Donchian Channel Indicator: The Complete a Trader's Guide

Channel forex trading strategies are very popular among traders. This fact is because the channel within which the quotes move is regularly formed on any instrument, any time frame, and can be used in a variety of ways (breakout strategy, rebound strategy, etc.) as a ready-made trading tactic.

There are Linear Progression Channels, Bollinger Bands, Fibonacci Channels, Envelopes, Ichimoku Channels, and Donchian Channel, which is created based on the Donchian Channel Indicator. It will become the main character of our today`s article. Let us consider in more detail the principle of its use and the rules for placing orders.

The Donchian Channel Indicator: Description and Main Signals

Richard Donchian is one of the legendary traders of the last century. He was the originator of the Turtles trading system. As it often happens, the peak of his popularity and success came to him late, at a respectable age. Donchian was a true workaholic, giving much energy to trading and creating effective trading theories. His works were used by a lot of traders, some of which were included in the top ten of the best market professionals, for example, Linda Raschke.

Initially, the Donchian Channel was developed for trading by breakout strategies when the price goes out of the channel and crosses one of its borders. As a rule, a new powerful trend starts at such moments.

What Does the Donchian Price Channel Look Like?

The algorithm looks like two curves, one of which corresponds to the upper limit of the corridor and the other - to the lower one. The upper curve shows the price maximums for the selected time period. The lower boundary shows the levels of price lows, also for a certain period of time. When price minimums/maximums are updated, the lines are rearranged and the channel width decreases or increases depending on the market situation. Another broken dotted line runs in the center of the channel.

The price position relative to this line shows the market trend:

- When the price breaks out of the middle line of the channel from the bottom up and rises higher, it indicates the bulls' advantage in the market. Price is trending upwards.

- When the price crosses the middle line of the channel from top to bottom and goes lower, it indicates a bearish advantage in the market. The price goes downward.

The Donchian Channel is also called a volatility indicator because it uses chart extrema in its calculations. The tool looks a bit like Bollinger Waves, but its lines are smoother and do not react as strongly to price changes as Bollinger Bands lines.

Channel Boundaries Signals

According to the indicator, trades can be opened at the moments of a breakout as well as a rebound from the channel borders.

Signals arising when price breaks out a channel edge are called trend signals:

- If the price breaks out the upper level of the Donchian Channel from the bottom up and the breakout candle closes above it, this is a buy signal. An uptrend begins;

- If the price crosses the lower level of the Donchian Channel from above downwards and the breakout candlestick is closed under it, this is a sell signal. The downtrend begins.

The breakout can be not only a true breakout when the boundary is crossed by the candle's body and the candle closes outside the range but also a shadow one.

It can be called a shadow breakout, which was made by the candlestick's shadow, but the candlestick itself closed inside the Donchian Channel.

The shadow breakout occurs before the price reverses after the rebound from the channel's boundary:

- If the shadow of the candlestick breaks out the lower boundary, and then the price returns to the channel and closes inside it, this is a signal of an upward reversal. You can place a buy order;

- If the shadow of the candlestick crosses the upper boundary, and then the price goes back inside the channel and closes there, this is a signal of a downward reversal. You may enter into a sell trade.

A shadow breakout usually indicates a price reversal from the broken-out boundary.

Price may not only break out the channel boundary but also rebound from it. In this case, the price moves inside the channel, and then, having touched one of its boundaries reverses in the other direction.

Signals when the price rebounds from the Donchian Channel boundaries:

- If the price rebounds from the upper boundary of the channel, this is a sell signal;

- If the price rebounds from the lower boundary of the channel, this is a signal to buy.

