What Is Heikin Ashi and How to Use It in Forex Trading?

Japanese candlesticks are an extremely popular tool for technical analysis. They are very informative and provide a clear picture of the situation in the market. However, after such a long period of using candlesticks, some traders have tried to improve the already seemingly perfect tool. Hence, the Heikin Ashi candlesticks are used by some traders as an alternative to traditional candlestick analysis. Today we will learn more about this indicator, its application, and trading strategies.

What Are Heikin Ashi Candlesticks?

The Heikin Ashi indicator is present in MetaTrader 4 and other popular trading platforms as a built-in tool for market analysis. When you run the indicator, a new different candlestick chart is drawn on top of the current chart, which has some features.

Heikin Ashi in Japanese means "band in the middle", and this quite clearly reflects the basic principle of drawing the chart and the logic behind it.

The Heikin Ashi candlestick chart is a candlestick chart, which is built by averaging the open, close, max, and min price data used in the construction of Japanese candlesticks.

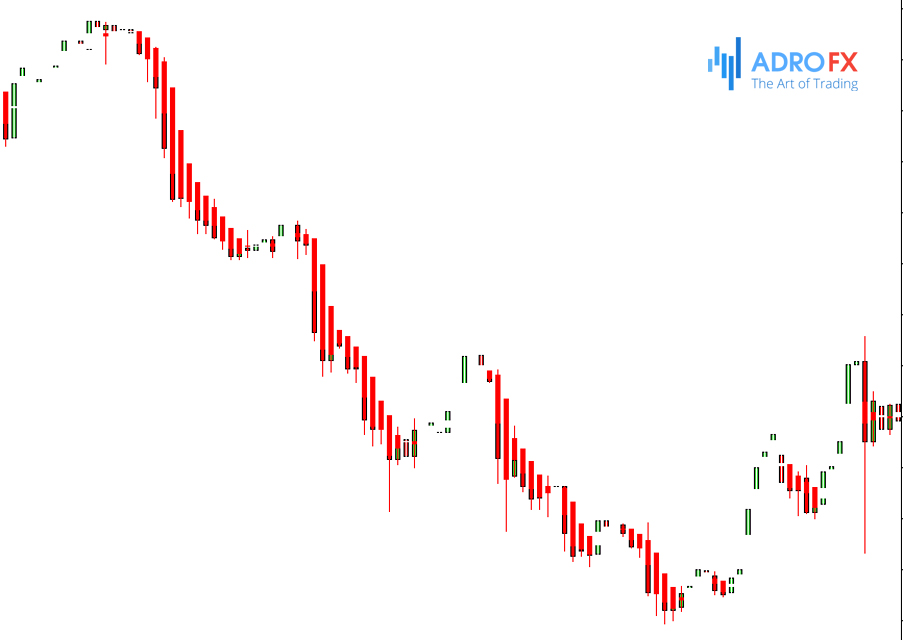

In simple terms, Heikin Ashi is a standard indicator of many popular trading platforms, which redraws the chart of Japanese candlesticks in a more averaged form, smoothing out the strong price movements and clearly indicating the direction of price movement.

Many technical analysis tools have problems filtering out market noise – minor price fluctuations. When such deviations appear on the chart, some indicators signal to the trader about the change in the trend, although in fact there is only a short-term change in the price direction. As a result, a wrong trading decision is made and the investor bears losses.

In order to clearly understand when the market is in correction and when the trend continues, the creators of Heikin Ashi have applied averaging (smoothing) to the usual candlestick chart, so it can be argued that the Heikin Ashi is a "candlestick Moving Average".

