Forex Trading Sessions: Types and Features

The schedule of forex trading sessions allows the trader to determine the best time to start working. During different sessions, the volatility of assets changes: increases or decreases. The highest trading volume is observed when different platforms and exchanges in different geographical zones work simultaneously. Traders track the chart with the help of the indicator of trading sessions - a special tool of technical analysis.

What Is a Trading Session on the Stock Exchange?

A trading session is a period of time when there is brisk trading on the market. The exchange works continuously five days a week: when in one geographical zone the working day comes to an end, and activity slows down, in another - a new day begins, and local platforms open. Thus, traders can work whenever convenient, anywhere in the world all week long, excluding weekends and world holidays, such as Christmas, New Year, etc. On these days the market is closed.

If you take the time frame M5-M15, you can see that the movement of the currency pair is accompanied by bursts of activity and almost complete decay. This can be explained by the fact that countries trade for 6 to 10 hours a day. Then the trading day in one country finishes and starts in the other time zone.

The forex market is different in the fact that there is always, in every period of time, a place where almost all currency pairs are traded. Quotes are broken only on non-business days.

It is advantageous to enter the market when exchange periods overlap: one session has already started, while the previous one is not over yet. At this time market volatility grows, and the volume of traded assets reaches its maximum, which is undoubtedly profitable for traders. They need to know when exchanges of interest to them open - the schedule of trading sessions.

Types of Trading Sessions

Forex trading sessions are grouped by location into four major groups:

- Asian;

- Pacific;

- American;

- European.

Each of them has its own features and significant differences from the others.

Working Hours of Trading Sessions

To work successfully on forex, a trader must take into account the time of the trading sessions. The session begins at 21.00 GMT from the platform in Wellington, New Zealand. This time is commonly used as a reference point so as not to confuse the opening time of the session in different regions.

This time is the opening time for most brokers. Some open five minutes after the start of the session, and others open an hour later: check with the broker you have chosen to work with. The opening time of trades will affect the quotes gap due to non-working days - gaps, as well as give a certain shape to the daily candle.

The price at the beginning of the week can be significantly different from Friday. This happens when events occur on non-working days that strongly influence the movement of currencies. At this time trading orders are executed more slowly. In addition, the difference between the price at which assets are sold and bought at the moment (spreads) can be very significant. Take these aspects into account when developing a strategy for behavior on the market.

In the client terminal trader sets the necessary time and gets the schedule of trading sessions.

It is enough to specify your time zone, and the program will reform the trading schedule taking this parameter into account.

Thus, the trader determines the beginning of trading and sees the intersection of the sessions at the sites of interest of different exchanges, when trading is the most active.

Main Features of Forex Trading Sessions

For a professional trader, it is important to know not only the hours of different trading sessions but their differences from each other. Each of them reacts more strongly to events in its geographical area than to external economic factors of remote regions.

Common features:

- Quiet movements of currency pairs during night hours;

- Increase of fluctuations (volatility) during the daytime;

- Differences lie in trading peculiarities: types of popular currency pairs, volatility, and influence of global economic aspects.

Asian Trading Session

Asian trading session originates in Tokyo. It is the Tokyo Stock Exchange of interest to those who trade world currencies. It opens at 00:00 GMT.

The importance of the Tokyo floor:

- Japan's stock market is the largest in the region;

- The country produces a large number of goods;

- The Japanese economy is closely linked to the United States markets;

- The U.S. dollar/yen currency pair is actively traded at this time.

Floors are also working in China, but for the forex market, they are not particularly interesting, because the yuan exchange rate is strictly regulated by the state. Chinese trades can affect only the gold market, which has a wide range of volatility.

Gradually, other Asian exchanges are joined; national currencies of India, Thailand, Laos, and other countries appear in the trading.

Also, during the Asian session transactions in major currencies continue. If something important happens, which is not very often, then there are sharp strong movements of assets. When the market stands out as a noticeable trend, it is usually supported by Asian sites.

