Top 5 Forex Trading Strategies for 2024: Expert Tips on Trend Following, Scalping, and More

The forex market in 2024 presents both opportunities and challenges for traders of all experience levels, from beginners to seasoned professionals. With global economic recovery, inflation concerns, and the rise of digital currencies influencing currency prices, having a well-defined forex trading strategy is more crucial than ever. Whether you're a novice trader looking to make your first moves or an experienced trader aiming to refine your tactics, selecting the right strategy can make a significant difference in your success.

In this guide, we'll explore the top 5 forex trading strategies for 2024, tailored to help you navigate the dynamic and often volatile forex market. From trend-following techniques that capitalize on market momentum to scalping strategies designed for quick gains, these approaches cater to different trading styles and risk appetites. No matter your experience level, these strategies, combined with expert insights on risk management and psychological resilience, will equip you with the tools needed to thrive in the ever-evolving world of forex trading.

Top 5 Forex Trading Strategies for 2024

Navigating the forex market requires effective strategies that align with market conditions and trading goals. As we approach 2024, here are five of the most promising forex trading strategies that traders can leverage to maximize their success:

- Trend Following Strategy

- Range Trading Strategy

- Breakout Strategy

- Scalping Strategy

- Swing Trading Strategy

These strategies each offer unique advantages and challenges, making them suitable for different market conditions and trading styles. Whether you’re a trend follower, range trader, breakout enthusiast, scalper, or swing trader, the key to success in 2024 lies in choosing a strategy that aligns with your goals and risk tolerance while adapting to the ever-changing forex market.

Now let's have a look at each of them in detail and at length.

Trend Following Strategy

The Trend Following strategy is widely used due to its simplicity and effectiveness in capitalizing on market momentum. The core idea is to align trades with the prevailing market trend, whether upward or downward, to potentially benefit from continued price movement.

How It Works

The basic principle is to buy in an uptrend and sell in a downtrend, assuming that the price will continue in its current direction. Traders rely on technical tools like moving averages (e.g., 50-day and 200-day) and trendlines to identify and follow trends. When the price is above a moving average, it suggests an uptrend, while prices below indicate a downtrend.

Entry and Exit Points

Ideal entry points occur during pullbacks within a trend, offering better prices and lower risk. Exiting trades often involves using trailing stops, adjusting the Stop Loss level as the trend progresses to lock in profits while staying in the trade.

Risk Management

Managing risk is crucial due to the unpredictability of trend reversals. Traders typically set Stop Losses to protect against unexpected moves and limit their exposure to 1-2% of their account per trade to prevent significant losses.

Pros and Cons

The major advantage is capturing large market moves with minimal effort once a trend is established. However, identifying trends in real time can be challenging, and trends don’t last forever. This strategy struggles in sideways markets, where trends are harder to find.

Also read: Support and Resistance in Forex Trading | Definition & Strategies

Range Trading Strategy

The Range Trading strategy excels in markets that are moving sideways, without a clear trend. The approach focuses on buying at the bottom of a defined range and selling at the top, profiting from price oscillations within this range.

How It Works

Range trading involves identifying support (a price level where demand prevents further declines) and resistance (where selling pressure stops price increases). In a ranging market, price moves between these levels without establishing a clear trend.

Entry and Exit Points

Traders typically enter long positions near support and short positions near resistance. Exits are straightforward, with traders aiming to sell at resistance if they bought at support and vice versa.

Risk Management

The primary risk in range trading is a breakout, where the price moves beyond the established range and starts a new trend. To manage this risk, traders use Stop Losses just outside the range boundaries and ensure that their position sizes are small, typically risking 1-2% of their account on each trade.

Pros and Cons

Range trading offers frequent trading opportunities in directionless markets and can be easier to predict within a well-defined range. However, breakouts can lead to significant losses if not managed carefully, and identifying genuine ranges can be challenging, especially for beginners.

Breakout Strategy

The Breakout Strategy aims to capitalize on sharp price movements that occur when the market breaks out of a defined range or pattern. These breakouts, which happen when the price surpasses key support or resistance levels, often lead to increased volatility and significant trading opportunities.

How It Works

Breakouts occur when the price moves beyond established support or resistance, signaling a potential trend change. Traders enter positions as soon as the breakout is confirmed, aiming to capture the momentum of the new trend.

