US Stocks Rise, Pound Sterling Recession, and Bitcoin Options Bullish Trend | Daily Market Analysis

Key events:

- UK - Retail Sales (YoY) (Jan)

- USA - Michigan Consumer Sentiment

- USA - PPI (MoM) (Jan)

- USA - FOMC Member Daly Speaks

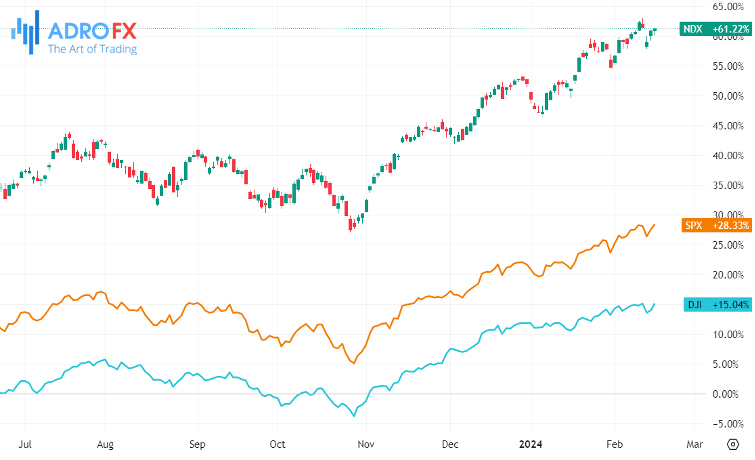

On Thursday, US stocks experienced an upward surge, supported by a notable rise in energy stocks, counterbalancing a decline in the technology sector led by Apple, and economic indicators pointing to potential weaknesses in consumer activity. The Dow Jones Industrial Average climbed by 252.97 points, or 0.66%, reaching 38,677.24. The S&P 500 registered a gain of 22.65 points, or 0.46%, closing at 5,023.27, while the Nasdaq Composite increased by 29.71 points, or 0.19%, to reach 15,888.85.

The Commerce Department's report on Wednesday revealed a 0.8% drop in retail sales last month, surpassing economists' expectations for a 0.2% decline. The decrease was primarily attributed to reduced receipts at auto dealerships and gas stations.

Morgan Stanley, in a note on Wednesday, interpreted the retail sales report as indicative of a robust but decelerating economy, predicting a potential rate cut in June.

Despite economic concerns, the labor market exhibited resilience, with initial jobless claims decreasing by 8,000 to 212,000 in the week ended Feb 10, surpassing the forecast for a 1,000 decline and signaling continued strength.

Treasury yields retreated from their daily highs, and the 2-year US Treasury yield, sensitive to interest rate changes, traded at 4.576%.

Following the data release, Goldman Sachs revised its outlook for US Q1 economic growth downward to 2.5%, down from a previous estimate of 2.9%.

The Pound Sterling rebounded from its daily low following disappointing United States Retail Sales data for January, which improved market sentiment.

During the European session, the Pound Sterling faced pressure as the United Kingdom Office for National Statistics (ONS) revealed that the economy entered a technical recession in the second half of 2023. The preliminary Q4 Gross Domestic Product data contracted by 0.3%, following a 0.1% decline in the July-September quarter. This marked the second consecutive quarter of contraction, meeting the definition of a technical recession. The data raises expectations of early rate cuts by the Bank of England as it may seek to implement growth-stimulating policies.

The overall outlook for the Pound Sterling remains subdued, with economic indicators signaling potential aggressive rate cuts by the BoE to prevent further contraction. Foreign outflows are likely for the Pound Sterling as expectations of a dovish BoE increase.

Despite steady consumer price inflation in January, the expectation for an acceleration was not met. BoE Governor Andrew Bailey anticipates price pressures to ease to the required target by Spring.

Bitcoin is exhibiting a bullish bias, sustaining the intermediate trend since the approval of spot BTC ETFs in January. Recent developments indicate accumulating bullish factors for the leading cryptocurrency.

Derivative exchanges have reported a surge in call options for buying Bitcoin within the $60,000 to $80,000 price range, their strike price. According to QCP Capital's Options Vol-cast report released on Thursday, BTC call option buying has significantly increased, with nearly $10 million spent on premiums for $60K and $80K strikes this week alone, expiring from April to December.

Traders typically purchase a call option when they anticipate the asset's price to surpass a predetermined set price before the expiry date. If Bitcoin's price exceeds the strike prices in the $60K to $80K range, traders can execute their contracts and realize profits. However, if Bitcoin fails to reach the specified strike prices, the options expire worthless, with traders only losing the premium paid to enter the trade.

The Australian Dollar is striving to halt its recent gains against the US Dollar, with the latter gaining momentum due to improved Treasury yields. Despite this, the AUD/USD pair received upward support following mixed economic data from the United States. The S&P/ASX 200 index also saw improvement after a surge in Wall Street overnight. Investor optimism prevails as they look ahead to key data releases, including the US Producer Price Index (PPI) and Michigan Consumer Sentiment Index scheduled for Friday.

The Australian economy has experienced modest growth, influenced by ongoing challenges in the labor market and subdued inflationary pressures. Recent employment data suggests that the Reserve Bank of Australia is unlikely to raise interest rates further in the March meeting. Market expectations now indicate that the RBA will maintain its current rates until August, with a projected 25 basis points (bps) rate cut in September, compared to previous projections for November.

The Japanese Yen is on a slight decline against the US Dollar during the Asian session on Friday, retracing part of its recovery gains from the year-to-date low earlier in the week. Uncertainty surrounding the Bank of Japan's exit from the negative interest rates policy, coupled with the overnight rally in US equity markets, are key factors undermining the safe-haven status of the JPY. Consequently, the USD/JPY pair is moving back above the psychological mark of 150.00. However, potential verbal intervention by Japanese authorities is expected to limit JPY losses and cap the currency pair.

As the early North American session approaches, traders will be closely monitoring US macro data, including the Producer Price Index, Housing Starts, and the Preliminary Michigan Consumer Sentiment Index. Additionally, speeches by Federal Open Market Committee members will provide further cues for market participants.