Navigating Turbulence: Unraveling the 2020 Stock Market Crash and Recovery

The initial impact of the 2020 stock market crash occurred on Monday, March 9th, marked by a historic plummet in the Dow Jones Industrial Average (DJIA), which was the most substantial point decline recorded up to that date. This was succeeded by two more instances of record-breaking point decreases on March 12th and March 16th.

Notably, the stock market crash of 2020 encompassed the three most severe point drops in the history of the U.S. market. These declines were triggered by pervasive global anxieties stemming from the coronavirus's rapid spread, concurrent drops in oil prices, and apprehensions regarding a potential recession in 2020.

Despite the intensity of the 2020 market crash, its impact was relatively short-lived. The stock market remarkably rebounded, even as numerous sectors of the U.S. economy continued to grapple with challenges.

The Descent of the Stock Market from a Historical High

Prior to the 2020 crash, the Dow Jones Industrial Average (DJIA) had achieved a remarkable record peak of 29,551.42 on February 12th. The onset of the 2020 stock market crash occurred just a mere week later, as the Dow commenced a gradual decline on February 20th. By the time Monday, March 9th arrived, the Dow had experienced a substantial descent of 2,013.76 points, resulting in a closing value of 23,851.02 (a decline of 7.79%). This event, often referred to as "Black Monday 2020," represented the most significant single-day point drop in the history of the U.S. market at that juncture.

March 11th saw the Dow concluding at 23,553.22, marking a notable decrease of 20.3% from the pinnacle observed on February 12th. This marked the initiation of a bear market, signifying the conclusion of the 11-year bull market that had commenced in March 2009.

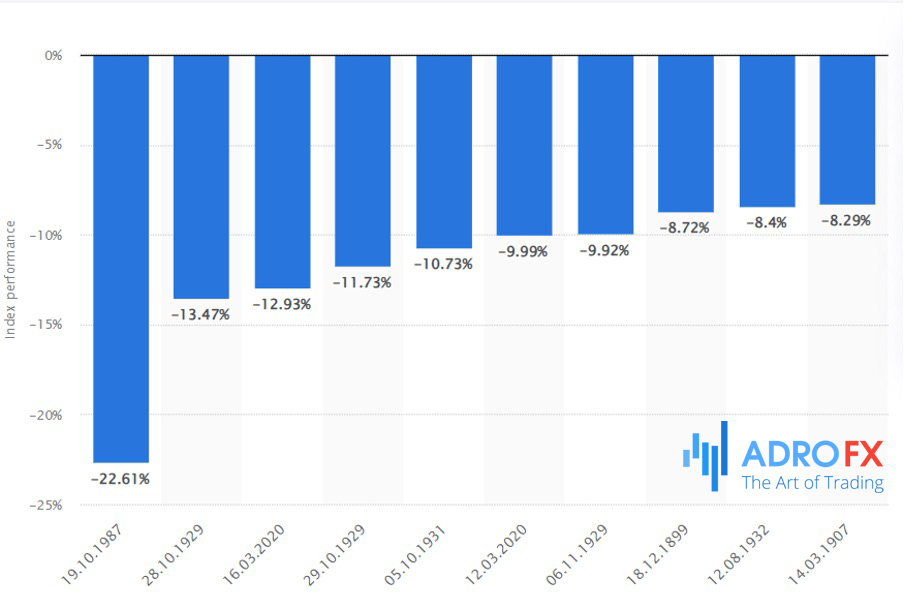

Subsequently, on Thursday, March 12th, 2020, the Dow registered a staggering descent of 2,352.60 points, concluding the day at 21,200.62. This sharp decline of 9.99% almost qualified as a correction within a solitary day.

The downward trajectory continued on March 16th, as the Dow underwent another record-setting plunge, relinquishing 2,997.10 points and concluding at 20,188.52. This particular day's point drop exceeded the original October 1929 Black Monday plunge of 12.93% for a single session.

From its zenith on February 12th to the nadir on March 16th, the DJIA incurred a substantial loss of 9,362.90 points, equating to a substantial drop of 31.7%.

The ensuing chart arranges the ten most substantial one-day losses in the history of the DJIA.

