S&P 500 Closes Lower Amid Rising Treasury Yields and Inflation Concerns | Daily Market Analysis

Key events:

- UK - Core Retail Sales (MoM) (Apr)

- Eurozone - ECB's Schnabel Speaks

- Canada - Core Retail Sales (MoM) (Mar)

- USA - Durable Goods Orders (MoM) (Apr)

- USA - Fed Waller Speaks

- USA - Michigan Consumer Sentiment (May)

The S&P 500 closed lower on Thursday as increasing Treasury yields, driven by persistent inflation concerns, dampened hopes for interest rate cuts. This overshadowed gains in tech stocks led by Nvidia.

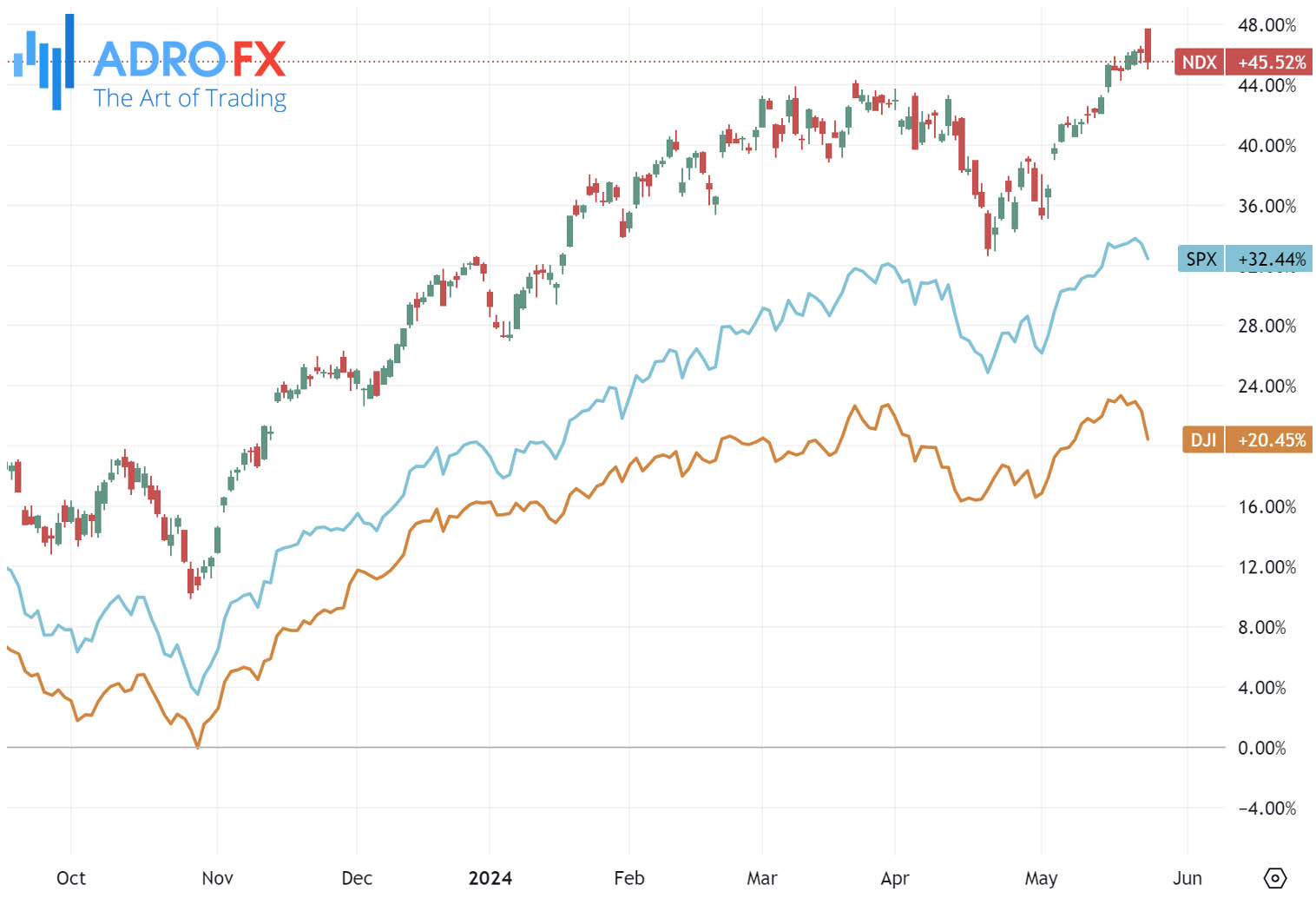

The Dow Jones Industrial Average dropped by 605 points, or 1.5%, while the S&P 500 fell by 0.7%. The tech-heavy NASDAQ Composite saw a more modest decline of 0.4%.

Renewed fears of a robust economy potentially reigniting inflation tempered investor expectations for rate cuts. This shift in sentiment came just a day after the Federal Reserve's May meeting minutes revealed concerns about stalling disinflation among its members.

Adding to the inflation concerns, initial jobless claims fell more than expected for the week ending May 11, suggesting continued strength in the labor market.

Treasury yields spiked, with the yield on the rate-sensitive 2-year Treasury note rising by 5.7 basis points to 4.94%. This surge forced traders to scale back their bullish bets on stocks.

The percentage of traders anticipating a rate cut in September decreased to 48%, down from 51% the previous day.

Despite the market's concerns, Atlanta Fed President Raphael Bostic stated on Thursday that recent inflation data indicates a gradual return to the 2% target, though progress remains slow.

In corporate news, Boeing Co (NYSE: BA) fell over 7% after the aircraft manufacturer warned that its cash flow could suffer more than the $3.9 billion hit it experienced in Q1, making it unlikely to achieve positive cash flow for the year. The company attributed its struggles to ongoing production issues and the recent departure of its chief executive officer.

Boeing also reported that China had halted deliveries, as the country's aviation regulator demanded additional certification documents.

The Australian Dollar continued its decline for the fourth straight session on Friday, likely due to risk aversion. The AUD/USD pair faced downward pressure as the US Dollar strengthened amid hawkish sentiment surrounding the Federal Reserve's commitment to maintaining higher policy rates for an extended period.