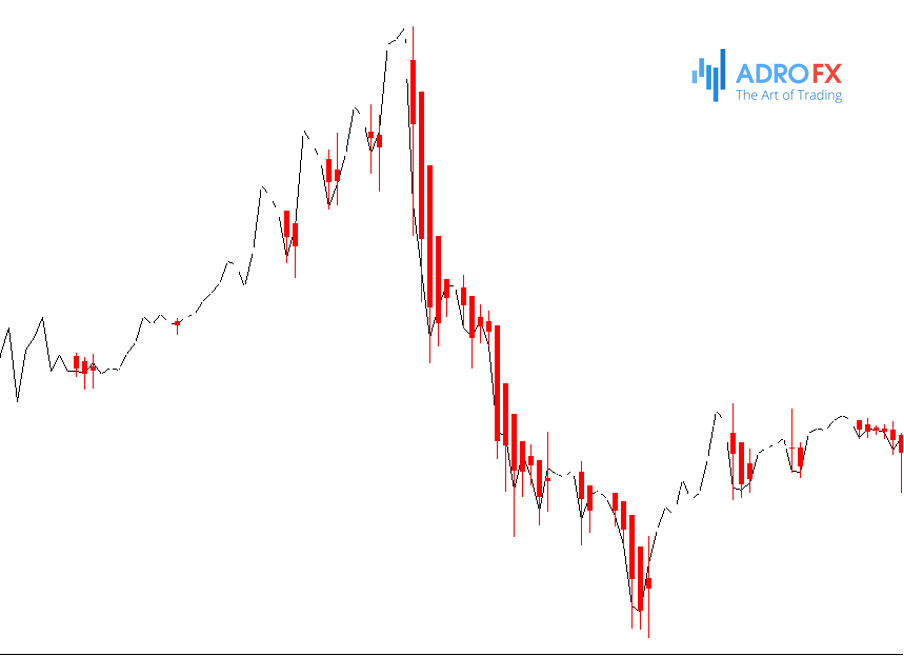

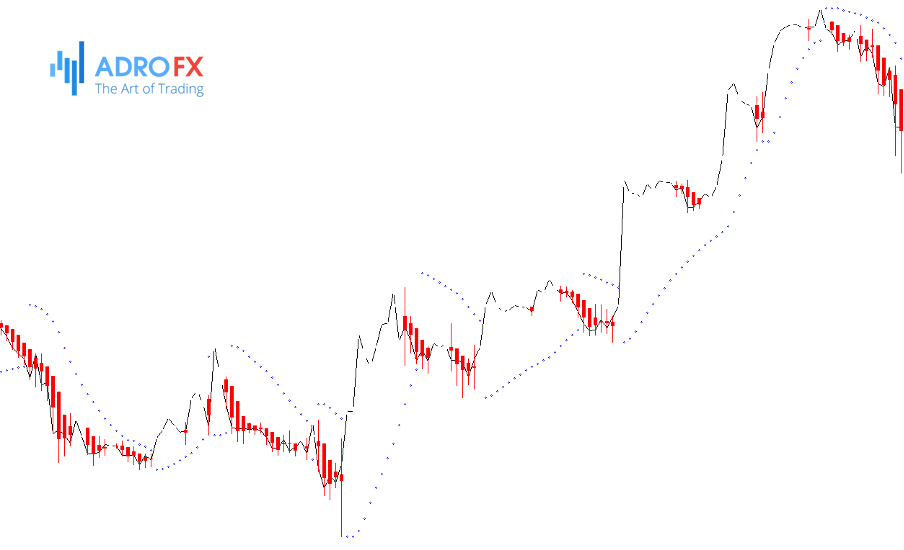

As it was mentioned above, this indicator is placed on top of the price chart, but in practice, it only complicates the work. Therefore, seasoned traders recommend removing the candlestick chart in the terminal settings or replacing it with a line, leaving only the Heikin Ashi:

As in the case of Japanese candlesticks, the indicator color scale can be adjusted.

Comparing the price levels of Japanese candlesticks with the Heikin Ashi at the same time interval, you will notice that their price range and shape are different, while the size is often the same. The reason for this discrepancy is the different methods of plotting charts.

To build the Heikin Ashi candlesticks, we use a formula where the price data are entered, while the regular candlesticks are built only by "naked" figures, without using any calculations.

The Heikin Ashi formula is based on the last closing price data. From the candle, which is not yet closed at the time of calculation, we take the data of Open, High, and Low.

The Close value, respectively, appears at closing. The prefix "ha" (Heikin Ashi) usually indicates result values, obtained after the calculations, for the construction of the indicator.