Tools Needed

Volatility indicators like Bollinger Bands and price patterns such as triangles or flags help traders anticipate breakouts. Tight Bollinger Bands often indicate an imminent breakout as the market consolidates before a significant move.

Entry and Exit Points

Traders typically enter as soon as the breakout occurs, waiting for confirmation such as a close above resistance or below support. Exit strategies can involve predefined profit targets or trailing stops to capture maximum gains while limiting losses.

Risk Management

False breakouts, where the price breaks out but then reverses, pose a significant risk. To mitigate this, traders use Stop Loss orders just below the breakout level for bullish trades and just above for bearish trades. Position sizing is kept conservative, with only a small percentage of capital risked per trade.

Pros and Cons

Breakout trading can lead to substantial profits by capturing significant price moves. However, it comes with challenges such as false breakouts and rapid price swings that make managing trades difficult.

Scalping Strategy

Scalping is a high-frequency trading strategy that focuses on making numerous quick trades throughout the day, profiting from small price movements. Unlike strategies that aim for large moves, scalping seeks to accumulate small gains that add up over time.

How It Works

Scalping involves holding positions for only a few seconds or minutes, relying on technical analysis and short-term charts (e.g., 1-minute or 5-minute) to identify trading opportunities. Speed is essential in both identifying and executing trades.

Tools Needed

Fast and reliable trading platforms with low latency and tight spreads are crucial for scalping. Indicators like moving averages, RSI, and MACD are often used to determine entry and exit points. Execution speed is also vital, with one-click trading features and direct market access being preferred.

Entry and Exit Points

Scalpers typically enter trades based on price action or technical indicators, setting tight profit targets (e.g., 5-10 pips). Automatic Take Profit and Stop Loss orders are commonly used to ensure trades are closed quickly and efficiently.

Risk Management

Controlling losses is critical in scalping due to the small profits per trade. Tight Stop Loss orders help protect against adverse market moves, and position sizing must balance the need for quick gains with the risk of significant losses.

Pros and Cons

The main advantage is the ability to generate consistent profits from small price movements. However, scalping requires intense focus, discipline, and quick decision-making. Transaction costs can also eat into profits, making it crucial to choose a broker with low fees.

Swing Trading Strategy

Swing trading is a strategy suited for traders who prefer holding positions for several days or weeks. This approach focuses on capturing medium-term price movements, often taking advantage of market corrections or reversals.

How It Works

Swing traders aim to profit from the market's "swings" - periods of upward or downward movement within a broader trend. By entering trades at the beginning of these swings and exiting once the move is complete, traders can capitalize on both upswings and downswings.

Tools Needed

Swing trading requires a solid understanding of technical analysis, including chart patterns and key price levels. Common tools include chart patterns like head and shoulders or double tops/bottoms, as well as indicators like the RSI, which helps identify overbought or oversold conditions.

Entry and Exit Points

Traders typically enter based on chart patterns or technical indicators, aiming for positions that align with medium-term price movements. Exit points are determined by target price levels identified through analysis, with Stop Loss orders in place to limit potential losses.

Risk Management

Risk management in swing trading focuses on controlling exposure over longer time frames. Stop Loss orders are crucial to protect against unexpected market moves, and position sizing is adjusted based on the trader's risk tolerance, typically keeping risk to 1-2% per trade.

Pros and Cons

Swing trading is less time-intensive than day trading or scalping, making it suitable for those with other commitments. It also offers the potential for larger gains by capturing significant price movements. However, it comes with challenges, such as exposure to overnight risk and market gaps, requiring patience and discipline.

