Understanding Forex Liquidity

Every trader who plans to trade shares on the stock market or forex instruments needs to understand what liquidity means. After all, a proper understanding of the concept of liquidity can help choose assets that are more promising from the perspective of potential gainfulness and, therefore, increase income.

In this article, we will discuss why liquidity is so important and what factors influence it. We will also tell you which formulas can be used to calculate various liquidity ratios and how to apply them in practice.

What Is Liquidity?

The term "liquidity" refers to any asset that can be sold or bought. Highly liquid and illiquid can be stocks, currency pairs, cash, real estate, etc. Broadly speaking, liquidity is the property of an asset to be bought or sold quickly at a price that is close to its market value. Thus, the faster you can get funds for that asset, the more liquid it is.

Evaluating liquidity can be very helpful in your investment decisions because the outcome of your trades depends directly on which assets (liquid or illiquid) you are trading. In addition, determining the liquidity of a particular asset will enable you to determine how quickly you can earn an income by trading it.

The most highly liquid asset is cash. There is always a demand for it. Notes can be exchanged for any commodity at any time. Despite assurances from economists that currencies depreciate with time, the currency is still liquid.

Due to this, the forex currency market is also highly liquid. The large daily volumes of transactions are concluded here for buying and selling currencies. Forex works round the clock and is among the most popular markets because trading currency pairs are usually not a purpose – every forex trader is tuned for speculation, i.e. for getting quick returns without burdening themselves with real assets.

Liquidity of Currency Pairs

Speaking about the liquidity of currency pairs in the forex market, we should note that this notion is somewhat different from the general definition. Initially, currency pairs are liquid by themselves. But for trading, it is important to know which of them are more liquid and which are less.

To determine the degree of liquidity, you need to know the trading volumes of each currency pair. Instruments with the highest volumes will be the most liquid. For example, EUR/USD is always at the top in terms of turnover, so it has the highest liquidity. It is followed by USD/JPY: it is the second most popular and, accordingly, the second most liquid pair. The Pound to the US Dollar (GBP/USD), which is a favorite currency pair for many traders, is close to the bottom of the third position.

In addition, the liquidity of currency pairs depends on trading hours. When placing a trade during the operation of the exchange, which is the main one for a particular currency pair, the liquidity is higher. When the main exchange is closed, the liquidity of the pair decreases. For example, currency pairs with Euro will be more liquid during the European trading sessions.

Liquid instruments will also have high volatility because these concepts are closely connected. Pairs with low liquidity, on the contrary, do not have considerable volatility, their quotes curve is steeper. This feature should be taken into account when trading on the forex market.

The liquidity of currency pairs is affected by many economic and political events. It is worth taking into account changes in geopolitics, international economic data, as well as domestic political events and economic indicators in individual countries. For example, Brexit collapsed the British pound by several thousand points overnight.

Why Is Liquidity Important When Trading Financial Instruments?

There are several important reasons why liquidity should be assessed when trading stocks and other financial instruments. It is liquidity that determines how quickly an investor can buy or sell a particular asset without losing value. The liquid market is often considered to be less risky because in this case, a trader can find a buyer for it quicker without losing the price. If the investor, on the contrary, buys the asset, then the chance of getting it at an undervalued price also increases significantly.

However, when buying and selling assets, one should keep in mind that market liquidity indicators are not fixed. The liquidity of stocks and currency pairs depends on many factors, including the volume and time of trading. For example, liquidity in currency pairs (including the pound sterling) decreases during the Asian trading session. This means that to achieve your investment and financial objectives as quickly as possible, you should always consider the liquidity of the particular asset at the moment.

How Can You Determine Liquidity?

The liquidity of financial instruments is based on exact numbers, so it is not difficult to measure it. There is a whole system of liquidity indicators, which makes it possible to evaluate assets quoted on the spot and futures markets in a short period.

As for the forex market, everything is a bit different: the liquidity criteria of currency pairs are determined by other means.

Pairs liquidity, as already mentioned, is determined by trading volume. For the forex market, which belongs to the OTC market, it is quite difficult to get accurate data. There are publicly available data collected by analysts and experienced traders, but it is better to monitor this indicator yourself because it tends to change over time.

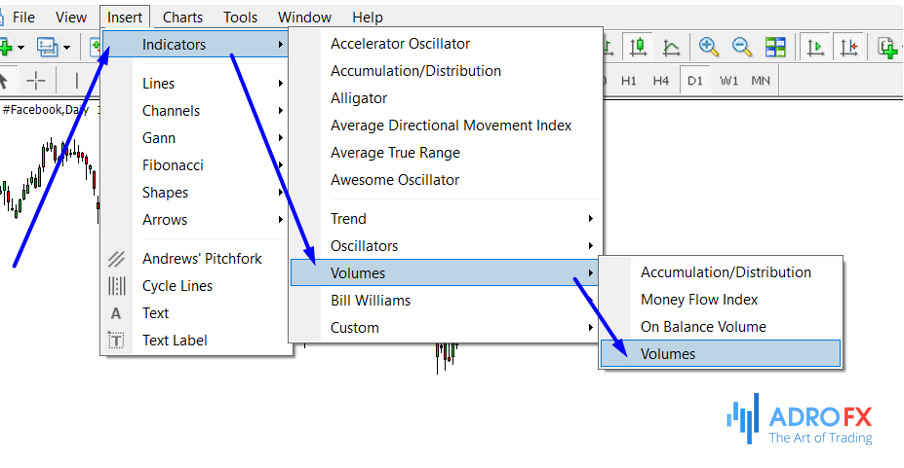

This can be done using the MetaTrader 4 trading terminal by activating the volume indicator (Volumes). It is located in the top menu: Insert → Indicators → Volumes:

The indicator window is displayed below the chart and represents the vertical bars (ticks), where you can see the number of placed orders. The more trades, the higher the volume bar and, consequently, liquidity:

If you set the time frame H4 or H1, you can see how trading volumes change at different times of the day. This information is no less useful for the trader.

