From Theory to Practice: Implementing Effective Forex Trading Strategies

Crafting a successful forex trading strategy stands as a pivotal aspect of navigating the currency markets. Across the board, traders have devised numerous strategies tailored to capitalize on market opportunities. However, finding the optimal strategy hinges on aligning it with one's trading style and risk tolerance, as there's no universal fit.

To thrive in the forex arena, traders must prioritize minimizing losses while maximizing gains. Any strategy that steers traders toward this objective holds the potential to be a winning one.

Choosing the Best Forex Trading Strategy

Before delving into specific trading methodologies, it's crucial to grasp the essentials of selecting a strategy. Three key factors come into play in this decision-making process.

Time Frame

Selecting a time frame compatible with your trading approach is paramount. The disparity between trading on a 15-minute chart versus a weekly chart is substantial. Scalpers, who aim to profit from minor market movements, gravitate toward lower time frames like 1-minute to 15-minute charts.

Conversely, swing traders often favor the 4-hour and daily charts to identify favorable trading setups. Thus, determining your desired trade duration is fundamental in choosing an appropriate strategy.

Number of Trading Opportunities

Consider how frequently you intend to enter positions. Scalpers, seeking numerous trading opportunities, lean towards strategies conducive to high-frequency trading.

Conversely, traders who dedicate time to analyzing macroeconomic indicators and fundamental factors typically opt for strategies based on longer time frames, entailing fewer but more substantial positions.

Position Size

Determining an appropriate trade size is paramount for success. Understanding your risk tolerance is crucial, as overexposure can lead to significant losses. Many traders adhere to a risk limit per trade, often around 1% of their account balance.

For instance, with a $30,000 account, a trader might risk up to $300 per trade within this limit. Depending on risk appetite, this limit can be adjusted between 0.5% and 2%.

In essence, the fewer trades you initiate, the larger your position size should be, and vice versa. Finding the right balance between trade frequency and position size is key to crafting a robust trading strategy tailored to your objectives.

Exploring Three Effective Trading Strategies

Having determined your preferred time frame, trade size, and trade frequency, let's delve into three renowned forex trading strategies known for their success.

Scalping Strategy

Forex scalping entails capitalizing on minor market movements by executing a high volume of trades, aiming for small profits on each. Unlike long-term positions, scalpers swiftly enter and exit trades, banking on frequent, incremental gains.

Scalping thrives in liquid and volatile markets, where price fluctuations offer ample opportunities for profit. Typically, scalpers target modest gains of around 5 pips per trade, relying on the cumulative effect of numerous successful trades. However, this strategy demands constant vigilance and rapid decision-making, as trades must be executed swiftly to exploit fleeting market movements.

