The Week Ahead: Central Banks Are in the Spotlight | Daily Market Analysis

Key events:

- Australia – Retail Sales (MoM) (Dec)

- Canada – GDP (MoM) (Nov)

- USA – CB Consumer Confidence (Jan)

- New Zealand – Employment Change (QoQ) (Q4)

Central banks will be in focus this week with meetings of the U.S. Federal Reserve (Fed), European Central Bank (ECB), and Bank of England (BoE), each expected to keep raising rates.

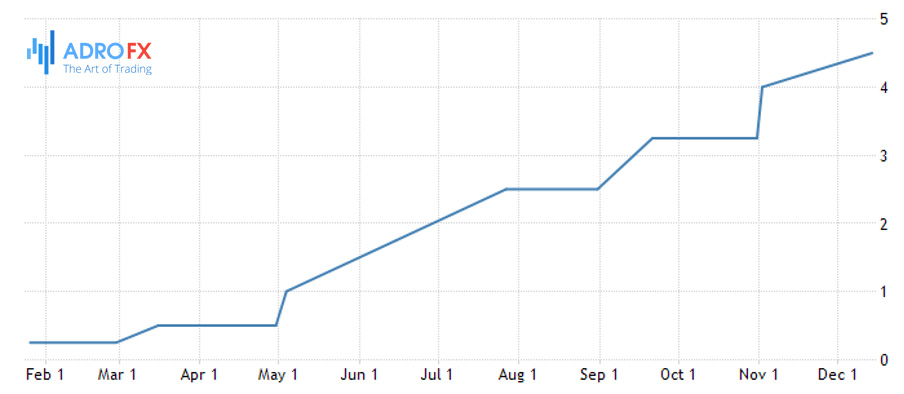

The Fed will be at the forefront on Wednesday, with markets more or less pricing in a 25 basis point rate hike that would increase the target range for the federal funds rate to 4.50%-4.75%. In 2022, the Fed conducted a massive policy tightening, raising the rate by 425 basis points from 0.25% to 4.50%. In fact, it was the most significant policy tightening in 40 years, consisting of four steep rate hikes of 75 basis points in the third and fourth quarters.

The central bank slowed the pace of rate hikes to 50 basis points at its December meeting, and another slowdown to 25 basis points is expected at this week's meeting.

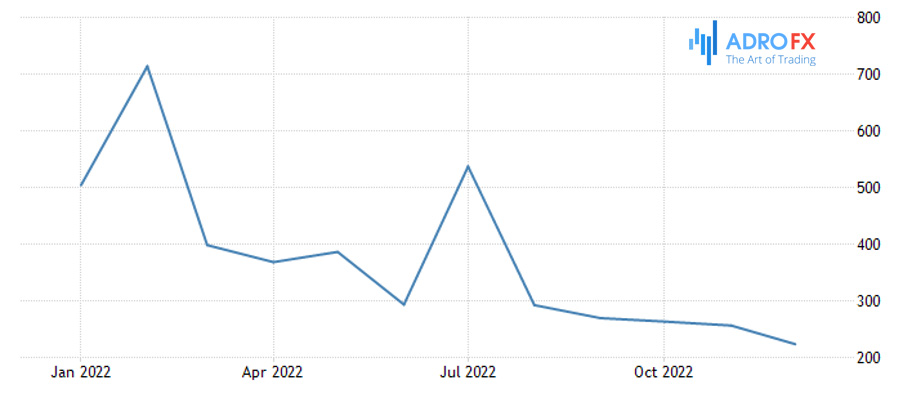

U.S. Non-Farm Payrolls

The slowdown in policy tightening is seen as justified given the disinflationary phase that the U.S. economy is in - consumer prices are rising but at a slower pace. Annual inflation peaked last June at 9.1%, and thanks to the latest data from the Bureau of Labor Statistics (BLS), we saw inflation slow to 6.5% for the sixth straight month through December. Nevertheless, the inflation rate remains three times the Fed's target, so the Fed is unlikely to talk much about cutting rates, as there is still work to be done. The latest FOMC meeting minutes (released in early January) also showed that further rate hikes are around the corner, and a rate cut in 2023 is questionable.