By the way, there is a strategy of analysis using the Volumes indicator, which helps to determine the further trend and find the entry point into the market.

What Factors Affect Market Liquidity?

The liquidity of any financial instrument is greatly impacted by a huge number of factors, such as interest rates, current prices, central bank rules and regulations, the number of assets in circulation, etc. Liquidity also depends on the class of asset. For example, real estate is much less liquid than stocks. In addition, the liquidity of some assets, such as commodities and derivatives, usually depends on the volume of trading and the number of exchanges on which they are traded.

Generally, there is a certain correlation between liquidity and the type of exchanges used for trading. As a rule, the highly liquid assets are those traded on popular and large exchanges. While instruments traded on less developed or small markets are illiquid.

Another factor that affects liquidity is the time of day you choose to trade. For example, you will get the best selling or buying prices for currency pairs involving the euro during the official business hours of all European exchanges. But the liquidity of the same pairs during the Asian session hours will be much less.

Here is another example of comparing the liquidity of different assets. Let's compare the liquidity of Google shares and Tesla Motors. For example, on October 9, 2020, the total trading volume of Google stock was $1.3 million. These numbers are huge, so this company's stock is highly liquid. But if you compare them to Tesla Motors, which had a total trading volume of $42 million that day, it is immediately clear that Google stock showed less liquidity than Tesla Motors stock that day.

We do not recommend you trade stocks of companies whose daily trading volume is in double or triple digits as they are often considered illiquid.

Forex Trading Based on Liquidity

The liquidity of a currency pair is one of the main factors which are taken into account when making trading decisions. A trader always evaluates the potential of a currency pair based on the price movement that the instrument demonstrates. The trading strategy depends on it, including the choice of currency pairs.

Instruments with high liquidity show powerful movement. At the same time, the amplitude of price fluctuations is also considerable. That is why it is not recommended to start trading on the currency market with such instruments. Their movements are sharp and often unpredictable, which can cause big losses in a short period or simply the loss of the deposit.

In the case of high liquid, pairs trader is strictly limited in time, and sometimes inexperienced traders have no time to make a correct decision. These instruments fluctuate so unexpectedly that even traders with great experience get baffled. But if experienced traders compensate for pairs' behavior with an accurate strategy, beginners do not have one and lose their deposits.

It is better to start with more stable and predictable instruments that can be easily detected even by beginners. Undoubtedly, their gain per unit of time is smaller, but you can check your assumptions and change the tactics.

Traders with experience, practicing balanced trading, usually use both volatile and low-volatility pairs. As a rule, the former are traded in the short term or even intraday, while the latter are traded in the medium term. Such a strategy allows to earn in case of successful hitting the trend, at the same time it limits the losses if the trader sets the Stop Loss and Take Profit orders correctly.

The spread of currency pairs also depends on the liquidity level. If a lot of trades are opened and closed, and in big volumes, the difference between the bid and ask prices is smaller, because buyers and sellers can find common ground more quickly.

When there are far fewer trades, it's harder for buyers and sellers to meet a price that will suit them, so the spread becomes wider. This is very noticeable in exotic instruments, such as the USD/MXN pair.

How to Assess the Liquidity of an Investment Portfolio

Liquid assets are considered beneficial for investment. But the volatility of the market forces traders and investors to think through ways to reduce risks in advance. The simplest one is to form a complete investment portfolio. Then any unforeseen circumstances with one of the assets can be compensated at the expense of other, more advantageous assets.

An investment package allows you to average risks due to asset liquidity spikes.

The key metrics of a portfolio of investment instruments are:

- Value;

- Rate of return;

- Risk level;

- Term of investment of funds;

- Minimum size of investments.

Each asset is evaluated individually as well as the average value is calculated. The latter is an indicator of portfolio efficiency, and its stability in the current market. In the first stage, it is important to evaluate the rate of return on investment, the risk of non-return, and losses.

Subsequently, the systematic analysis yields a result, what percentage of the income received is rationally invested in the expansion of the investment portfolio, and what volume of returns is considered net income and withdrawn from the turnover. Both processes should run in parallel, taking into account changes in the state of assets separately and in the averaged version.

About AdroFx

Established in 2018, AdroFx is known for its high technology and its ability to deliver high-quality brokerage services in more than 200 countries around the world. AdroFx makes every effort to keep its customers satisfied and to meet all the trading needs of any trader. With the five types of trading accounts, we have all it takes to fit any traders` needs and styles. The company provides access to 115+ trading instruments, including currencies, metals, stocks, and cryptocurrencies, which make it possible to make the most out of trading on the financial markets. Considering all the above, AdroFx is the perfect variant for anyone who doesn't settle for less than the best.