What are Trading Signals and How Do They Work?

Trading on the forex market is a very advantageous niche, bringing a solid income. However, beginning traders do not always have all the necessary skills to start earning on the exchanges at the start. Therefore, some tools facilitating or automating the work were developed for beginners. In this article, we will tell you what forex daily signals are, what kinds they are and how they can be used to generate substantial income on a regular basis.

What Are Forex Trading Signals?

Forex trading signals – some trading tools, working in the mode, determining the possible periods of successful orders, and giving information on the possible return. Daily trading signals services are divided into software and manual. The first – is based on technical analysis, embedded in the properties of the algorithm, they conduct market analysis, find various patterns, and inform the player on the need to open a position. The latter is conducted by professional traders, in specialized companies, and is issued via messengers, e-mail, SMS, or other means of communication.

What Are Trading Signals Based On?

Forex signals are formed based on fundamental and technical analysis. At the time of news release, increased volatility is formed in the market, which is taken into account when setting stops and determining earnings targets. Technical analysis is conducted with the help of indicators and patterns.

The best technical analysis indicators for forming signals:

Moving Averages (MA). One of the most common indicators is a method of averaging the price over a period specified in the settings. Simple MA is an arithmetic average of prices for a period. Other variants of Moving averages differ in the approach to the weight distribution of earlier and later prices of a period.

Oscillators (RSI, MACD, CCI, Stochastic). Confirming the signal of trend indicators tools. They show overbought and oversold areas and help predict the moment of a trend reversal.

Channel indicators (Bollinger Bands, Keltner Channel, Donchian Channel). They build a channel in which the price is most of the time, returning to its average value - the center of the channel.

Patterns, Level Indicators. Patterns are candlestick patterns that allow predicting the trend direction or reversal moments.

How to Choose Daily Forex Signals?

Working on forex, relying only on your forces, guided only by your signals, implies a good knowledge of the market, and the ability to determine the exact signal and filter out false ones. Ultimately, the signals allow traders to secure some gains or get out of potentially losing trades in time.

Before you start using recommendations from providers, you need to choose signals wisely.

You need to be cautious about the signals offered by forex brokers, even if they offer compensation for an incorrect signal. Non-regulated brokers benefit from unsuccessful trades for traders, so they have little interest in supplying traders with useful signals. Any signals offered by brokers must be tested on a demo account. It is even more true when a broker offers to open an account using a referral link with a condition of signal delivery.

A company, providing signals, should be questioned if it has recently entered the market, there are no independent statistics on the signals, it has a lot of rave reviews, while there are no negative ones, the paid signals are too cheap, the support is poorly responded or does not respond at all, etc.

Signals that are offered on social networks and forums are rarely effective. It is extremely unlikely that a trader who developed or received a signal that works well will share it with other traders. At the very least, such a signal must be paid for. In any case, if buying a signal seems like a potentially good investment, you should check the reviews about the seller and the effectiveness of their signals.

In the end, after searching for a reliable signal provider, most traders stop at the well-proven resources that are not so numerous in the world. But even if a signal provider is reliable, the final decision regarding the use of signals is up to the trader. Trading signals cannot be completely trusted. One should compare them with each other and take into account many related circumstances - the influence of macroeconomic factors, unexpected news, non-market factors, and so on.

Pros and Cons of Using Signals in Trading

The advantages of using daily forex signals in trading:

Saving time. It is not always possible to follow all the charts at the same time. You don't always have enough knowledge to make the right decision. You don't always have time to analyze dozens of information sources to find signals.

Training. Using the signals of a provider, a trader can analyze them. Signals are an opportunity to learn from the experience of others.

Psychological effect. By relying on the ready-to-use signals, the trader, to some extent, removes the responsibility for their decisions. After all, from a psychological point of view, in the case of failure, it is always easier to blame someone else instead of yourself. The psychological burden is reduced.

A trader can always become a signal provider himself, thus receiving additional income. Some brokers have multi-level social trading. A trader copies trades of one or several traders to the account. And it allows other traders to copy their accounts.

Disadvantages of using signals in trading:

The risk of an unscrupulous signal provider. The signals provider is 100% interested in the efficiency of his signals in only one case - if he also opens trades on them. Most of the independent platform "providers" are not engaged in trading or cannot provide evidence of real open trades. The situation is similar to social trading - a provider's account can turn out to be a fake one created by a broker.

Lack of guarantees. No one can guarantee 100% effectiveness of signals. And if a trader follows the recommendations, they are responsible for it as well.

Additional expenses. Signals provider's commission, fees to the service for accessing the signals channel, and a fixed fee to the trader.

The efficiency of free signals can be easily checked on a demo account. If the signals are paid, it makes sense to consider what is more beneficial: a low-priced subscription for several days and testing the signals on a demo account. Or, replenish the deposit and risk a real amount at once.

It is more complicated with social trading – the demo account is rarely available for signal providers. That is why the cent account can be an alternative way to minimize risks: you can evaluate the effectiveness of real trading with minimal losses.