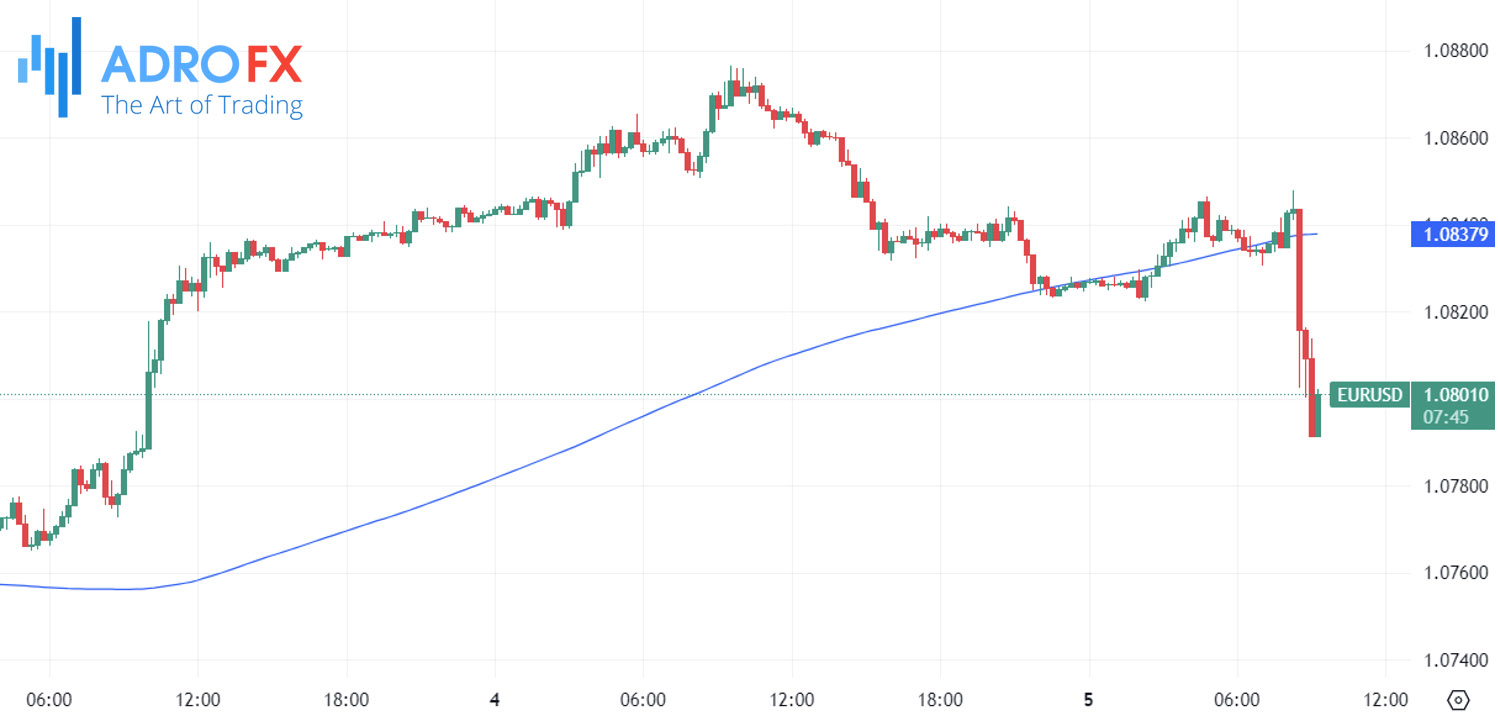

An illustrative example of scalping involves monitoring a 15-minute EUR/USD chart attached above. Here, the strategy revolves around selling whenever the price attempts to breach the 200-period moving average. By setting a tight Stop Loss and a profit target of 5 pips each, a series of successful trades can accumulate substantial profits over time.

Day Trading Strategy

Day trading involves executing trades within a single trading day, capitalizing on intraday market fluctuations. Unlike scalping, day traders aim to close all positions before the trading day ends, mitigating overnight risk exposure.

Day traders typically rely on shorter time frames, such as 30 minutes or 1 hour, to identify trading opportunities. Fundamental factors and scheduled economic events play a significant role in shaping day trading strategies, with traders leveraging news releases and economic indicators to anticipate market movements.

A typical day trading scenario might involve identifying horizontal support and resistance levels on a GBP/USD hourly chart. By strategically entering and exiting positions based on price movements relative to these levels, day traders aim to capture short-term profits within the day's trading session.

Position Trading Strategy

Position trading takes a long-term approach, focusing on fundamental factors and macroeconomic trends to identify substantial market movements. Unlike scalping and day trading, position trading disregards minor market fluctuations, instead prioritizing broader market dynamics.

Position traders adopt a patient stance, holding trades for weeks, months, or even years to capitalize on cyclical market trends. Central bank policies, geopolitical developments, and macroeconomic indicators inform their trading decisions, with profit targets often spanning hundreds of pips per trade.

For instance, observing the Dollar Index (DXY) on a weekly chart can reveal long-term trends influenced by significant economic stimuli and policy shifts. Position traders monitor such indicators to identify optimal entry and exit points, aiming to capitalize on extended market trends for substantial gains.

In essence, whether employing scalping, day trading, or position trading, each strategy offers distinct advantages suited to different trading styles and objectives. By understanding the intricacies of each approach and aligning them with your trading goals, you can enhance your proficiency in navigating the dynamic landscape of forex trading.

Final Thoughts

In conclusion, mastering a successful forex trading strategy is pivotal for navigating the complexities of currency markets. Traders are presented with a myriad of strategies, each tailored to capitalize on specific market conditions and trading styles. However, the key lies in selecting a strategy that aligns with individual preferences, risk tolerance, and objectives.

When choosing a strategy, three fundamental factors come into play: the preferred time frame, the frequency of trading opportunities, and the appropriate position size. By carefully considering these elements, traders can tailor their approach to suit their unique trading preferences and goals.

Exploring three effective trading strategies - scalping, day trading, and position trading - highlights the diverse options available to traders. Scalping offers rapid trades aiming for small profits, ideal for those comfortable with high-frequency trading. Day trading capitalizes on intraday fluctuations, leveraging shorter time frames and fundamental factors for timely decisions. Meanwhile, position trading adopts a long-term perspective, focusing on macroeconomic trends and fundamental analysis to identify significant market movements.

Ultimately, successful trading hinges on understanding the nuances of each strategy and selecting the one that best aligns with your trading style and objectives. By leveraging the insights gained from exploring these strategies, traders can enhance their proficiency and navigate the dynamic landscape of forex trading with confidence and precision.

About AdroFx

Established in 2018, AdroFx is known for its high technology and its ability to deliver high-quality brokerage services in more than 200 countries around the world. AdroFx makes every effort to keep its customers satisfied and to meet all the trading needs of any trader. With the five types of trading accounts, we have all it takes to fit any traders` needs and styles. The company provides access to 115+ trading instruments, including currencies, metals, stocks, and cryptocurrencies, which make it possible to make the most out of trading on the financial markets. Considering all the above, AdroFx is the perfect variant for anyone who doesn't settle for less than the best.