Nasdaq Hits Record High, Gold Faces Challenges As Central Bank Comments Influence Currency Markets | Daily Market Analysis

Key events:

- Eurozone - CPI (YoY) (Feb)

- USA - S&P Global US Manufacturing PMI (Feb)

- USA -ISM Manufacturing PMI (Feb)

- USA -ISM Manufacturing Prices (Feb)

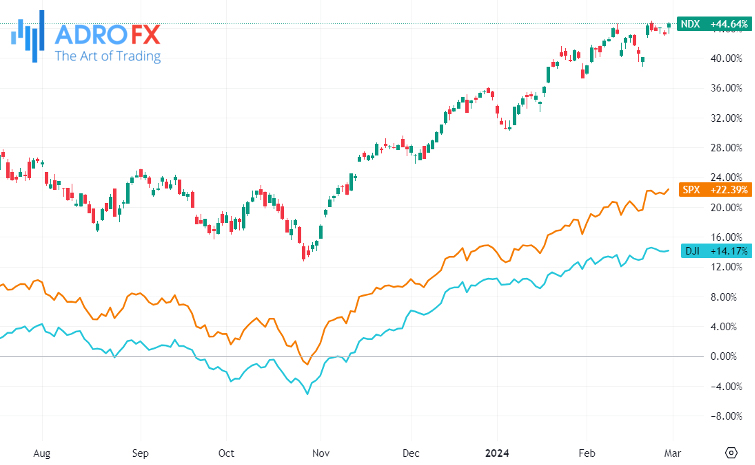

On Thursday, the Nasdaq achieved a record high for the first time since 2021, propelled by the ongoing artificial intelligence-driven rally and optimism stemming from an inflation report that aligns with expectations for a potential summer interest rate cut.

The S&P 500 marked a 0.4% increase, closing at a record of 5,092.21, while the NASDAQ Composite saw a 0.7% climb, also reaching a record of 16,091.92. Both benchmarks recorded their best monthly returns since November. The Dow Jones Industrial Average experienced a modest rise of 46 points, or 0.1%.

Meanwhile, the price of gold faced challenges in capitalizing on the positive momentum observed the previous day beyond the $2,040-2,042 horizontal barrier. It remained within a narrow band during the Asian session on Friday. Despite this, the precious metal remained close to a nearly one-month high reached on Thursday, benefiting from a slight downturn in the US Dollar. The US Personal Consumption Expenditures Price Index released on Thursday indicated the lowest annual inflation in January in three years, creating a possibility of an eventual interest rate cut by the Federal Reserve. However, the USD failed to build on the previous bounce from the weekly low, providing support for gold.

Nevertheless, recent comments from influential FOMC members suggest that the US central bank is not in a rush and will wait until the June policy meeting before considering interest rate cuts. This more hawkish stance supports higher US Treasury bond yields, potentially limiting substantial USD downside and capping gains for the non-yielding gold price. Additionally, the prevailing risk-on sentiment, reflected in the extended global equity market rally, discourages fresh bullish bets on the safe-haven XAU/USD. Traders are advised to exercise caution before anticipating further upward movement.

In the currency market, the Japanese Yen faced renewed selling pressure during the Asian session on Friday, retracing from a two-week high triggered by hawkish remarks from Bank of Japan board member Hajime Takata the previous day. BoJ Governor Kazuo Ueda's statement that the 2% inflation target is not currently in sight, coupled with an unexpected recession in Japan, dampened speculation about an early rate hike, potentially in March. Additionally, the prevailing risk-on sentiment across global equity markets is undermining the safe-haven appeal of the JPY.

NZD/USD ended its four-day losing streak after comments from Reserve Bank of New Zealand Governor Adrian Orr on Friday. According to Orr, the central bank foresees starting policy normalization in 2025. Consequently, the currency pair climbed higher, reaching nearly 0.6090 during the Asian session.

Governor Orr highlighted the expected progress of the economy, noting a decline in inflation expectations. Despite remaining elevated, inflation is on a downward trajectory. Orr underscored the necessity for maintaining a restrictive monetary policy for an extended period. He also expressed optimism about economic growth picking up in 2024.

In the case of the EUR/USD pair, it reversed its three-day losing streak in the early European session on Friday, despite renewed demand for the US Dollar. The market awaits cues from Eurozone inflation data scheduled later in the day.

Eurozone inflation experienced a further decline last month, fueling speculation that the European Central Bank might initiate interest rate cuts later in the year from current record highs. The ECB is set to announce its interest rate decision on March 7, with no anticipated changes. The bank is expected to revise down its forecasts for inflation and growth in March, emphasizing the need for additional data to ensure that rising wages do not lead to price pressures before considering rate cuts.

USD/CAD ended its winning streak that began on February 23, possibly influenced by improved crude oil prices, given Canada's status as the largest oil exporter to the United States. The pair edged lower to nearly 1.3560 during the Asian session on Friday.

Furthermore, positive Canada's Gross Domestic Product Annualized may have supported the Canadian Dollar. The data reported a 1.0% growth in the fourth quarter of 2023, exceeding market expectations of a 0.8% increase compared to the previous decline of 0.5%. Additionally, GDP (QoQ) rose by 0.2% against the previous decline of 0.1%.