The 2020 Crash in Contrast to Earlier Black Mondays

Leading up to March 16, 2020, two preceding instances of Black Monday had undergone more severe percentage declines. Specifically, on Black Monday, October 19, 1987, the Dow Jones Industrial Average (DJIA) experienced a substantial decline of 22.6%. This event stands as a benchmark for significant market downturns.

Revisiting Black Monday, October 28, 1929, the average encountered a near 13% plunge. This occurrence marked a pivotal moment within the four-day downturn that catalyzed the stock market crash of 1929, ultimately instigating the onset of the Great Depression.

Root Causes of the 2020 Market Crash

The impetus behind the 2020 market crash was primarily the mounting concern among investors regarding the far-reaching consequences of the COVID-19 coronavirus pandemic. The pervasive uncertainty surrounding the virus's potential impact, coupled with the widespread closure of businesses and industries prompted by state-imposed shutdown orders, inflicted substantial harm on various sectors of the economy. Anticipations of employee layoffs, resulting in elevated unemployment rates and diminished consumer purchasing power, further intensified investor apprehensions.

The situation escalated on March 11th when the World Health Organization (WHO) officially designated the disease as a pandemic, highlighting their concern over inadequate governmental responses to counter the rapid proliferation of the virus. Investor anxiety had already been heightened due to President Donald Trump's initiation of trade conflicts with China and other nations. By February 28th, the Dow had already plummeted over 14%, from its February 12th peak of 29,551 to 25,409. The Dow officially slipped into a correction territory, marked by a decline of over 10%, as it concluded at 25,766 on February 27th.

Impact and Consequences of the 2020 Crash

Typically, a stock market crash has the potential to trigger an economic recession. This likelihood is magnified when it occurs in conjunction with a pandemic and an inverted yield curve. An inverted yield curve arises when the return, or yield, on short-term Treasury bills surpasses that of the 10-year Treasury note. This phenomenon is only observed when the immediate risk is perceived to outweigh future risks.

Ordinarily, investors seek lesser returns for short-term investments and greater returns for longer-term commitments. However, during an inverted yield curve scenario, the demand for higher short-term returns surpasses that for long-term investments. This inversion was present during the initial stages of the recession, instilling unease among numerous investors.

A notable instance occurred on March 9th, 2020, when investors demanded higher yields for one-month Treasury bills compared to 10-year notes. This shift signaled the gravity of their concerns regarding the coronavirus's repercussions.

The crash prompted a surge in demand for bonds, leading to historically low bond yields. Investors who divested their stocks during the crash redirected their funds into bonds. This heightened demand drove bond yields to unprecedented lows.

While the average duration of bear markets is approximately 22 months, some have been notably shorter, spanning as brief as three months. The 2020 recession was followed by a robust stock market recovery in the subsequent summer and fall months.

By November 24th, 2020, the Dow Jones Industrial Average had surged past the 30,000-point milestone. This positive momentum continued, culminating in record highs for both the S&P 500 and the Dow on January 3rd and January 4th, 2022, respectively.

Impact on Investors and Their Response

When a recession looms, a common reaction is for many individuals to succumb to panic and offload their stocks in an attempt to avert further losses. However, the swift market recoveries post-crash in 2020 indicated that a substantial number of investors opted to maintain or even increase their investments over the course of 2020 and 2021, rather than hastily selling.

The impact of recessions on investors can yield varied outcomes. The survival of an investor through a market downturn is contingent upon their investment strategy and ability to manage their emotions. A cursory examination of the S&P 500 and Dow Jones charts illustrates that investors remained committed to investing not only during the brief recession but also in its aftermath. Had this not been the case, the pace of price escalation might have been slower, potentially prolonging the duration of the recession.

In March 2020, the Federal Reserve made a decisive move by lowering its target rate range for federal funds to zero. Consequently, this led to reductions in interest rates for various types of loans, encompassing auto loans, school loans, and home loans. This decline in rates rendered acquiring home mortgages or car loans more economical throughout 2020 and 2021. However, it's important to acknowledge that the benefits were not evenly distributed across the economy, and the thriving stock market did not necessarily equate to a comprehensive recovery. Despite investors reaping substantial gains during 2020 and extending into 2021, the situation for workers was less favorable.

