag is rarely used as an independent instrument – it is an additional indicator to other instruments, including oscillators for forex.

How Does Zig Zag Work?

The indicator determines the most significant high and low price points and connects them with straight lines. Thus, excessive insignificant fluctuations remain unnoticed by the trader. The indicator looks like a broken line superimposed on the main chart. It takes the fluctuation of the price as an estimate and filters out fluctuations outside this value. For example, if the value of the filter is 10%, then everything less than 10% will not be marked as insignificant.

The trader should closely monitor the behavior of the indicator because its last line can change when the tracked data changes. This is one of its drawbacks. For example, it marks the lower extremum. However, if the trend remains bearish, the indicator shifts the line lower, and the indicators are repainting. If the trend changes to an uptrend, the indicator marks the upper extremum and repaints the values. Because of this feature of the Zig Zag, it is reasonable to use it in time frames from 1 hour.

Indicator Settings

The color, type, and width of lines can be changed in the algorithm settings, as well as the time frame, for which the tool will build lines.

The quality of the drawing is affected by the input parameters of the tool:

- "Depth". Minimum distance (in candles) from one extremum to another (from minimum to minimum and from maximum to maximum).

- "Deviation". Minimum difference between price extremums of neighboring candlesticks.

- "Backstep". Minimum distance (in candles) between two opposite extremums (Min and Max).

Varying the indicator parameters affects the sensitivity of the tool: if the parameters are reduced, the indicator will show more lines displaying more points of extrema. The preset parameters of the tool are quite correct, and it is not recommended to change them.

What is the Zig Zag Indicator Formula, and How Is It Calculated?

A simplified version of the calculation of Zig Zag lines looks like this:

- Firstly, Min and Max of the chart are taken as equal and fixed, according to the Low and High points of the first candle in the analyzed section of the chart;

- Next, the extremums of the next candle are compared to the fixed Low and High, and if they are not higher/lower by the value of Deviation, the new extremum is not fixed.

Thus, if the maximum of the current candle doesn't exceed the fixed maximum per the Deviation, the indicator starts analyzing the extrema of the next candle, and so on, until a new point max is found. If the maximum turned out to be higher than the fixed value, the point max is updated.

The same rule works for the Low prices of the chart. If the minimum of the analyzed candle is lower than the fixed minimum according to Deviation, the indicator updates the extremum.

If the indicator does not detect a renewal of the Low or High point on the area corresponding to the Backstep and Depth, it starts searching for the opposite extreme point. At that, all subsequent minima and maxima, which correspond to the conditions of Zig Zag settings, are connected by linear segments.

How to Work with the Zig Zag Indicator

The indicator is most frequently used for drawing support and resistance levels from the extremums found. Then among the levels found, the key levels are identified, from which the price bounced most of the time. These lines can affect the dynamics of price changes.

In addition to the search for Support and Resistance levels, the Zig Zag is used to determine the supply and demand zones. The principle is the same as with the levels: the minimums of the chart are used for finding the demand zone, while the maximums of the chart are used for finding the supply zone. Keep in mind that the strength of support/resistance levels is directly proportional to the number of price tests. In contrast, the strength of supply and demand zones decreases with each price test.

The next way to use the Zig Zag indicator is by drawing trend lines:

- The downtrend line is plotted on the successively decreasing highs of the chart; The uptrend line is plotted by consecutively growing minimums of the chart.

Zig Zag can be also used to find candlestick patterns and figures on the chart. Let's consider the most common variants that most often appear on charts:

- Head and shoulders. Beginners are not always able to quickly determine, and in forex, it is very important, the market reversal and trend change. With the help of the indicator, which marks the lines on the extrema, this task is greatly facilitated. The characteristic of the figure "Head and shoulders" is an extremum marked on the chart with the subsequent larger top, which is also found by Zig Zag, and the third smaller top.

- Double top. It looks like two extrema drawn by the Zig Zag indicator on the chart.

- Double Bottom pattern. It is an inverted Double Top.

Also, quite often Triple Top and Triple Bottom appear on the chart. There are dozens of different patterns, but they are easiest to identify using Zig Zag.

In addition, the signals that are identified with this tool can be based on candlestick patterns, such as a Pin Bar appearing on the peaks of market quotes. Or in conjunction with Fibonacci Retracement, when the indicator draws a bounce from Fibo levels at 38.2, 50, and 61.8. This is very convenient for traders, especially beginners, as confusion about how to trade disappears. The Zig Zag indicator eliminates the emerging subjective approach of the trader when analyzing the market.