From the above formulas, it becomes clear that the current indicator's candle is calculated with a delay, so the signals sent by the "Heikin Ashi" are lagging in nature. In this case, the calculations of a new candle will be possible only after the next candle appears on the chart.

Such a lag can be both positive and negative in practice.

When trading volatile instruments, such as currency pairs GBP/JPY, EUR/JPY, and CAD/JPY in low time frames, the indicator will be able to effectively filter out the market noise, false breakouts, and entry points. At the same time, when operating in a market with low volatility, such as AUD/NZD and/or in high time frames, Heikin Ashi will very rarely give signals. At the same time, their reliability will be low due to the lag of the indicator.

The averaging and connectivity of candlesticks allow you to accurately track the trend of the price. When forming a trend line, the candlesticks on the chart have no or almost no shadows. Heikin Ashi candlesticks change color less often than Japanese candlesticks, so the trend on the Heikin Ashi is more reliable.

On the Heikin Ashi chart, before entering the market, the trend must be confirmed by at least three candles of the same color, indicating the development of the trend in one direction.

The direction of the trend is confirmed by the fact that the bodies of candlesticks are growing. If the bodies of candlesticks are shortening and the shadows are getting longer, the trend is close to completion. A candlestick with a short body and long shadows on the chart is a strong reversal signal.

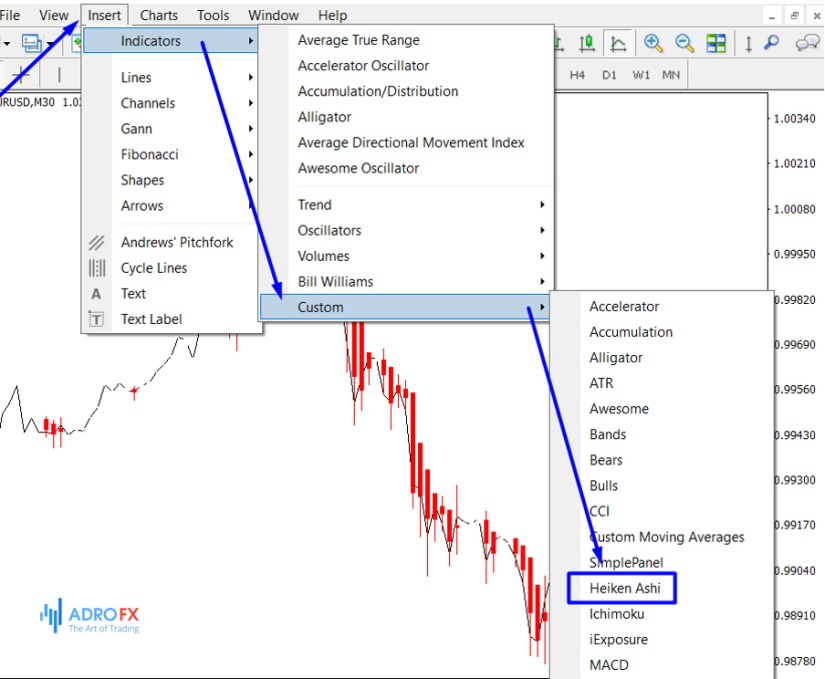

Heikin Ashi Indicator in MetaTrader 4

One way to display the Heikin Ashi chart is to use the MetaTrader 4 terminal. The MT4 platform has a built-in smoothed Heikin Ashi indicator. To use it, simply click on the Insert tab, then Indicators > Custom > Heikin Ashi. The indicator will replace your original chart:

In some cases, the default MT4 colors of HeikinAshi candles are red for bearish and white for bullish. If you use white or another very bright color for the chart background, you will not be able to see bullish candles. If this happens, simply open the Heikin Ashi settings and change the color of the bullish candles to green or whatever color you prefer to use.

How to Read the Heikin Ashi Chart

Analysis of the Heikin Ashi indicator, in general, is the same as one of the Japanese candlesticks, there are all elements - channels, trend lines, resistance/support, as well as on the chart formed typical patterns, but less frequently than on the chart of Japanese candlesticks.