At the pandemic's outset, unemployment witnessed a sharp ascent, surging from 3.5% in February to a staggering 14.7% in April 2020. Although unemployment rates exhibited a rapid decline over the subsequent year, it wasn't until March 2022 that the national unemployment rate managed to recover to 3.6%, reflecting the challenges faced in restoring employment to pre-pandemic levels.

Efforts that Curtailed the Duration of the 2020 Recession

The aftermath of the 2020 stock market crash ushered in a period of recession, which, in turn, was succeeded by a notable but unevenly distributed recovery.

Under the purview of both the Trump and Biden administrations, the federal government orchestrated the passage of multiple legislative acts aimed at revitalizing the economy. These measures encompassed targeted support for specific sectors, direct financial assistance to taxpayers, expansions in unemployment insurance benefits, and provisions for rental aid. These interventions contributed to alleviating concerns among investors, thereby fostering additional gains within the stock market. The positive effects were further bolstered by the advancement and dissemination of several COVID-19 vaccines, an initiative that was instigated during the tenure of the Trump administration.

Initially, access to vaccines was confined to specific demographic groups delineated by age or health status. However, in March 2021, President Biden issued directives mandating that all adults should be eligible to receive vaccines by May 1, 2021. This expansion in eligibility aimed to accelerate the vaccination process and consequently expedite the restoration of normalcy.

The causative factors underlying the unprecedented stock market crash of 2020 were indeed profound. Nonetheless, investor optimism remained robust, buoyed by a synergistic blend of federal stimulus initiatives and the promising strides in vaccine development.

Summary

In retrospect, the 2020 stock market crash stands as a remarkable testament to the intricate interplay between global events, investor sentiment, and governmental interventions. The initial shockwaves on Monday, March 9th, when the Dow Jones Industrial Average experienced a historic plunge, sent reverberations through the financial landscape. This drastic decline, followed by subsequent record-breaking drops, underscored the unprecedented nature of the situation. With three of the most severe point drops in U.S. market history, the crash was shaped by the pervasive anxiety stemming from the rapid spread of the COVID-19 pandemic, coupled with volatile oil prices and looming recession fears.

While the intensity of the 2020 market crash left an indelible mark on the financial landscape, its impact proved transitory. The stock market demonstrated remarkable resilience, rebounding despite the persisting challenges faced by various sectors of the U.S. economy.

The tumultuous journey from the market's peak to its trough, marked by a historic record high on February 12th and subsequent steep declines, encapsulates the inherent volatility of financial markets. The crash not only prompted introspection into historical parallels, notably contrasting the 2020 crash with previous Black Mondays, but also illuminated the intricate web of factors that can trigger such significant market disruptions.

Investor responses to the recession were diverse, with some choosing to remain steadfast and others yielding to panic. The subsequent recovery, however, highlighted the importance of maintaining composure and strategic foresight in the face of adversity. Governmental initiatives, spanning from targeted sector support to broader economic stimulus, played a pivotal role in curbing the recession's duration. These measures, combined with the monumental development and deployment of COVID-19 vaccines, underscored the collaborative efforts needed to navigate unprecedented challenges.

In sum, the 2020 stock market crash and its aftermath unveiled the intricacies of financial markets and underscored the profound influence of external events on investor behavior. It serves as a testament to the resilience of economies, markets, and individuals, as well as a reminder of the importance of adaptability, strategic planning, and collective action in the face of unforeseen disruptions.

About AdroFx

Established in 2018, AdroFx is known for its high technology and its ability to deliver high-quality brokerage services in more than 200 countries around the world. AdroFx makes every effort to keep its customers satisfied and to meet all the trading needs of any trader. With the five types of trading accounts, we have all it takes to fit any traders` needs and styles. The company provides access to 115+ trading instruments, including currencies, metals, stocks, and cryptocurrencies, which make it possible to make the most out of trading on the financial markets. Considering all the above, AdroFx is the perfect variant for anyone who doesn't settle for less than the best.