Advantages of the Zig Zag Indicator

The Zig Zag indicator is used in combination with other technical analysis tools. It is often used in strategies with Elliott wave calculation, using Bollinger Bands, and Fibonacci Retracement to determine standard patterns.

For example, this is the trend pattern "bottom-correction-bounce" (1-2-3), which is formed at the end of a trend and indicates a change in the trend. This pattern is easily identified by the Zig Zag indicator and allows you to predict the entry point into trades with great accuracy.

Zig Zag is most widely used by traders who work with Elliott's Theory as it helps them identify Elliott Waves without drawing them on a chart. The main price movement, according to the Elliott Theory, is an impulse wave in the trend direction interspersed with corrections. Zig Zag allows us to determine the first impulse wave and enter the trade under optimal conditions.

Zig Zag is often used with the Bollinger Bands according to a fairly simple methodology. If an angular bend in the Bollinger Bands appears on an uptrend, a line is drawn from the previous peak of Zig Zag through the bottom point of the Bollinger Band to the touch of the bottom line. The indicator allows you to determine the appropriate entry point to place a long position.

Disadvantages of the Zig Zag Indicator

Unfortunately, there are no perfect tools in trading, and Zig Zag is no exception. It has two main disadvantages - the repainting of the market quotations and the lag when using its standard versions.

The notion of "lag" implies that the indicator will follow the market price, but with some delay in real-time. As a result, the Zig Zag indicator processes only the historical data, without looking into the future and without predicting the quote changes. Most trading indicators, such as Moving Averages, Stochastic, Parabolic SAR, and others have the same properties.

Zig Zag Indicator in the MetaTrader 4

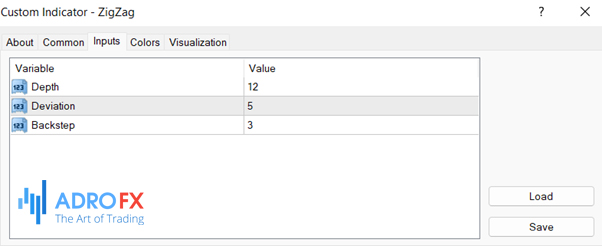

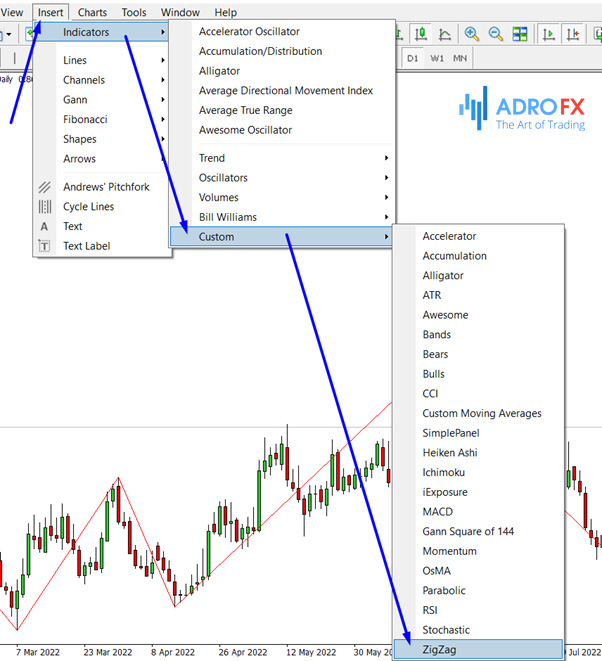

The Zig Zag indicator is a popular trading tool. For example, in MetaTrader 4, it is located in the "Custom" tab. To load it on a chart, you should enter the "Insert" tab, go to "Custom" at the bottom of the tab and find the indicator in the pop-up menu:

After you click on it, the indicator settings window will appear on the chart, where Deviation - 5, Depth - 12, and Backstep - 3 are set by default, you can also change the time frame and indicator color here. By leaving these parameters or setting your own, you can load Zig Zag on the chart.

Zig Zag-Based Trading Strategies

Even though Zig Zag is better used with other indicators, strategies are using only Zig Zag. It is used to mark a minimum on the chart, it must be confirmed by two candles or more on the trend. This can be a signal to buy an asset with Stop Losses up to 10 points below the low.