The Asian session is characterized by the horizontal movement of the market, that is, it enters into a flat.

Currency operations of the Japanese Central Bank, disclosure of information about the country's development, and news about macroeconomics can influence volatility.

Quiet trading on a low-volatility market at night is a specially designed strategy that brings income to those who have managed to adapt to such market movements. The objective of the trader is to predict the jump in the Japanese currency or to build a strategy on the gaps - the difference between the prices of currencies on non-working days and at the beginning of the working week.

The activity of the Asian session peaks from 5 am to 9 pm GMT, when European markets are opened.

European Trading Session

The beginning of the European trading session is considered the start of the active work of traders. This session begins with the opening of the Frankfurt Stock Exchange, and an hour after it the London Stock Exchange – the main European exchange – opens. Gradually, traders from Europe get involved in trading.

The number of instruments that can be operated amounts to thousands, so many traders are waiting for the European session. It may seem that the first time after the opening the movements of quotations do not yield any logic. The trend movement is gradually revealed. If this does not happen, the market is flat, but its range is wider than in Asia.

Experts distinguish two highs:

- When trading in London just opens and coincides with the end of the Asian session;

- When the European session closes and overlaps with the opening of the American one.

In the first case, traders make a decision and estimate the trading potential based on the behavior of European players. In the second case, the Europeans are guided by the actions of their American colleagues.

Forex market experts consider the European session to be the most important. Trades with the British pound and Swiss franc become relevant. The high volatility lasts for two-three hours, and during lunchtime, it is noticeably reduced.

A distinctive feature of European trading is high volatility, large volumes, and rapid price changes.

The London Stock Exchange closes at 16:30 GMT. Shortly before that, the minute candles change their range sharply. If you trade by the candlesticks, be aware that they might change a few minutes before the market closes.

American Trading Session

American trading session is different in that they have little effect on currency markets: the main trading floors focus on stocks and commodities.

Major trades are held in the first half of the American period when the European session is still open. After it closes assets slow down: they fluctuate slightly or move slowly in line with the trend.

As the United States is linked to the economies of many countries, all key currency pairs are traded during the American session. Among them, the most popular are:

- Euro – U.S. dollar;

- Japanese yen – U.S. dollar;

- Canadian dollar – U.S. dollar.

The main markets are New York and Chicago. Canadian exchanges do not play a big role, and Latin American exchanges have much smaller trading volumes, so they are not taken into account in Forex.

It is believed that the American session is aggressive and unpredictable. Statistics of the United States in the morning are superimposed on the afternoon in Europe, the number of transactions increases. The greatest activity is from 16 to 19 hours.

Within an hour after the end of the American session, there is usually no movement on the market. Keep in mind that at that time swaps are paid: the difference in interest rates on the loans of currencies that make up the pair. Open trades are recalculated every day, and a swap is paid on each trade. One thing to keep in mind is that Wednesday night is the time for the triple rate to accrue, as there is a weekend ahead when the exchanges aren't open.

Pacific Trading Session

After the end of the American session, the Pacific session opens. It runs from 10 pm to 7 am. The Wellington exchange does not give large turnovers, but it is the start of the trading day. An hour later, the larger Sydney Stock Exchange opens. More and more players come to the market and the liquidity of assets grows. Particularly high activity is noted in the stock market. This can be explained by the fact that the Sydney exchange trades in futures for U.S. indices. And trades in other instruments depend on them. Sydney is the first major marketplace on the schedule. The largest turnover occurs in the Australian, New Zealand, U.S. dollar, and Japanese yen.

