US Stocks Struggle Amid Mixed Signals; Focus Shifts to Inflation and Employment Data | Daily Market Analysis

Key events:

- UK - Bank Holiday

- Australia - Retail Sales (MoM) (Jul)

The US stock benchmarks have been grappling with a lack of decisive direction, alternating between substantial gains one day and notable losses the next. As the week concluded, the S&P 500 managed a modest uptick of 0.8%, signaling its first positive movement in the past four weeks. In contrast, the Dow experienced a decline of 0.4%. Conversely, the Nasdaq displayed resilience, soaring by 2.3%. Despite these impressive gains, the Nasdaq, which has a strong focus on technology stocks, found it challenging to sustain momentum, even following Nvidia's impressive financial results.

The highlight of the week revolved around Federal Reserve Chair Powell's speech at the Jackson Hole summit. While Powell didn't introduce fresh insights, he reaffirmed the central bank's commitment to achieving the 2% inflation target and maintained a cautious stance. He welcomed the deceleration in price increases amid tighter financial conditions and gradually easing supply constraints.

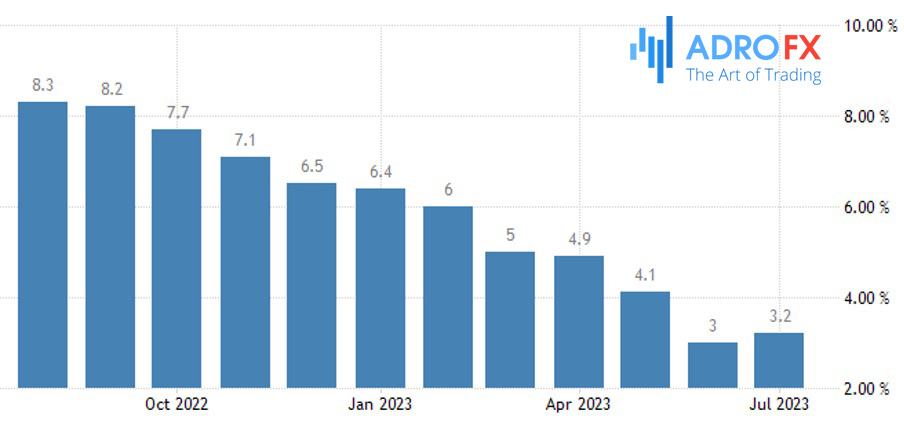

Consumer price inflation has indeed significantly receded from its peak of 9.1% last year to just above 3%. Yet, Powell cautioned that attaining the 2% objective "still has a long way to go, even with the more favorable recent readings."

Hence, the Federal Reserve intends to tread carefully regarding future interest rate adjustments as it navigates the final and intricate phase of combating inflation. Simultaneously, Powell hinted that the Fed might opt to maintain stability during the September 19-20 meeting, considering that the full consequences of previous rate hikes have yet to fully materialize. On the whole, Powell's speech brought few, if any, surprises.

While the policy discourse has shifted somewhat from a laser focus on inflation, the overall sentiment aligns with the current projection of no rate hike in September and a likely consensus that more stringent monetary measures are currently unwarranted. However, with the attention to economic expansion, any unexpected positive outcomes in upcoming key data releases such as the Non-Farm Payrolls report, JOLTS, and ISM manufacturing indices could elevate expectations of a September rate hike.

Anticipating an era of prolonged higher interest rates, Treasury yields saw a notable surge. The 2-year Treasury yield temporarily ascended, reaching levels near the cycle peak of 5.12%.

As a result of these climbing Treasury yields, the technology sector briefly encountered pressure. This is because sectors like technology, characterized by elevated valuations, become relatively less appealing in the face of rising yields. This phenomenon contributed to both Alphabet (NASDAQ: GOOGL) and Meta (NASDAQ: META) experiencing temporary losses.

Gold prices experienced a slight decline on Friday, driven by a general preference for the dollar in anticipation of further insights into US monetary policy at the Jackson Hole Symposium. However, despite these losses, indicators of diminishing economic growth helped gold maintain its position above crucial thresholds.

This week signaled a positive turn for gold, marking its first week of gains in five, as it rebounded from the five-month lows it had touched earlier in August. Despite the dip on Friday, spot prices managed to hold steady around the significant $1,900 per ounce mark.

Nonetheless, the future trajectory of the precious metal remained uncertain due to the looming possibility of elevated US interest rates. The dollar continued to strengthen, reaching its highest point in over two months on Friday, while Treasury yields advanced, edging closer to levels not seen in several decades.

In Europe, the stock market saw modest advances in anticipation of ECB President Lagarde's speech at the Jackson Hole symposium on Friday. This marked her inaugural participation in the event since taking on the role of ECB chief in 2019. During her speech, Lagarde reiterated the Bank's commitment to maintaining interest rates at appropriately restrictive levels for as long as necessary to ensure a prompt return of inflation to the targeted 2% threshold. She also emphasized that the Bank's future choices will be guided by three key criteria: the inflation outlook, underlying inflation dynamics, and the efficacy of monetary policy transmission. The upcoming monetary policy meeting on September 14 suggests that the ECB is inclined towards a more cautious approach, although this decision is likely to be closely debated.

Consequently, the forthcoming inflation report for the Euro area holds significant significance.