Also read: Crafting a Winning Day Trading Strategy: A Comprehensive Guide

Case Studies: Real-World Examples Based on GBP/USD Hourly Chart

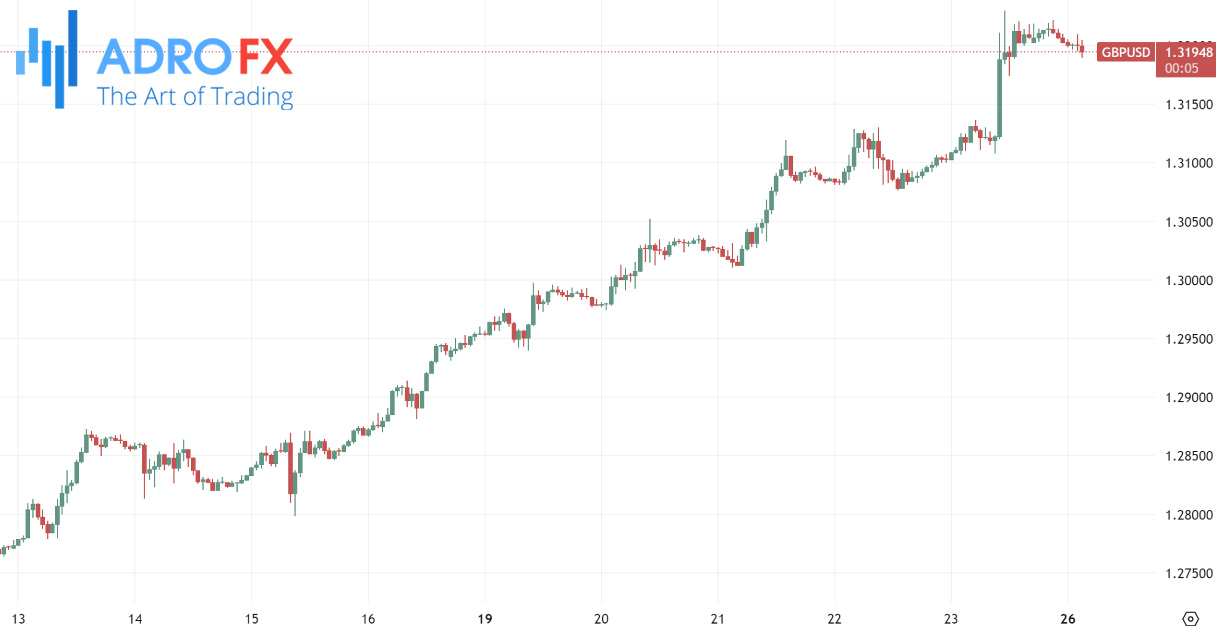

Analyzing the attached GBP/USD hourly chart, we can apply the top 5 forex trading strategies to real-world scenarios, highlighting successful trades and key lessons in execution and timing.

Trend Following Strategy

From August 13 to August 21, the chart shows a clear upward trend, with GBP/USD steadily climbing from around 1.27500 to 1.31500. A trend-following trader could have entered a long position early in the trend (e.g., after confirming the higher lows and the break of resistance at 1.29000) and held the trade until signs of exhaustion appeared around 1.31500.

Successful trend following relies on identifying the trend early and having the discipline to hold the position as the trend continues. Exiting too soon could mean missing out on further gains, while staying too long might result in losses when the trend reverses.

Range Trading Strategy

Between August 14 and August 17, the GBP/USD price fluctuated within a range between 1.28500 and 1.30000. A range trader could have taken advantage of this by buying near the support level (around 1.28500) and selling near the resistance level (around 1.30000) multiple times.

Range trading is effective in sideways markets, but traders must be vigilant for potential breakouts. Setting Stop Losses just outside the range can protect against unexpected moves, like the breakout seen on August 21.

Breakout Strategy

The breakout strategy would have been highly successful around August 21, when the GBP/USD pair broke above the 1.30000 resistance level and surged towards 1.31500. A trader entering at the breakout point could have capitalized on the sharp upward move.

Timing is critical in breakout trading. Entering too early might expose a trader to false breakouts, while entering too late could mean missing the most profitable part of the move. Confirmation from volume or momentum indicators can help in filtering false signals.

Scalping Strategy

During the session on August 25, where the price oscillated within a smaller range between 1.31700 and 1.32000, scalpers could have executed multiple short-term trades, profiting from small price movements. By focusing on quick entries and exits, scalpers might take advantage of the market's micro-trends.

Scalping requires precision and quick execution. Small price moves must be exploited rapidly, and transaction costs should be considered to ensure that profits aren’t eroded. Scalping is also demanding in terms of time and attention.

Swing Trading Strategy

A swing trader could have entered a long position around August 17, when the price began to rise from the support level at 1.29000. By holding the position through the swings and capturing the upward movement towards 1.31500, the trader could have profited from a multi-day move.

Swing trading requires patience and the ability to hold through short-term fluctuations. The key is to focus on the bigger picture and resist the temptation to react to every minor price change. Proper risk management ensures that a pullback doesn’t wipe out the gains from a well-planned trade.