On Tuesday, the January U.S. consumer confidence index will be released, which is expected to rise to 109 after December's increase to 108.3, up sharply from 101.4 in November. However, U.S. manufacturing activity has recently moved into contractionary territory, with the latest December ISM index reading of 48.4, the second consecutive decline below 50.0. The latest ISM data will be released Wednesday and is expected to fall back to 48.0, although the forecast range is set between 49.5 and 47.5. The other main event this week in the U.S., of course, is Friday's jobs report. The consensus forecast for nonfarm payrolls for January suggests a drop to 168,000, but the projected range is between 260,000 and 130,000.

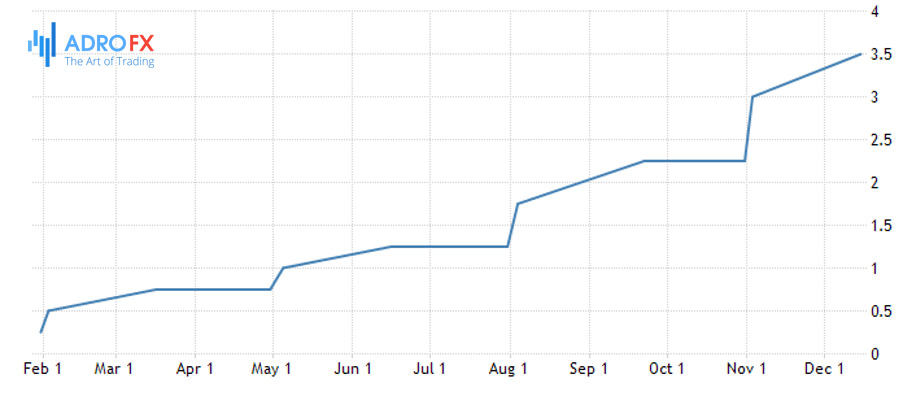

Thursday is a big day for the Bank of England and the ECB. At noon GMT, the focus will be on the Bank of England, which is expected to raise the bank rate by 50 basis points, bringing the rate to 4.00%. Annual inflation in the U.K. remains in double digits. According to the Office for National Statistics (ONS), consumer prices rose 10.5% in the 12 months through December, down from a November reading of 10.7% and an October peak of 11.1%.

UK interest rate

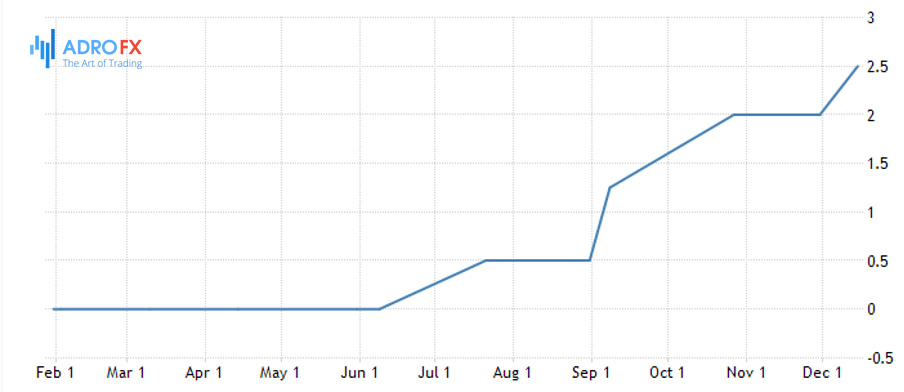

Among other things, the ECB is expected to follow suit shortly after the Bank of England meeting at 13:15 GMT and raise its main refinancing rate by 50 basis points. Eurozone inflation rose 9.2 percent in the 12 months through December, down from November's 10.1 percent and October's peak of 10.6 percent. Like the Fed and the Bank of England, inflation is well outside the ECB's 2% target, so the probability of a 50 basis point rate hike is now 86%.

Euro Area interest rate