US Markets Climb as Tight Trump-Harris Race Fuels Investor Caution and Dollar Strength | Daily Market Analysis

Key events:

- USA - Crude Oil Inventories

- USA - 30-Year Bond Auction

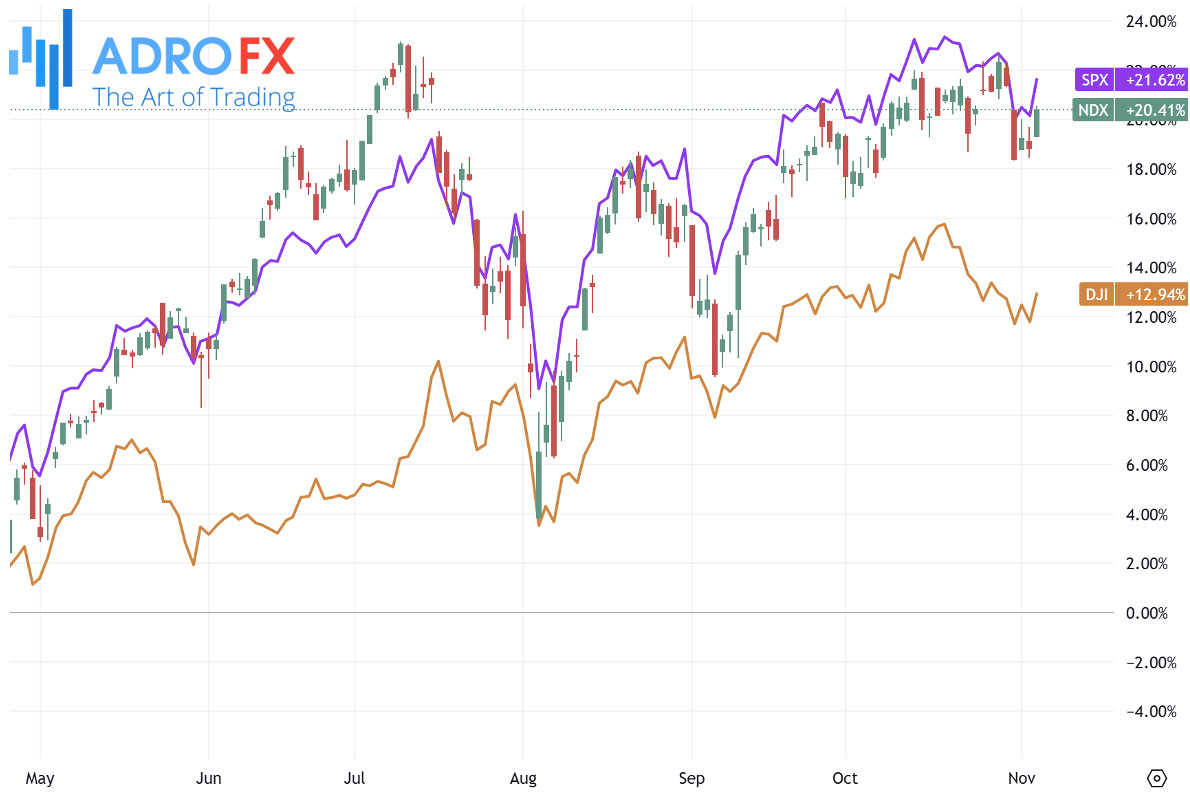

The S&P 500 surged on Election Day, Tuesday, driven by continued gains in the tech sector.

The Dow Jones Industrial Average rose by 427 points, or 1%, while the S&P 500 increased by 1.2%, and the NASDAQ Composite gained 1.4%.

Investors were cautious as recent polls revealed a tight race between Donald Trump and Kamala Harris in the upcoming presidential election, with the outcome expected to significantly influence trade and tax policies over the next four years.

While previous polls indicated Trump gaining ground, recent data suggested this trend may be reversing just ahead of the election.

A Trump administration is anticipated to introduce more inflationary policies and implement stricter trade tariffs on China, potentially affecting the big tech sector. In contrast, Harris has proposed raising taxes on high-net-worth individuals and large corporations while offering tax relief to families.

Gold extended its range-bound consolidation below the $2,750 mark as the European session approached on Wednesday. The US Dollar partially trimmed its intraday gains after reaching its highest level since early July, as some profit-taking occurred amid a slight pullback in US Treasury bond yields. This, combined with ongoing geopolitical risks related to conflicts in the Middle East, provided support for the safe-haven metal.

However, gold’s upside appears limited due to the robust bullish outlook for the USD, reinforced by the likelihood of a Trump victory in the election. Additionally, concerns over deficit spending and expectations of a less aggressive monetary policy easing by the Federal Reserve could continue to lift US bond yields, favoring a stronger dollar. As such, any upward movements in XAU/USD may present selling opportunities and remain capped.

The Australian Dollar retraced its recent gains against the USD on Wednesday, driven by election-related anticipation in the US. The AUD/USD pair depreciated as the US Dollar strengthened.

Earlier, the Australian Dollar saw a boost after the Reserve Bank of Australia maintained its Official Cash Rate (OCR) at 4.35% on Tuesday, marking its eighth consecutive pause. RBA Governor Michele Bullock reiterated a hawkish approach, emphasizing the need for restrictive monetary policy amid persistent inflation and a robust labor market. October’s Purchasing Managers Index (PMI) data for Australia also showed positive trends, with growth in the services sector counterbalancing a continued decline in manufacturing.

The Japanese Yen recovered some of its intraday losses against the USD, pulling the USD/JPY pair to the mid-153.00s during the European session on Wednesday. Caution among JPY bears was evident as investors considered potential intervention by Japanese authorities to support the currency.

Additionally, hawkish commentary from the Bank of Japan’s recent meeting minutes indicated a willingness to hike interest rates if economic and inflation forecasts align, lending further support to the yen.

Meanwhile, a modest retreat in US Treasury yields spurred some USD profit-taking after a strong rally to the highest level since early July, benefiting the lower-yielding JPY. However, expectations of political challenges in Japan that might hinder further rate hikes by the BoJ, along with a risk-on market sentiment, could limit the JPY’s gains.

The USD/CHF pair saw robust gains on Wednesday, reaching its highest level since early August at around 0.8755 in the Asian session. While spot prices retraced slightly, currently trading just above 0.8700, the pair remained up 0.90% for the day.

Expectations of heightened market volatility have tempered additional upward moves for the USD/CHF pair, yet the overall market fundamentals suggest the pair's path remains upward. Thus, any pullbacks may present buying opportunities.

The NZD/USD pair depreciated by more than 1% as the USD strengthened following favorable election results for Republican candidate Donald Trump. The pair traded around 0.5930 during Asian trading hours on Wednesday.

New Zealand’s unemployment rate for the third quarter rose to 4.8% from 4.6% in the second quarter, falling below market expectations of 5.0%. Employment Change declined by 0.5% quarter-on-quarter and 0.8% year-on-year in Q3.

Additionally, the Reserve Bank of New Zealand cut its Official Cash Rate by 75 basis points as part of an ongoing easing cycle initiated in August. Markets anticipate an additional 50-basis-point cut at the final policy meeting of the year on November 27, potentially lowering the OCR to 4.25%.