U.S. Stock Market: What to Expect in 2023? | Daily Market Analysis

Key events:

- New Year's Day

2022 has become the most volatile year in a decade: the world economy is going through tough times, central banks are struggling with high inflation, and the stock market has been under pressure from a bearish trend since the beginning of the year. Will the situation change in 2023 and what should investors expect?

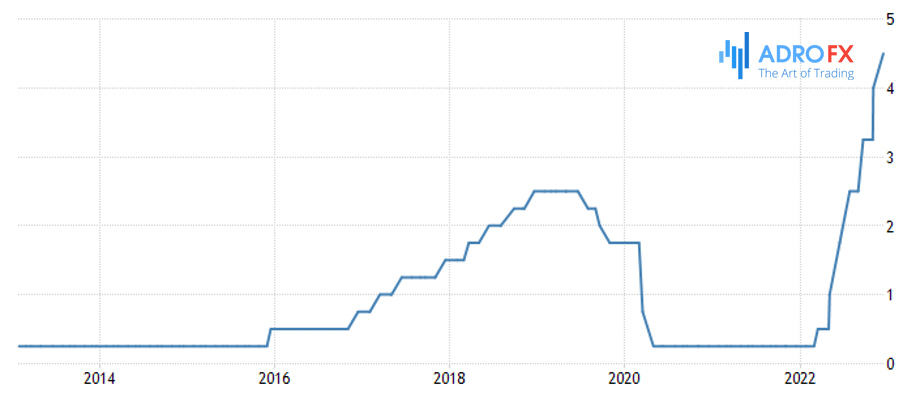

The main reason for the decline in the U.S. stock market this year has been higher inflation and the U.S. Federal Reserve's (Fed) response to curb inflation. June saw record inflation data which broke a 40-year high and cemented a bearish trend in the market which had been going on since the beginning of the year.

As history shows, the average bear market since World War II has lasted 14 months and resulted in declines of more than 30% from previous highs. The current trend has now lasted more than 11 months. From this, we can conclude that statistically speaking, we are two-thirds of the way through.

In addition, one of the fundamental reasons why the market will show strong growth soon is the excess of money from investors. A serious bear market forms precisely when people start selling stocks when they are in need of money. Right now, investors are selling stocks simply because they are afraid of losing value. But such corrections always come to an end pretty quickly, replaced by an equally tumultuous rise. Investors are holding huge amounts of cash right now, and the money supply is at record levels. That gives confidence that markets will rebound quickly. Better now is the opportunity to buy companies with strong financial fundamentals at a discounted price.

In addition, inflation in the U.S. continues to slow: November data showed a decline to 7.1%, which exceeded analysts' expectations. The dynamics of inflation and the rate of its slowdown are a certain signal of the Fed's successful policy, giving additional hope to stock market participants that the regulator will start easing its monetary policy this year.

Basically, experts consider three scenarios for the U.S. economy this year:

- Optimistic Scenario. Economic activity continues to slow down, and the economy remains under pressure, but growth remains at 1%. Inflation slows at an accelerated pace, and the Fed may cut the rate to 4.25%, by the end of 2023.

- Moderate Recession. The economy may experience a mild recession during the first half of 2023, but by the second half of 2023, economic activity recovers, the Fed cuts the rate to 4.75%, and signals further easing of monetary policy while maintaining a downward trend in inflation.

- Stagflation. This scenario is based on a more sustained inflation trend in 2023, which encourages the Fed to take more aggressive steps and allows rates to be cut only to 5.5% at the end of 2023. However, the likelihood of this scenario developing is very low, as inflation is already showing a good rate of deceleration.

At the same time, some believe that the U.S. can avoid a recession this year and go with the optimistic scenario. The stock market is supported by strong economic macro data and some issuers have already proven their ability to withstand a rate hike. The stock market has fallen on fears and expectations last year, but in such situations, fear quickly changes to euphoria. There is potential in the U.S. stock market, and we should not rule out the possibility that the S&P 500 index could gain 15% in 2023 from current positions.