US Stocks Edge Modestly Higher, Dollar Set to Conclude 2023 with Losses | Daily Market Analysis

Key events:

- USA - Chicago PMI (Dec)

US stocks experienced modest gains on Thursday, as traders consolidated positions amid the final days of a robust year on Wall Street. The Dow Jones Industrial Average showed a marginal increase of 55 points, equivalent to 0.1%, while the S&P 500 traded 7 points higher, reflecting a 0.2% uptick and the NASDAQ Composite climbed by 30 points, marking a 0.2% rise.

In the previous session on Wednesday, all three major indices enjoyed another positive outing. The Dow Jones Industrial Average, a blue-chip index, advanced over 110 points or 0.3%, the broad-based S&P 500 index saw a 0.1% increase, and the tech-heavy Nasdaq Composite registered a 0.2% climb.

These indices are poised to secure their ninth consecutive week of gains, contributing to an impressive late-year rally. As 2023 draws to a close, the DJIA and S&P 500 are on track to finish the year higher by 13% and 24%, respectively. The S&P 500 is nearing its highest closing level, set in January 2022, trailing by just 0.5%. Meanwhile, the Nasdaq Composite has surged an impressive 44%, propelled by a recovery in mega-cap tech stocks. These gains are attributed to heightened expectations of an early 2024 interest rate cut by the Federal Reserve.

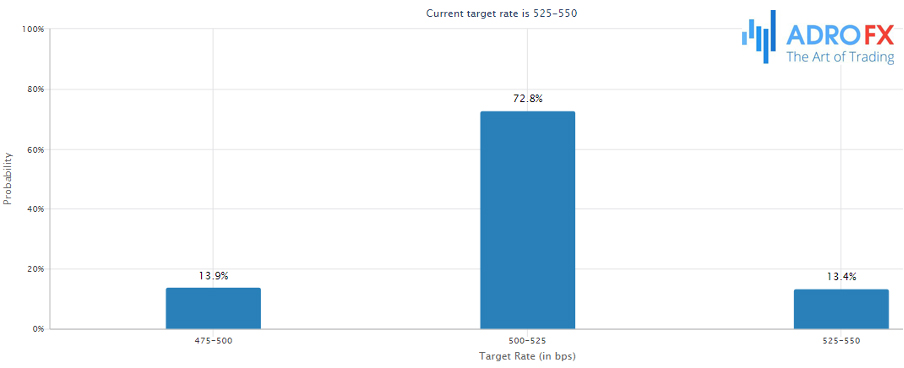

Market sentiment is currently pricing in an 87% likelihood of a Fed rate cut in March 2024, according to the CME FedWatch tool. Futures are indicating a potential easing of more than 150 basis points throughout the upcoming year.

In economic news released on Thursday, data indicated a rise in the number of Americans filing initial claims for unemployment benefits, increasing by 12,000 to 218,000. This suggests a cooling labor market in the fourth quarter of the year.

Within the corporate sector, Apple (NASDAQ: AAPL) shares experienced a 0.7% uptick after a US appeals court temporarily halted a government commission's import ban on the sales of the tech giant's flagship smartwatches. This intervention follows a patent dispute with Masimo (NASDAQ: MASI) over its medical monitoring technology.

As 2023 draws to a close, the US dollar appears poised to conclude the year with a loss, marking a reversal from two consecutive years of gains. This decline is attributed to market expectations that the US Federal Reserve could initiate rate cuts as early as March 2024.

On the final trading day of the year, the greenback remained generally weaker, with currency movements subdued amid a holiday lull leading up to the New Year. Since the Fed initiated an aggressive rate-hike cycle in early 2022, expectations regarding the extent of US rate increases have significantly influenced the dollar's performance over the past two years.

However, as economic data suggested a cooling of inflation in the United States, investor focus shifted to the possibility of the Fed starting to cut rates. These expectations gained momentum after a dovish tilt at the central bank's December policy meeting.

Against a basket of currencies, the greenback experienced a 0.02% decline to 101.18, hovering near a five-month low of 100.61 reached in the previous session. The dollar index was on track to register a loss of over 2% for the month and approximately 2.2% for the year.

The weakening dollar provided relief to other currencies, with the euro nearing a five-month peak at $1.1076 and set to rise more than 3% for the year.

Sterling was also on track for a 5% yearly gain, marking its best performance since 2017, with the British pound up 0.04% at $1.2740.

While the European Central Bank (ECB) and the Bank of England (BoE) did not signal imminent rate cuts at their policy meetings in the current month, traders continued to speculate that a Fed pivot and the potential for lower US rates in the coming year would create room for other major central banks to follow suit.

The yen, on the other hand, was poised to fall over 7% in 2023, extending into a third straight year of losses.

The decline is a result of the Bank of Japan's (BOJ) ultra-loose monetary policy stance. While market expectations point to the BOJ exiting negative interest rates in 2024, the central bank has not provided clear signals on how such a scenario might unfold. BOJ Governor Kazuo Ueda emphasized a lack of urgency in unwinding ultra-loose monetary policy, citing a small risk of inflation running well above 2%. A summary of opinions from the BOJ's policy meeting this month indicated calls for deeper debate on a future exit from ultra-loose monetary policy as the economy progresses toward achieving the bank's price target.