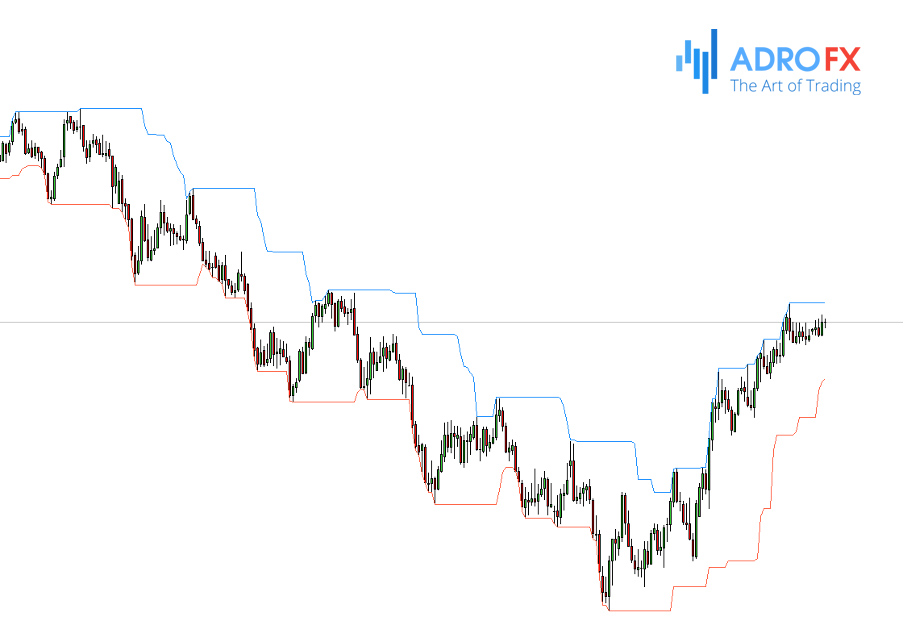

Changing the channel width also indicates a change in the market situation. For example, if the Donchian Channel becomes narrow, it indicates a flat. The market is calm at the moment, the volatility is low. When the price extremums are updated, the channel starts expanding, indicating the increase in market volatility:

- If the channel expands as a result of updating price lows, you can open a sell trade;

- If the channel expands as a result of updating price highs, you can open a buy trade.

Even though the Donchian Channel is quite an effective tool, it is not recommended to open positions only by its signals. It is necessary to use additional tools for signal confirmation.

Pay attention to the figure below. You can see on the chart how the price maximums began to gradually increase, which led to an increase in the channel width. These are clear buy signals as an uptrend is developing. It would be possible to enter the market with several orders, or gradually increase the already open position.

Calculation of the Donchian Channel Indicator

To plot the Donchian Channel, we should use the absolute minimum and maximum of the quote for the definite period. The upper boundary of the channel is drawn through the specified maximum, and the lower – through the minimum for the same period.

In the time period, only the number of candlesticks is always considered. For example, period 10 for the D1 chart is equal to 10 days, for the H1 chart – to 10 hours, and for the M5 – to 50 minutes.

In other words, a breakout of a 10-day channel on the D1 chart means that the 10-day maximum is broken out when the upper boundary of the channel is broken out, or the 10-day minimum when the lower boundary of the channel is broken out. In other words, the upper boundary is equal to the maximum value of the quote for the selected period, the lower boundary – to the minimum value, and the average boundary is equal to the sum of the upper and lower bounds divided by 2.

Donchian himself used the value of the channel period 20 for daily charts because it equals the average number of working days in a month. But we can experiment with the period value, considering that we can trade in any time frame. The most popular and well-proven variants are 18, 24, and 55.

The Donchian Channel Indicator in MetaTrader 4

Let's plot the Donhian channel indicator in MT4. First of all, download the indicator. Then move the archive file to the MQL4/Indicators folder (File menu -> Open Data Folder). Restart the terminal. Now go to the menu "Insert", then "Indicators", select "Custom" and then "donchian-channel".

From the settings, we have Periods, equal to 20 by default.

Shift is responsible for shifting the channel to the right side relative to the quotes chart, so the signal will be less delayed. The default value is 2, i.e. the shift of two candles to the right.

Mode sets the type of quote, based on which the Dominican channel will be built. If it is equal to 1, the price minimum and maximum are used, if it is 2 – Close prices.