VBO Trading Sessions Indicator

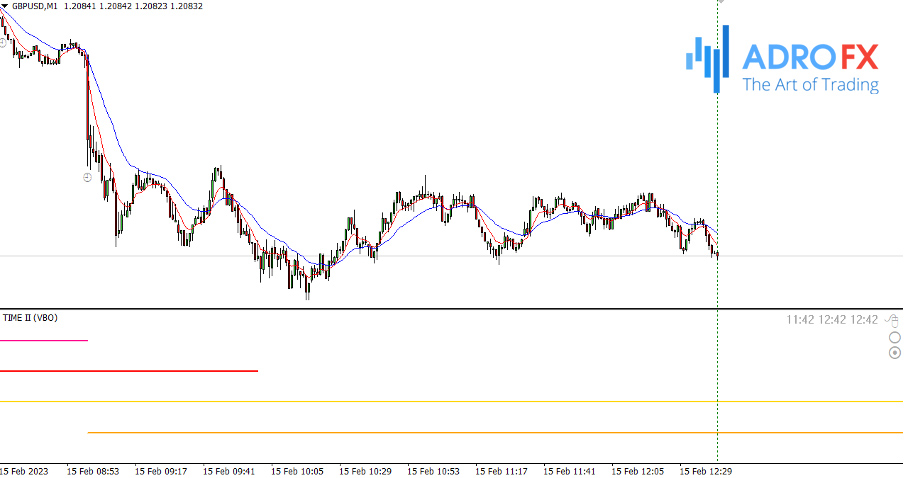

The VBO indicator is considered one of the most frequently used tools for determining the opening and timing of trading sessions. After installation, it appears in a separate window below the chart window:

VBO trading sessions indicator

The sessions are shown as colored horizontal lines. Each session is marked with a different color, so the indicator is very easy to work with. The tool is also equipped with an hour scale, which shows exactly what time the new trading period was opened.

The indicator has another useful feature - the ability to display sessions directly on the price chart itself. In this case, the desired periods will be highlighted with an outline in the form of rectangles.

You can switch between the modes of displaying sessions with a small icon in the upper right corner of the indicator. After clicking on it, the tool will alternately show sessions either on the main chart or under it.

The installation is standard and does not require any special skills. Move the distribution files from the archive to the terminal data directory and restart the program. After that, the indicator will be available through the main menu of the platform.

Forex Trading Sessions: Strategy

This strategy is based on the fundamental analysis of a chart. Its basic principle is the opening of trades in the direction of the London session. It is one of the most popular ones and "sets" the movement for almost all other assets.

The trades are placed once a day at 08.00 am GMT when the London session opens. You can trade on major currency pairs, such as EUR/USD, EUR/JPY, and so on. The time frame of the chart is thirty minutes.

Trading rules:

- At 08.00, open the chart of the required currency pair, and during the first 30 minutes, do not place any trades, but only analyze the price direction.

- When the first candle of the chart closes, an impulse for further price movement will be received.

- At the moment of opening the second 30-minute candle, it is necessary to place orders. At 5 points above the high price of the first candle of the session set the order Buy Stop. At 5 points below the low price of the previous candle, place a Sell Stop order.

- The Stop Loss can not be used, as opposite orders will perform the role of Stop Loss positions for each other.

- If after 2 hours, none of the orders has triggered, then both positions should be deleted, and you should not trade on this strategy on that day. The whole sequence of actions can be repeated the next day.

- The trading sessions indicator in this strategy is used only as a reference point. You can choose any other convenient tool.

Conclusion

The peculiarities of different types of trading sessions need to be taken into account when developing a forex trading strategy. Knowing the periods of the highest activity of currency pairs, you can get the maximum profit from trades and reduce the risk of losses. Install the trading session indicator into your trading terminal, and you will not forget to close open positions in time. Focusing on market time you will be able to intelligently plan your working hours.

About AdroFx

Established in 2018, AdroFx is known for its high technology and its ability to deliver high-quality brokerage services in more than 200 countries around the world. AdroFx makes every effort to keep its customers satisfied and to meet all the trading needs of any trader. With the five types of trading accounts, we have all it takes to fit any traders` needs and styles. The company provides access to 115+ trading instruments, including currencies, metals, stocks, and cryptocurrencies, which make it possible to make the most out of trading on the financial markets. Considering all the above, AdroFx is the perfect variant for anyone who doesn't settle for less than the best.