Lessons Learned

These case studies emphasize the importance of aligning your strategy with market conditions. Trend following works best in strong directional markets, while range trading and scalping are more suited to sideways movements. Breakout trading demands precise timing and the ability to distinguish real from false breakouts. Swing trading, on the other hand, requires patience and the ability to see beyond short-term noise.

The GBP/USD hourly chart provides a clear demonstration of how different strategies can be effectively applied, reinforcing the importance of adapting your approach to the current market environment.

Expert Tips

Navigating the forex market requires more than just knowing strategies - it demands adaptability, discipline, and a keen understanding of the ever-changing market dynamics. Here, we delve into the wisdom of seasoned traders, offering insights on how to fine-tune your approach, manage risks, and maintain psychological resilience. These expert tips can elevate your trading game, helping you stay ahead in a competitive environment.

Adaptation to Market Conditions

Experienced traders understand that no single strategy works in every market condition. For example, in trending markets, they might lean heavily on trend-following techniques. However, when the market shows signs of consolidation or enters a range-bound phase, they may switch to range trading or scalping strategies. The key is staying flexible and being able to recognize when the market environment changes. By regularly reviewing technical indicators, price action, and market news, experts can fine-tune their approach to match the prevailing conditions.

Risk Management

In the high-stakes world of forex trading, protecting your capital is just as important as making profitable trades. Effective risk management is the cornerstone of long-term success. Whether it's through the use of Stop Loss orders or precise position sizing, understanding how to minimize potential losses can make the difference between thriving and failing in the market.

- Importance of Stop Loss Orders

Successful traders never underestimate the importance of risk management. Setting Stop Loss orders is essential to protect against significant losses, especially during periods of market volatility. By pre-determining the maximum loss they're willing to tolerate, traders ensure they can survive losing trades and remain in the game long-term.

- Position Sizing

Another crucial aspect of risk management is position sizing. Experts often recommend risking only a small percentage of their trading capital on any single trade, typically between 1% and 2%. This approach limits the impact of anyone losing trade and helps traders stay financially stable even during a losing streak.

Psychological Factors

The mental side of trading is often underestimated but plays a crucial role in your overall success. Staying disciplined and keeping emotions in check are challenges that every trader faces. By mastering your psychological approach - knowing when to be patient, and when to act -you can avoid common pitfalls and maintain consistent, profitable trading behavior.

- Staying Disciplined

Emotions are a trader's worst enemy. Fear and greed can lead to poor decision-making, such as exiting a trade too early or holding onto a losing position in the hope of a reversal. Experts emphasize the importance of sticking to your trading plan and maintaining discipline. They use well-defined rules for entering and exiting trades to avoid making impulsive decisions based on emotions.

- Avoiding Emotional Trading

One way experts manage their emotions is by detaching themselves from the outcome of individual trades. They focus on the bigger picture, knowing that losses are part of the game and that their success depends on their long-term performance. Keeping a trading journal can also help by allowing traders to reflect on their decisions and learn from their mistakes.

Also read: Mastering the Art of Determining Beneficial Forex Trading Opportunities

Conclusion

In this guide, we've explored five essential forex trading strategies: trend following, range trading, breakout trading, scalping, and swing trading. Each of these strategies has its strengths and is best suited to different market conditions. By understanding when and how to apply them, traders can increase their chances of success.

We’ve also discussed the importance of adapting strategies to market conditions, managing risk effectively, and maintaining discipline in the face of emotional challenges.

Now that you’re equipped with these strategies and expert tips, it's time to put them into practice. Start by testing these strategies in a demo account or with small trades to see how they work for you. Continuously monitor your progress, learn from your experiences, and refine your approach. The forex market is ever-changing, and the best traders are those who never stop learning and adapting.

About AdroFx

Established in 2018, AdroFx is known for its high technology and its ability to deliver high-quality brokerage services in more than 200 countries around the world. AdroFx makes every effort to keep its customers satisfied and to meet all the trading needs of any trader. With the five types of trading accounts, we have all it takes to fit any traders` needs and styles. The company provides access to 115+ trading instruments, including currencies, metals, stocks, and cryptocurrencies, which make it possible to make the most out of trading on the financial markets. Considering all the above, AdroFx is the perfect variant for anyone who doesn't settle for less than the best.