Donchian Channel + RSI Trading Strategy

Let's consider an example of a simple trading strategy based on the Donchian Channel and RSI oscillator signals.

Chart time frame – H1. Currency pair – any currency pair with average or high volatility.

Positions may be opened on the rebound of the price from the boundaries of the Donchian Channel. The RSI indicator will confirm the rebound signal, coming out of the oversold or overbought area.

A long position may be entered under the following conditions:

The price reaches the lower boundary of the Donchian Channel, fails to break it out, and turns in the opposite direction. Either there was a shadow breakout and the price returned to the channel limits.

RSI exits the oversold area, breaking out the 30 level from the bottom to the top.

Take Profit should be set on the upper curve of the Donchian range. Stop Loss can be placed outside the lower boundary of the Donchian Channel.

A sell order may be made under opposite conditions:

The price reached the upper boundary of the Donchian Channel. It fails to cross the upper boundary of the Donchian Channel, it rebounds and turns in the opposite direction. The second option - a shadow breakout occurs and the chart returns to the channel.

The oscillator has left the overbought area, breaking out the line of 70 downwards.

Fixing Take Profit should be set at the lower border of the Donchian Channel. A protective Stop-Loss can be placed outside the upper boundary of the Donchian Channel.

Donchian Channel + MACD Trading Strategy

This strategy involves opening a trade at the Donchian Channel boundaries breakout moments. Trading will be done based on the trend. To confirm the signals of border breakout a trend oscillator MACD is used.

The time frame of the chart is M15. The asset to be traded should have medium or high volatility.

It is possible to open a long position, provided that:

- The Donchian Channel begins to widen in the direction of the uptrend. The maximums of the chart begin to increase sequentially;

- The candlestick breaks out the upper boundary of the Donchian Channel and closed above it;

- The MACD indicator is above zero, and the histogram is increasing.

If all three conditions coincide, it is possible to open a buy order. Stop Loss is placed behind the local minimum. Profit can be fixed by Take Profit, calculated using the formula SL*2, or manually when the opposite signal is received.

You may enter a short position when receiving the following signals:

Donchian Channel corridor begins to expand in the direction of the downtrend; The price minimums start to decrease consistently;

- The candlestick crosses the lower level of the channel and closes under it.

- The MACD indicator is below zero, the histogram is decreasing.

If all three signals coincide, one can open a short position right away. Stop Loss is placed behind the local maximum. The profit can be fixed by Take-Profit, equal to at least two Stop Losses. You can also fix the profit manually by closing the order when the signal to the contrary appears.

Advantages and Disadvantages of the Donchian Channel Indicator

The Donchian Channel has its own characteristics. Among the advantages, we can note its simplicity and efficiency. The indicator consists of only three lines, which are superimposed over the chart of price movements.

The Donchian Channel gives sufficiently high-quality signals. However, it may sometimes be wrong in low time frames, as there is market noise on such charts. Therefore, it is recommended to combine it with other indicators.

Donchian Channel perfectly combines with oscillators, such as RSI, Stochastic Oscillator, MACD, etc. While trading price breakouts, the Donchian Channel is combined with trend indicators - Parabolic SAR, Power Fuse, MACD, Moving Average, etc.

Conclusion

Although the Donchian Channel signals look simple, they have already proven to be effective. Understanding the basis of channel formation, you can make your own "add-ons" to the strategy, such as using the MA as an additional indicator, etc. To better filter, the signals, try combining them on the chart with other indicators and oscillators.

About AdroFx

Established in 2018, AdroFx is known for its high technology and its ability to deliver high-quality brokerage services in more than 200 countries around the world. AdroFx makes every effort to keep its customers satisfied and to meet all the trading needs of any trader. With the five types of trading accounts, we have all it takes to fit any traders` needs and styles. The company provides access to 115+ trading instruments, including currencies, metals, stocks, and cryptocurrencies, which make it possible to make the most out of trading on the financial markets. Considering all the above, AdroFx is the perfect variant for anyone who doesn't settle for less than the best.