What Is Three Black Crows Candlestick Pattern

Isn't it every trader's dream to catch the end of a trend and open a position at the very peak? Candlestick analysis provides such an opportunity. Candlestick analysis, despite its popularity, is not for everyone. To learn all the details and master all the facets of this science to perfection takes a fair amount of time. Even such seemingly simple figures as "Three white soldiers" or their antipode "Three black crows" in fact are full of secrets.

That is why we want to tell about the reversal pattern Three black crows, which proved itself in long-term trading.

Description of the Three Black Crows Candlestick Pattern

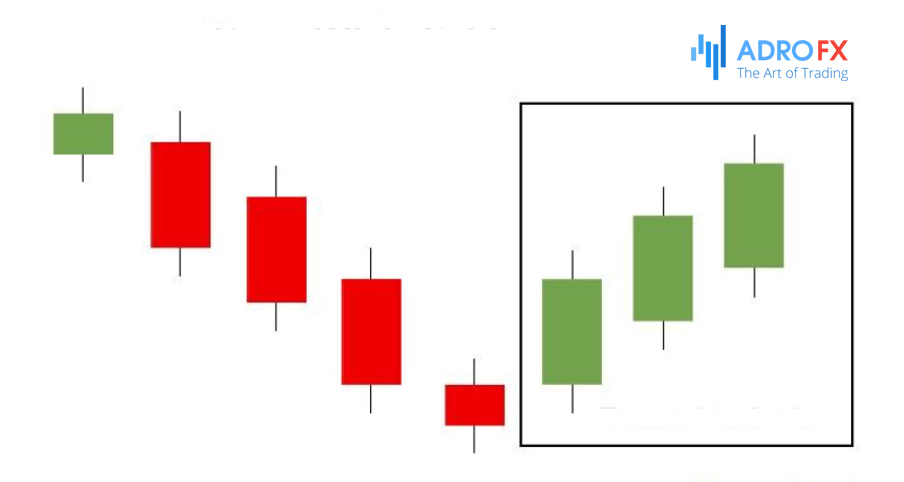

Three black crows is a candlestick analysis reversal pattern used by bears (the three white soldiers' mirror formation). If you see this combination, then take a signal that the moment is coming when you need to sell everything you can, because prices will fall sharply. The fall itself is the reason that the fixation of the market participants began, and a large number of sales began.

We understood the basis of this model, the only thing left is to recognize the combination at work.

To identify the three black crows pattern, look for the following criteria:

- There should be an uptrend in the market;

- Three long bearish candles should appear on the chart;

- Each of these candles should open below the opening of the previous candle;

- Each candle should set a new short-term low;

- The candlesticks have very small (or nonexistent) shadows.

Remember, the closing price of each candle, if they are really black crows, must be lower than the previous one, and each candle just has to close at its minimum price zone.

One more nuance: the model can be useful and work effectively not only as a reversal pattern but also when exiting a sideways channel.

How to Trade the Three Black Crows Pattern?

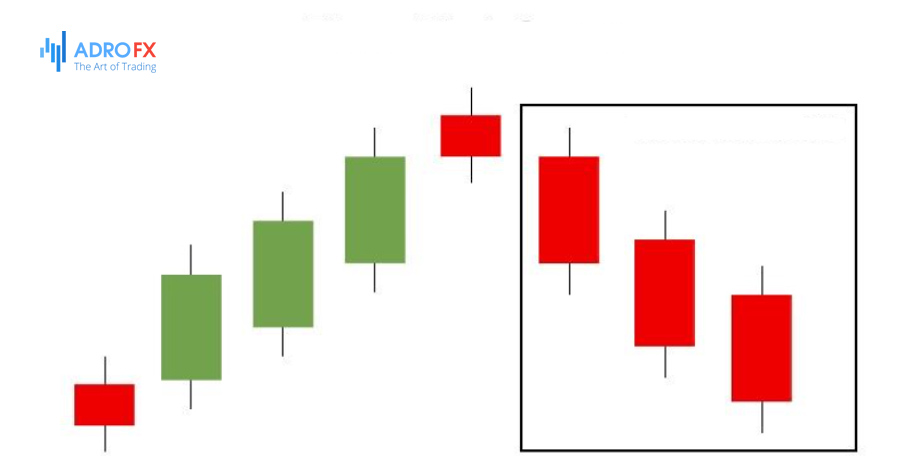

Basically, what you need to do is to go against the crowd. That means you should consider the three black crows pattern as a bullish signal alerting you to potential buying opportunities.

If the price is above the 200MA, look for opening long positions.