Traders pay attention to the type of candlesticks on the chart: a green (often blue, black) candlestick without a shadow shows a strong uptrend; a candlestick with a short body and long shadows on both sides indicates a possible trend change; a red candlestick also shows a trend change; a red candlestick without the upper shadow shows a strong downtrend.

But single candlesticks are not enough to enter the trade, it is necessary to wait for confirmation of the expected trend - candlesticks of the same color or another.

Typical patterns on the chart include triangles, wedges, and Doji. Triangles can be symmetrical, ascending, or descending. A symmetrical triangle is formed by converging symmetrical support and resistance levels.

This pattern shows the instability of the asset's price dynamics, the trend can reverse or remain the same.

The diverging triangle is formed by symmetrical diverging lines and is also an indicator of an unstable market.

A horizontal resistance level and an ascending trend line form an ascending triangle. This pattern on the Heikin Ashi chart suggests that a breakout of the resistance line is imminent.

The descending triangle is formed by the horizontal support line and the resistance level of the downtrend. When this pattern is formed, traders are waiting for the support level to be broken out.

Wedges are formed from Heikin Ashi candlestick extrema and are bounded by unidirectional support and resistance levels. If a wedge is formed against the trend, we can most likely expect a correction. Traders are waiting for a breakout of the level in the direction of the changing trend, this may be the best time to enter the market.

Doji is a classic type of Japanese candle, which can also be found on the Heikin Ashi chart. Because the opening and closing prices are equal, the candlestick has no or almost no body but has long lower and upper shadows of about equal size. The formation of the Doji shows that the market is in unstable equilibrium and a change in the trend can be expected.

Since Heikin Ashi shows trends more clearly, the appearance of one candle opposite to the previous trend is enough to consider options for further action – but still not enough to initiate action. For more confidence in the trend, the chart should be supplemented with oscillators.

How to Trade Using HeikinAshi Candlesticks?

One of the main features of the Heikin Ashi candlesticks is a small or no shadow during the formation of a stable trend movement. The absence or reduction of the lower shadow is observed during an upward bullish movement, and, conversely, the upper shadow is observed during a downward bearish movement.

Most of the indicator candlesticks open at the level of the middle of the preceding ones, so the chart has practically no gaps. If a gap is formed, it is worth remembering that the classic trading tactics for closing the gaps will not work.

Heikin Ashi is considered a trend indicator, so it is primarily used to determine the direction of price movement.

By assessing the color of the chart and the length of candlestick shadows, we can judge the nature of the trend. Thus, with light candles and absent/small upper shadows, the price movement is bullish, with dark candles and absent/small upper shadows - bearish.

Entering the market when trading Heikin Ashi is carried out taking into account the trading strategy. When trend trading, two rules should precede the opening of a position:

- There should be three candles of the same color and direction before the intended point of entry into the position;

- It is advisable to open a position in a chart, where the body of each new candle is larger than the previous one, as the increase in the candle bodies indicates an increasing trend, and their decrease, along with an increase in the shadows, indicates a rapid change in price direction.

When conducting counter-trend trading or looking for a reversal of the price movement, one should check the presence of Price Action reversal patterns on the chart. Despite the fact that the standard use of patterns is provided for the charts of Japanese candlesticks and price bars, some of them also give strong signals on the Heikin Ashi chart.

Thus reliable reversal signal gives the appearance of the indicator chart candle with a very short or missing body and long shadows, concerning the candlestick pattern Doji. Before opening a trade upon a Doji signal, it is advisable to check its validity.

When trading in low time frames, as in the case of Heikin Ashi, the trader risks finding themselves in a speculative trap, when the fundamental background for a short period of time will move the price in the opposite direction to the trend.

Subsequently, the price returns to the trend and the trader who opened the position against the trend suffers losses. To avoid such a speculative movement, the Doji reversal signal is checked using the standard price chart, which in this case will show the movement outpacing the Heikin Ashi. If the reversal movement is confirmed, it is safe to enter the market.