For a sell signal, a maximum confirmed by several candles should be set – entry is made with a Stop Loss up to 10 pips above the maximum. Trading is preferable in time frames of 15 minutes or more. Despite the apparent simplicity, this strategy is not often used, because one indicator is not enough for a full-fledged trade, in addition, the indicator lags, but still, trading using only Zig Zag is possible.

The same can be said about the breakout strategy based on the Zig Zag indicator, also using Stop Loss. Here, positions are opened upon the breakout of extrema and Stop Losses are set up to 15 pips higher or lower depending on whether the asset is being bought or sold.

The Zig Zag property of simplifying the identification of basic price movements is used in strategies related to the construction of patterns on the chart. For example, Zig Zag is used to draw one of the basic chart patterns – a triangle. For this purpose, Zig Zag determines two upper and two lower points, so that the upper point is lower than the first one, and the second lower point is higher than the first one. Trades are opened on the breakout at the point where the price is predicted to break out the pattern boundaries - either to sell or to buy.

One of the popular strategies is to trade using Zig Zag and Moving Average signals.

We open a buy order when the Zig Zag crosses the Moving Average from bottom to top and the indicator marks the high just after the low. A sell order is placed when the indicator shows the first low after the high when the Zig Zag crosses the Moving Average from top to bottom. This strategy requires the use of Stop Losses, placing them up to 40 pips depending on the trend.

The strategy of trading based on Elliott Waves with the use of Zig Zag implies the determination of the main waves. The main waves A and C develop in the direction of the key trend with corrective movements B and D. A sell order is opened immediately after the completion of the B-C correction before the D impulse. Strategies with Elliott waves often use the Fibonacci Retracement, which allows specifying corrective movements of waves and opening trade on the formed trend. In addition, the Zig Zag in the wave strategy can confirm the trend reversal after the completion of the correction.

The strategy using Zig Zag, Fibonacci, and MACD determines the entry point against the trend or the entry point on the reversal as precisely as possible. The indicator shows the price movements, the Fibonacci Retracement is overlaid on the "waves" according to which the price is moving and the MACD indicator shows the divergences and convergences which mark the end of the current trend.

This strategy first determines the price movement based on the MACD. If it indicates a change in trend, the Zig Zag price wave is identified and the Fibonacci is overlaid on it. Trading positions are opened using the Fibonacci Retracement in the direction indicated by the MACD. This strategy also involves the use of Stop Losses.

It is considered to be a fairly versatile strategy that can be used in almost any market situation, including when the flat trend prevails, but the effectiveness of trading is higher in a volatile market because in this case there are more signals.

A long-term strategy, in which the Zig Zag indicator is used together with the Stochastic or RSI indicators, is designed to determine the correction after the trend reverses and after the exit of the flat. Additional indicators should show overbought and oversold zones to determine the beginning of a possible trend change. The trader identifies new extrema and opens sell or buy trades depending on the emerging trend. The trades are closed only when the indicators show another change in the trend. The strategy is implemented with the use of Stop Loss support.

The Zig Zag indicator is also used in Williams strategies, which are in the list of standard in the trading terminals. Within these strategies, the Alligator, AC (Acceleration/Deceleration), and Awesome Oscillator indicators are used:

- The trader marks the Alligator indicator patterns: if the pattern is above the three indicator lines, it is a signal to buy, if below - to sell.

- The Awesome Oscillator and Acceleration/Deceleration indicators confirm the signals of the previous indicator by color and oscillator position, for example, green and above zero confirm a signal to buy.

- The Zig Zag in this strategy allows to cut off the market noise and quickly assess the trend reversal.

Conclusion

The Zig Zag indicator has been successfully used in various strategies. Its main task is to define the trend movements, cutting off unnecessary signals and thus increasing the accuracy of forecasts. But it is not predictable on its own, since it analyzes only past price movements and repaints the latest data. That is why it is used in combination with other indicators and trading tools.

About AdroFx

Established in 2018, AdroFx is known for its high technology and its ability to deliver high-quality brokerage services in more than 200 countries around the world. AdroFx makes every effort to keep its customers satisfied and to meet all the trading needs of any trader. With the five types of trading accounts, we have all it takes to fit any traders` needs and styles. The company provides access to 115+ trading instruments, including currencies, metals, stocks, and cryptocurrencies, which make it possible to make the most out of trading on the financial markets. Considering all the above, AdroFx is the perfect variant for anyone who doesn't settle for less than the best.