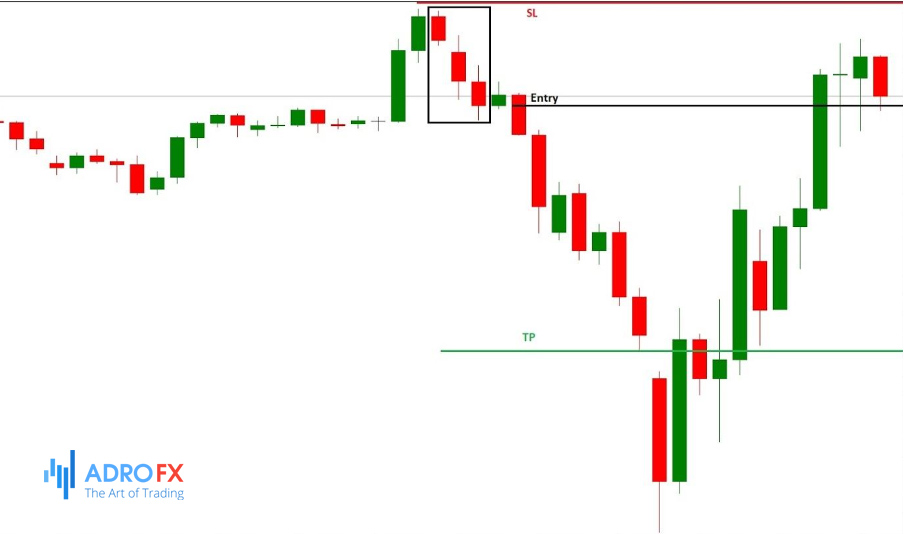

Wait until the three black crows pattern appears in a meaningful area (e.g., support or resistance level, trend line, etc.).

Open a long position when the market shows a bounce from lower prices. For example, a pin bar or an engulfing pattern will appear.

But how then can you trade a trend reversal? To do this you need to:

- Find a breakout of the previous low;

- Find a lower high and a lower low.

As we know, an uptrend consists of higher highs and lows. Thus, when the price breaks out below the low of the previous swing, it is a sign that the uptrend is weakening.

It does not yet mean that the uptrend is over because it can be a false breakout and the market will continue to rise afterward. That's why you need to pay attention to the appearance of lower highs and lows.

After the price drops below the low, you need to figure out if the buyers are losing strength. The easiest way to find out is to make sure that price can't retest the highs and instead makes lower highs and lows.

You can also analyze the market structure in a higher time frame. If the price is at a resistance level in a higher time frame, the probability of reversal becomes even higher.

Tips for Trading Three Black Crows

The trading sense of the three black crows is absolutely transparent - it's short selling. Still, it does not hurt to be vigilant (after all, the market downturn can cause the bulls are willing to buy at a low price) and take note of our tips:

- Before you enter the market with a short position, it's a good idea to evaluate the situation. It is good if the formation of the three black crows was preceded by a prolonged upward trend or market consolidation in the area of high prices. However, other options are also possible.

- The forex market is more dynamic than the stock market and this fact influences the postulates of the candlestick analysis. Being a classical reversal pattern, the three black crows in forex can signal a reversal of the market and the continuation of the downtrend after a price correction or exit of the horizontal price channel (flat).

- When reversing on the top, in most cases, the first candle of the three black crows will be a part of another reversal candlestick pattern. For example, it may be a bearish engulfing, a dark cloud cover, the evening star, and the like. The presence of such a double confirmation is very valuable because it allows you to trade with more confidence.

- Special attention should be paid to the size of the bodies of candlesticks in the pattern. So if the candlesticks are small, it's not three black crows pattern. There are no specific values, and the size of the candlesticks will have to be estimated visually, based on your experience.

- The relation between the sizes of the candlesticks in the pattern is also important. If the last one is significantly smaller than the previous ones - these are not the three black crows. It is impossible to trade on such a pattern.

- Similarly, you should refuse to trade if the last candle in the pattern has a long bottom shadow. Its presence means that even though during the trading the price is falling low, the period will close much higher. Therefore, the bulls' pressure is strong and the bears are in confusion.

- Quite often after the formation of the three black crows, there is a price correction upwards (sometimes significant, up to 50-90% of the model value). If there are signs of a pullback, it would be wise to wait for its completion and enter the market at the peak of a new downward wave. It will allow reducing the risks and increasing profits.

-

The last tip – do not get hung up on the candlestick analysis. It always helps to have confirmation from indicators or forex graphical analysis (for example, identifying a double top or head and shoulders will increase the chances of success)

About AdroFx

Established in 2018, AdroFx is known for its high technology and its ability to deliver high-quality brokerage services in more than 200 countries around the world. AdroFx makes every effort to keep its customers satisfied and to meet all the trading needs of any trader. With the five types of trading accounts, we have all it takes to fit any traders` needs and styles. The company provides access to 115+ trading instruments, including currencies, metals, stocks, and cryptocurrencies, which make it possible to make the most out of trading on the financial markets. Considering all the above, AdroFx is the perfect variant for anyone who doesn't settle for less than the best.