Another fairly reliable signal that can be formed by the candlestick patterns of Heikin Ashi is a period of consolidation.

It shows up on the chart as several candlesticks flopping in a row with a small body. In this case, the color and length of the shadows do not matter. To confirm the movement in the channel, you can use any channel indicator on a standard price chart.

Bollinger Bands, which identify the actual nature of any price movement, are also suitable for this purpose. After such a channel movement on the Heikin Ashi, there is usually a reversal of the price movement. It is also possible to trade within the channel itself, taking into account the anticipated movement after the end of the flat.

When trading Heikin Ashi candlesticks, you should always remember that they are calculated by a formula, and, therefore, their minimums, maximums, and bodies do not reflect the real price values. The position of such a candle does not mean that the price on a regular chart has reached the same level.

Now let's look at the most popular trading strategies using the Heikin Ashi indicator.

Heikin Ashi-Based Trading Strategies

Heikin Ashi + Stochastic

There is an interesting trading system based on the combination of the Heikin Ashi and overbought/oversold areas indicator - oscillator. We will consider it on the example of a Stochastic Oscillator:

The signal for entering the trade is a change of the candle color in the simultaneous exit of the Stochastic from the extreme areas. Specifically, when the oscillator exits the oversold area, it is necessary to enter the market with a short position, but if the curve left the oversold area, then it is necessary to open a long position. The signal is considered to be strong enough. It is recommended to open an order when the next candle after the change of color appears.

The Stochastic Oscillator in this case allows us not to wait for the classic Ashi signal - the appearance of three candles of the same color.

When the oscillator curve reverses, it is recommended to exit the trade, regardless of the position performance.

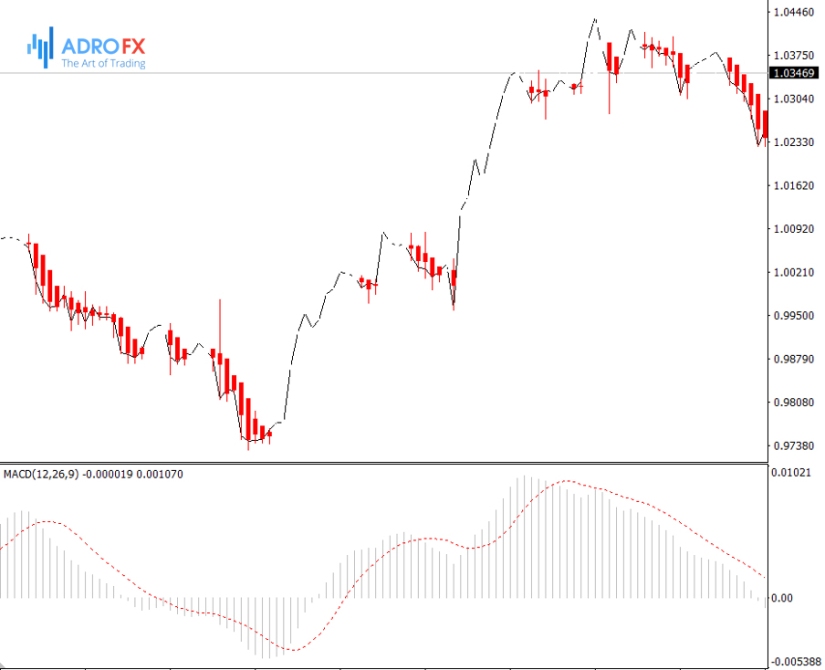

Heikin Ashi + MACD

Another strategy that gives good trading results is the combination of the Heikin Ashi and MACD. In spite of the fact that the MACD indicator is lagging like the Heikin Ashi, in the H1 time frame, the system gives very good results. Focusing on the three Heikin Ashi candles, the direction of the trend is determined.

After that, when the MACD curve crosses the zero level, the trader should open a position.

The position is closed when the specified level of profitability is achieved, or when the indicator candle color changes.

Heikin Ashi + Parabolic SAR

There is a fairly simple scalping strategy based on a combination of the Heikin Ashi and the Parabolic SAR indicators. As a rule, the combination of two tools of technical analysis of the same type does not bring effective results, but this system is an exception to the general rule.