The AUD was further pressured by a drop in the Consumer Inflation Expectation, which fell to 4.1% in May from 4.6% in April, its lowest level since October 2021. This decline raises concerns that inflation may remain above target for a longer time. The latest meeting minutes from the Reserve Bank of Australia indicated that policymakers found it difficult to predict future changes in the cash rate.

The USD extended its gains after higher-than-expected PMI data from the United States was released on Thursday. This data heightened concerns that interest rates will remain elevated for a longer period, pushing Treasury yields higher. Additionally, the most recent FOMC minutes revealed that Fed policymakers are concerned about the slow progress on inflation, which has been more persistent than expected at the beginning of 2024.

The Japanese Yen continued to decline on Friday following the release of softer National CPI data from Japan. The annual inflation rate dropped to 2.5% in April from 2.7% in the previous month, marking the second consecutive month of moderation but still remaining above the Bank of Japan’s 2% target. This sustained inflation keeps pressure on the BoJ to consider further policy tightening. The BoJ has emphasized the need for a stable 2% inflation rate along with strong wage growth before normalizing policy. Investors expect that the persistent weakness of the JPY might prompt the BoJ to advance its next interest rate hike to mitigate the impact on living costs.

The USD/CAD pair continued its upward momentum for the fifth consecutive day, hovering around 1.3730 during Friday's Asian trading session. The strength of the USD, bolstered by upbeat US PMI data, lent support to the pair. Traders are now focusing on the upcoming Canadian Retail Sales and US Durable Goods Orders for further direction. Additionally, the Fed’s Waller is set to speak later in the day.

The Canadian Dollar came under selling pressure as crude oil prices declined, given that Canada is the largest oil exporter to the United States. Furthermore, the anticipation that the Bank of Canada might reduce interest rates before the US Fed is putting additional pressure on the Loonie against the USD.

Investors will be closely watching the US Durable Goods Orders on Friday, which gauge the value of orders received by manufacturers for items expected to last three years or more. Additionally, the Michigan Consumer Sentiment Index will offer insight.