What Signals You Shouldn't Use

Given the vast choice of signals offered online, it is easy to fall for some unreliable signal providers. That is why it is so important to choose carefully and know which daily forex signals you should stay away from.

Signals for which the provider promises 80-90% results. In forex trading, no one can guarantee a result. And if the provider says that 80% of signals are guaranteed to work, they are either deceiving or relying on statistics. But statistics do not guarantee that the same performance will remain in the future.

Free signals. A broker can share signals as part of a loyalty program, but the company may be not interested in your successful trading if it belongs to the category of scammers.

Tip 1. Be skeptical of daily forex signals that require a subscription fee. In most cases, the provider is not interested in their reliability. Instead of generating accurate signals, it is more return-wise beneficial for the provider to attract new clients through an aggressive marketing campaign.

Tip 2. Double-check the signals, if possible. Therefore, work with time frames from H1 and higher. In this time frame, one candle corresponds to an hour - this is enough time to assess the fundamental factors and read the analytics.

How to Use Forex Signals in Trading?

The first step to the use of signals is to have an open account with any broker and an installed terminal (for example, MetaTrader 4). If you use the simplest signals for manual trading, then you only need to wait for the right moment to enter and open a position (or set a pending order on the specified parameters).

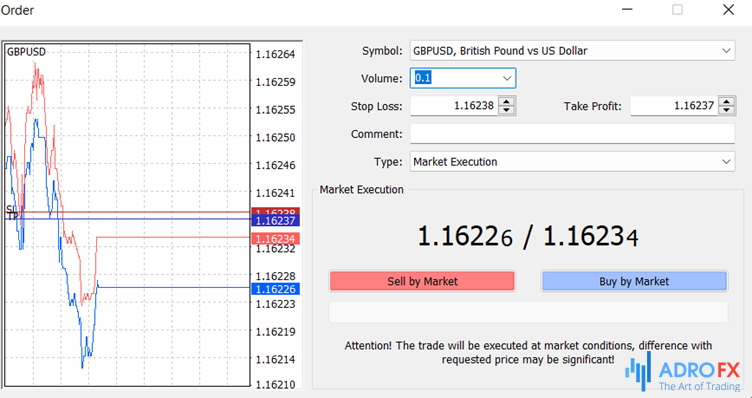

When opening an order through the trading terminal you need to specify: lot volume, Stop Loss, and Take Profit. If this is pending execution, then specify the moment of opening (the value of the asset at the moment of opening) and the expiry time (after what period the conditions will cease to be active).

It is also possible to close orders using the pending method, without waiting for the price to reach Take Profit or Stop Loss levels. The closing price may not be specified in the signal, so a trader will have to orient oneself according to the market situation and close at the moment of gain.

If you use automatic signals, then take care of constant access to the Internet. The signals provider will provide you with instructions on how to configure them.

How to Filter out False Forex Signals?

Given the dynamics of the forex market, filtering false signals is of particular importance. There is a temporal way to filter signals, which is that after the formation of a certain signal, you just need to wait for some time for the signal to be confirmed or rejected. But while this is the easiest way, it is also the most inefficient, because it is difficult to determine when a reasonable expectation will lead to a missed benefit.

There are graphical ways of filtering. For example, in the case of candlestick or bar trading, a trader can open trade only after a candlestick has closed 100% above (or below) a certain level.

The trader can also enter a trade only after two consecutive bars or candlesticks close in the desired direction. A trader may wait for a bar or candle to be less than or greater than a certain point.

There are also technical methods that help in filtering signals - oscillators and indicators. In particular, the Williams Fractals indicator can be used, which can be used to confirm or refute a signal to open a trade that is given by another trader's instrument. Graphical and technical methods are problematic because it takes time to confirm the signal. So, ultimately, the best way to identify and cut off a false signal is through trader experience.

Should You Use Forex Trading Signals?

The question of which signals to trust more - your signals or those from providers - is a question of how well the trader can trade independently. If a trader feels confident in their skills and has an effective trading strategy, then they do not need third-party signals, they can successfully trade by their signals, indicators, the news, etc. independently of others' opinions.

But on the other hand, an experienced trader needs additional information. It is not necessarily a signal from another trader to buy or sell, but, for example, a rumor, information on social networks, the opinion of reputable traders - all this affects the market, i.e. all these signals and therefore require attention and should be considered in trading.

Summary

Forex signals are growing in popularity, because they provide an opportunity to earn a virtually passive income, without having to analyze the market yourself. It can take months to develop the ability to competently analyze the charts, and signals can start generating income the very next day: the forex daily signals give you all the information you need, and you will only have to open a trade and it will close automatically - at Stop Loss or Take Profit.

If you want to start working with daily forex signals as soon as possible, we recommend you have a closer look at AdroFx: we provide our clients with trading recommendations on a daily basis given in a form of easy-to-follow instructions.