Trading using this system goes as follows:

- The entry into the market is done according to the standard "three candles" scheme, plus Parabolic SAR, located far from the candlestick shadows of the Heikin Ashi indicator.

- After opening a position, it is necessary to constantly analyze the location of the Parabolic SAR, as long as it continues to be distant from the chart, the trader should hold a position.

- If the Parabolic SAR starts to get closer to the Heikin Ashi, or its points have moved to the other side of the candlestick indicator, the position should be closed.

Advantages and Disadvantages of the Heikin Ashi Indicator

Heikin Ashi has all the advantages of the Japanese candlesticks - they are descriptive, contain lots of information in a concentrated form, and reflect the trend better than the Japanese candlesticks because they cut off unnecessary movements (market noise).

The disadvantage of this indicator is that it takes time to form such clear information, i.e. it`s lagging.

Keep in mind that it is preferable to choose assets with high volatility for trading using this chart, because the smoothing character of the chart may lead to the fact that the trader will not notice the price fluctuations, significant for trading. For the same reason, it is advisable to use additional oscillators when trading Heikin Ashi.

Therefore, when trading the Heikin Ashi chart, it is advisable to keep the Japanese candlestick chart on, which will show the trend before it appears on the Heikin Ashi chart. This will reinforce the belief that the trend is valid and you can enter the trade. Basically, traders do not use Heikin Ashi alone in trading. The main purpose of this type of chart is to confirm the trend.

Because of its peculiarities, Heikin Ashi is not very suitable for working in time frames lower than 30 minutes, consequently, it is not suitable for scalping strategies. It is preferable to place intraday trades of a few hours' duration on the Heikin Ashi chart.

Tips For Trading Heikin Ashi Charts

Considering the specifics of the Heikin Ashi indicator, it is possible to identify a number of recommendations to eliminate unreliable signals and increase the profitability of trading.

Among the most common we can name the next ones:

- The Heikin Ashi candlesticks rarely give profitable results in scalping trading.

- The indicator can be used for trading any currency pairs and stocks, but the best result is achieved by trading in volatile instruments with large volumes (currency pairs containing dollar, euro, yen, blue chip stocks, and futures);

- Some traders would like to use the whole set of Price Action patterns to work with the indicator. In this case, they have a natural question: "How to enter the market - at the next candle after the pattern, or after three candles of the same color? In this case, the best solution will be to act according to the rules of the candlestick patterns application - to open a position on the next candle after the pattern;

- When Heikin Ashi candlesticks change color, it is recommended to close the position, even though the size of the candlestick body and shadows may remain unchanged;

- It is recommended to use the Heikin Ashi indicator for volatile assets. The same recommendation can be given for the trading sessions - during the European trading session, the Heikin Ashi signals will be more informative than during the Asian session, where many trading systems do not show the proper results.

Conclusion

Even though Heikin Ashi is a trend indicator, it differs from most analogs with its unique interface, which allows trading using only the tool itself, bypassing the price chart, without which using other tools would be impossible.

An interesting point is the combined use of the indicator with candlestick and Price Action patterns. It is difficult to say whether there is another indicator of that nature, which allows the direct overlaying of candlestick patterns, bypassing the price curve.

However, the signal lag effect is inherent in any trend-following technical analysis tool. The lag can have both negative and positive aspects. In the latter case, it is the delayed signal that allows filtering out the market noise - a false short-term change in the price movement, which results in making unprofitable trading decisions.

About AdroFx

Established in 2018, AdroFx is known for its high technology and its ability to deliver high-quality brokerage services in more than 200 countries around the world. AdroFx makes every effort to keep its customers satisfied and to meet all the trading needs of any trader. With the five types of trading accounts, we have all it takes to fit any traders` needs and styles. The company provides access to 115+ trading instruments, including currencies, metals, stocks, and cryptocurrencies, which make it possible to make the most out of trading on the financial markets. Considering all the above, AdroFx is the perfect variant for anyone who doesn't settle for less than the best.