US Stock Indices Find Optimism in Thursday's Turnaround, Fueled by Financial Strength and Upbeat Job Data | Daily Market Analysis

Key events:

- Eurozone - CPI (YoY) (Dec)

- USA - Average Hourly Earnings (MoM) (Dec)

- USA - Nonfarm Payrolls (Dec)

- USA - Unemployment Rate (Dec)

- USA - ISM Non-Manufacturing PMI (Dec)

- USA - ISM Non-Manufacturing Prices (Dec)

- Canada - Employment Change (Dec)

- Canada - Unemployment Rate (Dec)

Thursday marked a potential turning point for the S&P 500 and Dow Jones Industrial, as both indices geared up for their initial positive sessions of 2024. Financial stocks and robust job data played pivotal roles in steering investor sentiment, prompting a reconsideration of earlier projections regarding the timing of potential interest-rate cuts.

This positive shift in the prominent US stock indices comes after a lackluster beginning to the year, with the S&P 500 experiencing its most significant two-day dip since late October, primarily driven by profit-taking after a robust rally in the preceding year.

The surge in these indices toward the end of 2023 was largely fueled by speculations that the Federal Reserve might initiate rate reductions in the current year. However, the recently released minutes from the central bank's December policy meeting offered limited insights into the possible commencement of easing measures.

Traders, using the CME Group's FedWatch tool, currently assess a 66.4% likelihood of at least a 25-basis point rate cut in March, with an almost 93% probability for a similar move in May.

Leading the charge were financial institutions, exhibiting strength ahead of the upcoming earnings season. JPMorgan Chase & Co achieved a record high, registering a 1.2% increase after BofA Global Research raised its price target. Truist Financial Corp also demonstrated resilience with a 1.7% advance, following an upgrade in its rating and price target by BofA.

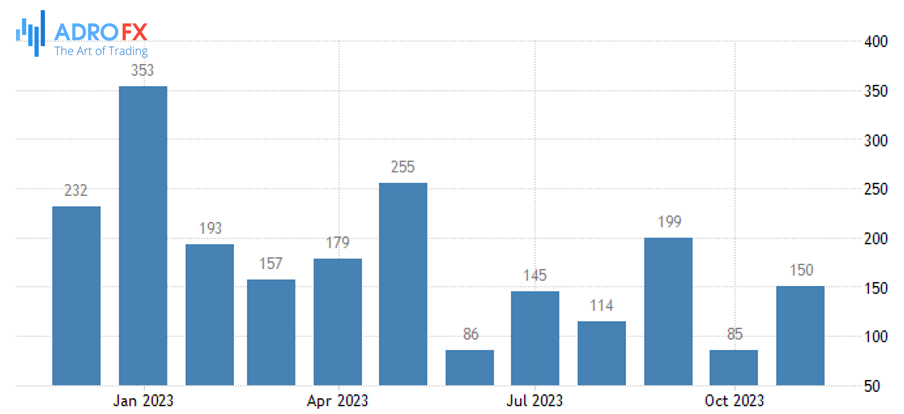

The positive momentum was further fueled by the ADP National Employment report, revealing that US private employers exceeded expectations in hiring for December. The data indicated ongoing robustness in the labor market, serving as a sustaining force for the broader economy. Notably, private payrolls grew by 164,000 in December, compared to a 101,000 rise in the previous month. Official US employment data for December is slated for release on Friday.

The US Dollar Index experienced a somewhat indecisive session, concluding around the 102.40 mark after a brief retreat to the vicinity of the 102.00 zone. Investor caution in anticipation of the crucial Nonfarm Payrolls figures appeared to influence the dollar's price movements amid mixed trends in risk appetite.

Meanwhile, the Canadian Dollar demonstrated marginal movement on Thursday, with attention shifting elsewhere in the lead-up to Friday's release of the US Nonfarm Payrolls data. Although US data points reported on Thursday generally surpassed expectations, market dynamics reflected a nuanced response rather than a decisive shift in one direction.

Canada is poised to unveil key economic indicators on Friday, including December's Unemployment Rate, annualized Average Hourly Wages, and Net Change in Employment figures. However, the overarching focus remains on the US NFP data, which is expected to shape market expectations and reactions as the first trading week of 2024 concludes.

Meantime, the GBP/USD experienced fluctuations on Thursday, briefly reaching an intraday high of 1.2730 before encountering downward pressure from US Dollar flows, pulling the Pound Sterling back below the 1.2700 threshold.

Despite positive UK economic data early on Thursday, including elevated Mortgage Approvals and a higher-than-expected reading in the UK S&P Global/CIPS Services Purchasing Managers’ Index (PMI) for December, the Cable struggled to gain significant momentum. The overall impact of the data, classified as low-impact, hindered the development of a substantial bullish trend across the currency pair.

The price of gold faces ongoing challenges in establishing a clear trend on Friday, remaining within a tight trading range below the $2,050 mark as the European session approaches. Traders exhibit caution, refraining from making bold directional moves, and opting to await the release of the official monthly employment data from the United States.