S&P 500 and Nasdaq Hit 14-Month Highs, ECB Signals Rate Hike, BoJ Maintains Policy | Daily Market Analysis

Key events:

- Japan - BoJ Press Conference

- Eurozone - CPI (YoY) (May)

- USA - Michigan Consumer Sentiment (Jun)

- USA - Fed Waller Speaks

On Thursday, the S&P 500 and Nasdaq reached their highest levels in 14 months, propelled by positive economic data that suggested the US Federal Reserve is approaching the conclusion of its aggressive interest-rate hike campaign. This news delighted investors, leading to a surge in the stock market.

The release of various economic indicators indicating a decrease in inflation helped drive down Treasury yields. This alleviated concerns about future interest rate hikes and contributed to the record-breaking performance of tech giants Apple (NASDAQ: AAPL) and Microsoft (NASDAQ: MSFT).

In May, unexpected growth was observed in US retail sales as consumers increased spending on a wide range of goods, including vehicles. Another data set revealed that jobless claims remained steady at 262,000 for the week ending June 10, although this figure exceeded economists' predictions of 249,000 claims.

Furthermore, import prices experienced a decline in May, with the annual decrease being the most significant in three years. This followed a report earlier in the week that indicated lower-than-anticipated inflation rates in April.

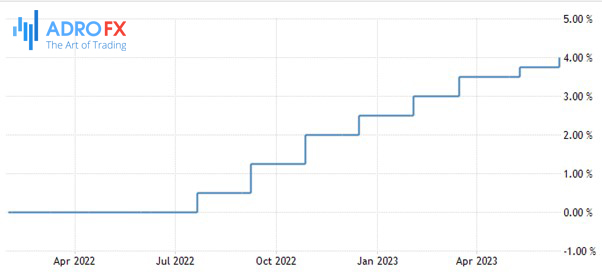

On Wednesday, the Federal Reserve elected to keep interest rates unchanged within the range of 5% to 5.25%. However, they hinted at the possibility of raising rates by at least 0.5% later this year due to persistent inflation.

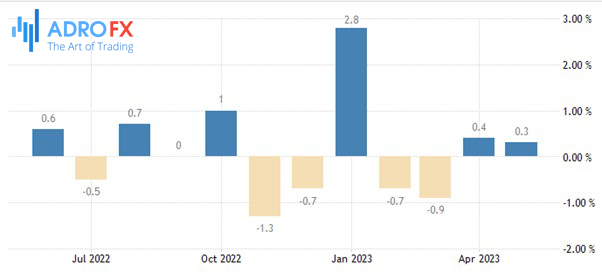

The European Central Bank (ECB) meeting held yesterday unfolded as anticipated, featuring a 25 basis point rate hike and a formal decision to conclude asset purchase program (APP) reinvestments starting in July.

Notably, the staff projections were revised upward for both underlying and headline inflation across the forecast period, with a significant projection of 2.2% for 2025, surpassing the ECB's target. During the meeting, Christine Lagarde stated that it is highly probable that another rate hike will occur in July. However, she did not offer any guidance regarding the future path of interest rates beyond that point, reiterating the concept of a known destination but an unknown journey. Expectations remain unchanged, with an anticipated ECB rate hike of 4% by September. Experts emphasize that the burden of proof will shift following July when we receive two new inflation reports and updated staff projections ahead of the September meeting.

Following the ECB meeting, the EUR/USD experienced a significant surge as the implied probability of a July rate hike rose from 50% to 80%. The currency pair surpassed its 50-day moving average (DMA) and reached a level of 1.0950, marking an increase of over 3% since the beginning of the month. The medium-term outlook for EUR/USD remains optimistic due to the contrasting stances of a notably hawkish ECB and a Federal Reserve (Fed) that appears to be winding down its efforts. The next target for a bullish movement is set at 1.12.

Conversely, the US dollar weakened and fell below its 50-DMA. This decline can be attributed to multiple factors, including lackluster retail sales, an increase in jobless claims, a slowdown in industrial production, and the potential impact of a stronger euro following the ECB's upward revision of inflation forecasts.

As widely expected, the Bank of Japan (BoJ) has maintained its current yield curve control policy in its recent announcement. Following the decision, the yen experienced further depreciation, leading to USD/JPY trading at approximately 140.7 levels. The BoJ maintains its outlook for inflation to decelerate later in the year. They have committed to persist with monetary easing while remaining responsive to economic activity, price developments, and financial conditions. The upcoming press conference will be closely monitored for insights into the BoJ's perspective on the recent yen depreciation and its potential impact on inflation.

Japan's economic recovery has been gaining momentum recently, heightening the possibility of tightening measures by the BoJ. The wage figures for May, which will be released in three weeks, will be crucial in assessing broader wage pressures ahead of the next BoJ meeting at the end of the following month. Analysts anticipate an expansion of the tolerance range surrounding the 0% 10-year yield target at either that meeting or the one scheduled for September.

Today, an important economic indicator to watch in the United States is the Michigan Consumer Sentiment Survey, which includes a component on inflation expectations. This particular component is of interest to the Federal Reserve as it monitors inflation trends. In April, year-ahead inflation expectations surged to 4.6% but declined to 4.2% in May.

At 13:45, Fed Board Member Christopher Waller is scheduled to deliver a speech in Oslo on the topic of "financial stability and macroeconomic policy."

Regarding the euro area, the final inflation data for May is expected to be broadly consistent with the preliminary figures, providing further insights and details on the inflation situation.