US Equities Gain Despite Recession Concerns, Regional Banks Recover | Daily Market Analysis

Key events:

- Australia - Building Approvals (MoM) (Mar)

- Australia - NAB Business Confidence (Apr)

- Eurozone - ECB's Lane Speaks

US equities showed strength on Friday, with the S&P 500 rising by 1.8% after experiencing four consecutive down days. This gain came despite a week of better-than-expected earnings reports. However, the more robust payroll reports helped counter any concerns of an impending recession, which had been fueled by a short-selling frenzy earlier in the week that primarily targeted regional US bank stocks.

Also, there was another positive development for stocks, as regional banks saw a slight recovery after a difficult week. PacWest's shares surged by more than 80%, reducing their overall decline for the week to around 40%. The KRE (SPDR S&P Regional Banking ETF) also experienced a rally of 6.29%, reducing its weekly decline to less than 10%.

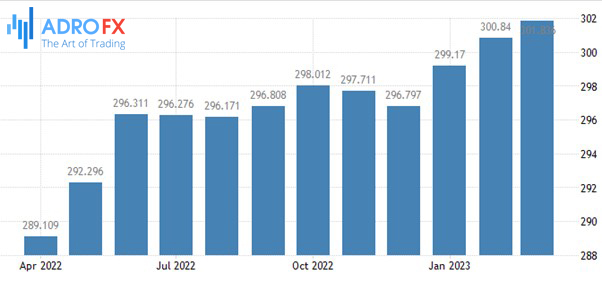

At the same time, the US dollar is facing selling pressure due to the debt ceiling and stress in US regional banks. Cable is testing the ceiling of a long-term down-trending channel, and economists and markets have different opinions on what the Bank of England (BoE) should do. Economists are betting for one more rate hike from the BoE, while the interest rate markets are pricing in a 25bp hike this Thursday, followed by one or two more rate hikes until September, which could push the British policy rate to the 5% psychological mark. The BoE should continue hiking rates due to UK inflation. However, Governor Bailey thinks that price pressure will drastically cool later this year, but he should consider the risk that it might not. Expectations between the BoE and the Fed are diverging in favor of the latter, which should keep Cable on a path toward further gains.

The dominant view around the forex market is that no matter how strong the US economy is, the Fed will still have to cut rates. Their high values, long-term plateau holding, default risks due to the debt ceiling and the banking crisis will in any case provoke a recession. That is why EUR/USD rose in response to the positive from the US labor market.

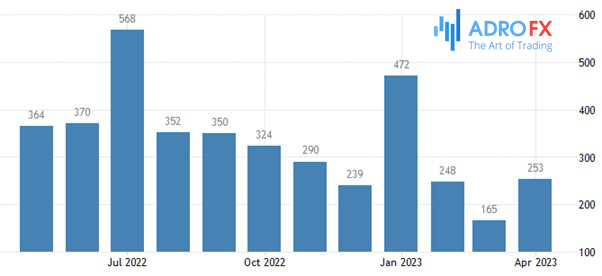

It seemed like April's job growth of 253,000, the unemployment rate dropping to 3.4%, the lowest mark since 1969, and the average wages rising to 4.4% should have caused the euro to capitulate. Especially since Jerome Powell argued that it would take an increase of about 3% in the latter indicator for inflation to return to the 2% target. The labor market is too hot and rumors of the demise of the economy are exaggerated to justify a dovish reversal in 2023.

This is the 13th consecutive month of job gains above Bloomberg experts' forecasts. Since the beginning of 2022, the states have added 6 million jobs, compared to the 4.2 million expected by experts. If a recession is coming, someone forgot to tell the US economy.

Markets are waiting for a recession, and any failure to increase borrowing costs is perceived as a form of tightening, which will eventually lead to a recession. In addition, monetary policy divergence has yet to be undone.

According to Union Investment, monetary policy divergence on both sides of the Atlantic is something entirely new. While it used to be thought pointless to forecast the ECB, as it would stop at -200 bps from the federal funds rate anyway, the European Central Bank is now ready to live its own life.

The upcoming US economic data releases are highly anticipated as they may have an impact on the Federal Reserve's next decision. Before the Fed's next meeting, there are two Consumer Price Index (CPI) reports, and one more jobs report to be released. The first US CPI report is scheduled to be released on Wednesday. Market expectations are that the US core inflation may have eased from 5.6% to 5.5% in April, while the headline figure may have stabilized at around 5%. However, the monthly headline figure may have ticked up from 0.1% to 0.4% due to the recent jump in energy prices following OPEC's production cuts. Any unexpected increase in inflation figures may bring back the Fed hawks to the market and reduce the expectations of a Fed rate cut.