Mixed Stock Performance Amidst Data Analysis, Rate Hike Speculations, and AI Focus in Earnings Season | Daily Market Analysis

Key events:

- USA - FOMC Member Daly Speaks

- USA - FOMC Member Mester Speaks

- USA - FOMC Member Bostic Speaks

- UK - BoE Gov Bailey Speaks

On Friday, US stocks showed little change and ended the week with a downward trend as investors analyzed a range of data released at the beginning of the month. This data seemed to bolster confidence in the stability of the US economy, leading to expectations that interest rates may remain elevated for an extended period.

Last week, equity markets faced challenges due to a string of positive economic data, which fueled speculations of prolonged higher interest rates. After wavering back and forth and considering the possibility of rate cuts later in the year, it appears that the markets have finally accepted the notion that this economic cycle will take longer to unfold. As a result, the S&P 500 experienced a decline of 1.2%.

The Dow experienced a weekly loss and closed lower on Friday as traders evaluated a weaker-than-expected monthly jobs report for June, breaking a streak of 15 months of meeting estimates. Despite this, there is still anticipation that the Federal Reserve will likely proceed with a rate hike later this month.

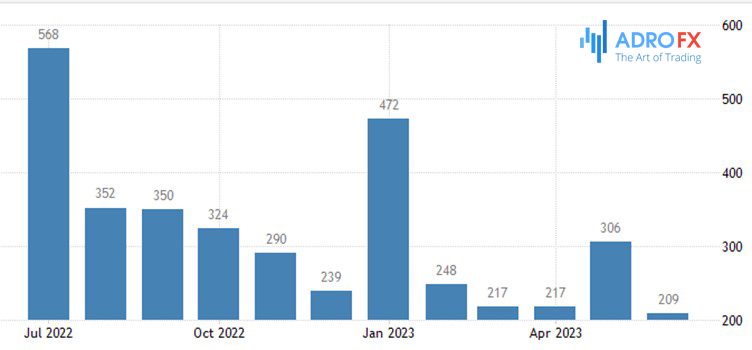

In June, the economy added 209,000 jobs, falling short of the projected 225,000 and exhibiting a significant decline from the 306,000 jobs added in the previous month. This marks the slowest pace of job creation since December 2020.

However, there was positive news on wage growth, as average hourly earnings increased by 4.4% last month, surpassing estimates of 4.2%.

While expectations for a rate hike in July remained intact, investors are speculating that the cooling labor market might dissuade the Federal Reserve from implementing further hikes after July.

In response to the jobs report, Morgan Stanley stated in a note, "Today's report supports our view that the incoming data will not meet the bar for the Fed to deliver a hike in September."

On another note, US-listed shares of Alibaba (NYSE: BABA) rose by 8% after Chinese authorities announced a $984 million fine on Ant Group, marking the conclusion of the fintech company's extensive regulatory restructuring process.

The second quarter of the 2023 earnings season is set to commence this week, with analysts converging on a consensus that S&P 500 earnings per share (EPS) will decline by 9% year-on-year. This decline is driven by stagnant sales growth and margin compression. However, particular attention will be given to the impact of artificial intelligence (AI) on companies, given the developments in the tech sector throughout this year.

Nonetheless, the timing and effectiveness of S&P 500 companies in leveraging AI to generate additional profits remain uncertain. Therefore, management guidance and commentary will assist investors in identifying the companies that enable, scale, and benefit from AI in the long term.

For instance, MU (Micron Technology) presented revenue and earnings outlooks that surpassed expectations, instilling confidence, while NVDA (NVIDIA) provided significantly higher-than-consensus sales guidance for the second quarter.

Nevertheless, the shine of AI has dulled somewhat due to potential restrictions on the export of AI chips to China, which represents a notable risk for stocks in this sector.

Policymakers within the G4 countries have demonstrated remarkable consistency in their approach, with even the Japanese yen (JPY) joining in after the release of wage data this week. This has limited the potential for the US dollar to appreciate against other major currencies. With interest rates and equities experiencing fluctuations, there is less room for foreign exchange (FX) markets to adjust.

The European Central Bank (ECB) has been closely aligned with the Federal Reserve, sometimes even surpassing it in terms of rhetoric. This has allowed the market to reevaluate the short-term outlook for the Eurozone, despite slower economic growth.

The ECB's singular focus on combating lower inflation has supported the euro. However, there are limits to this argument. The idea that the ECB would take extreme measures to control inflation can only be effective for a certain period, particularly when the economy is already in a technical recession.

If this trend persists, the more hawkish members of the ECB might ease their stance, causing the EUR/USD exchange rate to decline back to 1.07.

Looking ahead, investors will closely monitor a series of economic indicators and events during the week. This includes Wednesday's release of consumer and producer price indexes, import and export price indexes, Michigan consumer sentiment and expectations, as well as speeches from various Federal Reserve officials, including Barr, Mester, Daly, Bostic, Bullard, Kashkari, and Waller.